Commercial Real Estate News

Office Tenants' Flight to Quality Buildings Increases in 2024

Commercial News » New York City Edition | By Michael Gerrity | July 19, 2024 8:54 AM ET

Based on recent analysis of office markets in 57 U.S. cities by CBRE, a top-tier echelon of office buildings that is thriving while much of the sector struggles to adapt from high interest rates, inflation and reduced demand due to hybrid work.

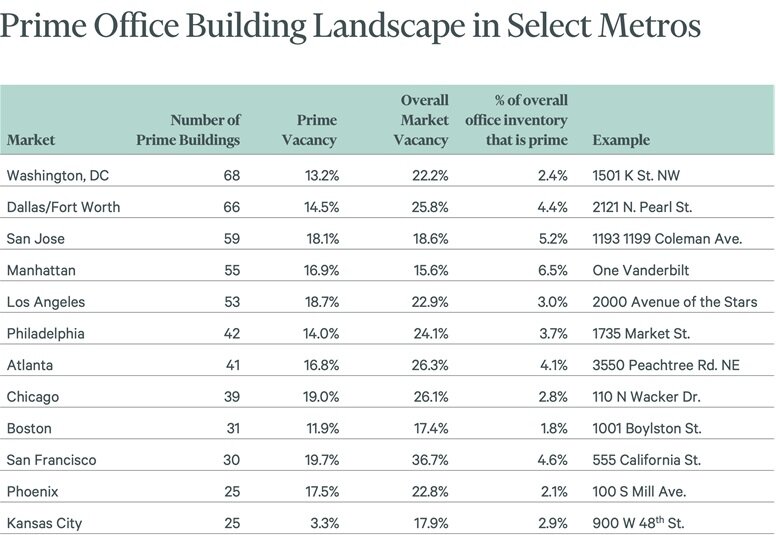

CBRE researchers and brokers collaborated to identify each market's highest quality buildings, designated as prime office buildings. The resulting roster of 830 properties comprises just 8% of the U.S. office market by square footage and just 2% by building count. It's a more exclusive designation than the oft-used Class A, which spans 61% of the U.S. office market.

CBRE found that these prime properties are outperforming the broader office market in most cities, underscoring the ongoing "flight to quality" in which companies are favoring new, high-quality buildings in an effort to support and increase office attendance. Average vacancy in the prime buildings in this year's first quarter (14.8%) was 4.5 percentage points lower than the rest of the market, a gap that has widened from 1.9 percentage points in the middle of 2018.

Prime buildings attracted an average rent premium of 84% more than the rest of the market in the first quarter, up from 60% in mid-2018. Additionally, prime buildings cumulatively registered 48 million sq. ft. of positive net absorption - meaning more space newly occupied than vacated - from 2020 to 2024. That's in comparison to the rest of the office market logging negative net absorption - more space vacated than newly occupied - of 170 million sq. ft. in that span.

"The widening gap between prime office space and commodity office space reflects commercial and societal shifts of recent years. This new analysis is one of the clearest indicators yet of the size of that widening gap," said Mike Watts, CBRE President of Americas Investor Leasing. "Companies seeking to recruit and retain talent are targeting the best quality office space - prime space - to make in-person work as effective and enjoyable as possible for employees and clients."

CBRE's analysis included multiple factors. CBRE researchers and brokers in each market identified the top 2% to 5% of the market's office buildings by examining their age, quality of design, location, views, green certifications, ceiling heights and differentiation from surrounding buildings. Also receiving extensive consideration were amenities such as concierge service, on-site management, outdoor terraces, fitness centers, car parking, access to public transportation, daycare and electric-vehicle charging stations, among others.

The prime designation -- like Class A, B and C -- includes some subjectivity and local relativity. Prime buildings are the best in their own metro area, not necessarily nationally. For example, Manhattan has fewer prime buildings - by Manhattan standards - than Dallas/Fort Worth and Washington, D.C. However, many nonprime buildings in Manhattan would grade out as prime in other markets. Similarly, some prime buildings in Dallas, for example, wouldn't be considered prime in Manhattan.

Looking ahead, prime office space will become more scarce as developers curtail office construction of all types due to high vacancies and the challenging markets for financing. CBRE Econometric Advisors forecasts completion of 14.8 million sq. ft. of prime office buildings in the U.S. this year, declining to 4.2 million sq. ft. of completions in 2025 and 2.6 million sq. ft. in 2026.

"This slowdown in construction of prime office buildings will cause vacancy for that subsector to decline if demand remains relatively constant," said Jessica Morin, CBRE Director of U.S. Office Research. "And that may benefit the next tier of office properties just below prime, as companies who can't find prime space to lease in a given market opt instead for nearby buildings that are almost prime."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3