Commercial Real Estate News

U.S. Tech Sector Doubles Its Share of Largest 100 Office Leases in 2021

Commercial News » New York City Edition | By Michael Gerrity | February 18, 2022 9:03 AM ET

Many of largest office leases driven by tech companies in Manhattan, Washington DC, Boston

According to a new report from global property consultant CBRE, technology companies doubled their share of the largest 100 U.S. office leases agreed to in 2021, underscoring the sector's leading role in the office-market's recovery.

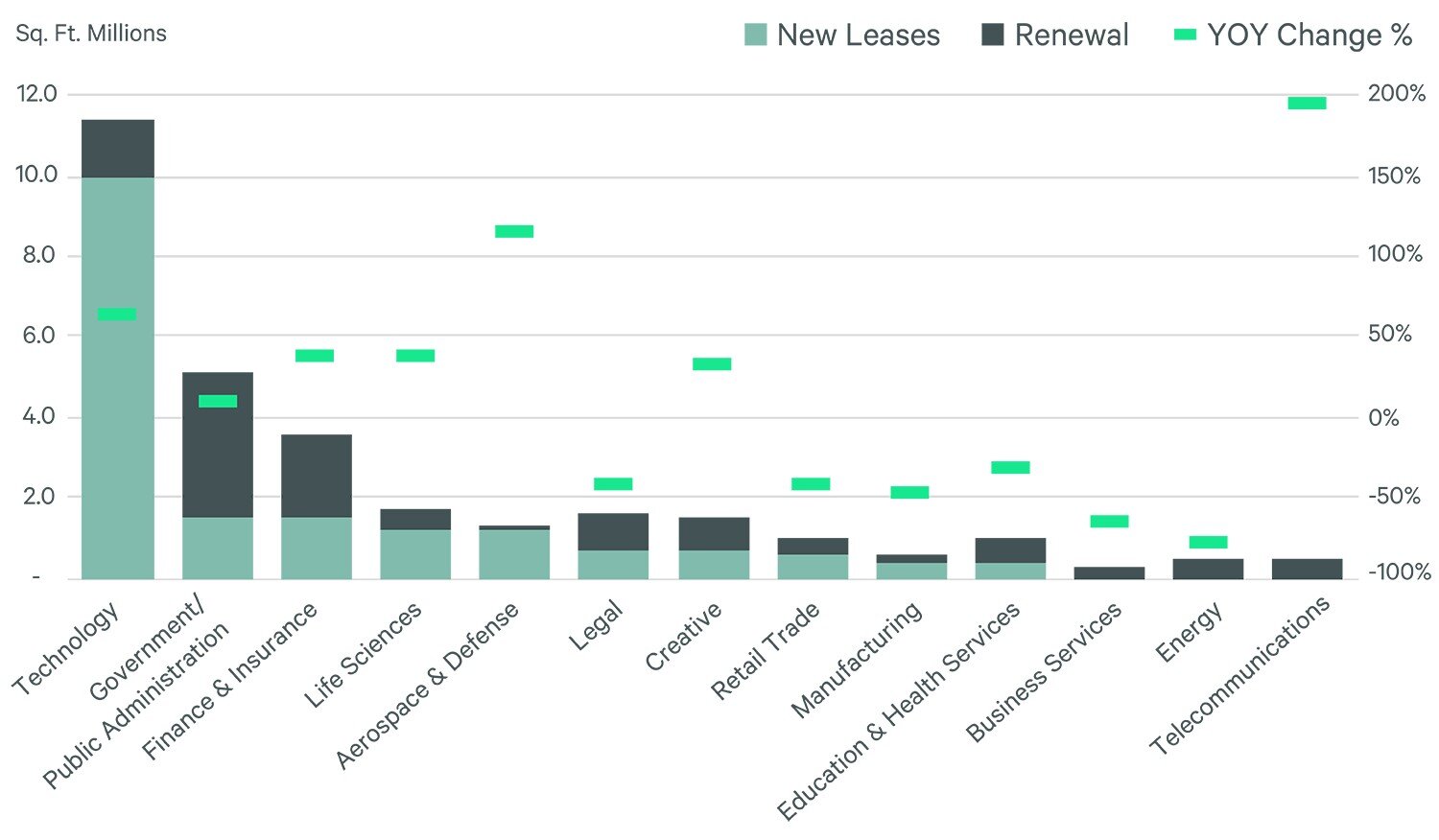

Tech companies accounted for 36 of those top 100 leases, up from 18 in 2020. In terms of size, tech companies claimed a cumulative 11.4 million sq. ft. of the top leases, or 37 percent of the total square footage.

Those 2021 totals exceed the year-earlier figures of 6.8 million sq. ft. and a 24 percent share, respectively. Tech's pre-pandemic share was 32 percent in 2019.

Tech markedly outpaced the leasing activity of other active industries within that largest-100 category last year: government and public administration at 5.1 million sq. ft.; finance and insurance at 3.6 million; life sciences at 1.8 million; legal at 1.7 million; and creative industries at 1.6 million.

"The tech sector has played a big role in office-leasing activity in recent years, and it rebounded in 2021 to rival its pre-pandemic activity," said Manish Kashyap, CBRE Global President of Advisory & Transaction Services. "Overall, office leasing in the U.S. was up nearly 27 percent last year, and several other indicators of the market's performance turned positive late in the year. The tech industry is the big engine there."

Overall, last year's top 100 office leases were larger and, in a sense, newer than in 2020. Specifically, the average size of those top leases in 2021 was 307,000 sq. ft., up 7 percent from a year earlier. And 61 percent of last year's top leases were new leases or expansions as opposed to renewals, an increase from 57 percent a year earlier.

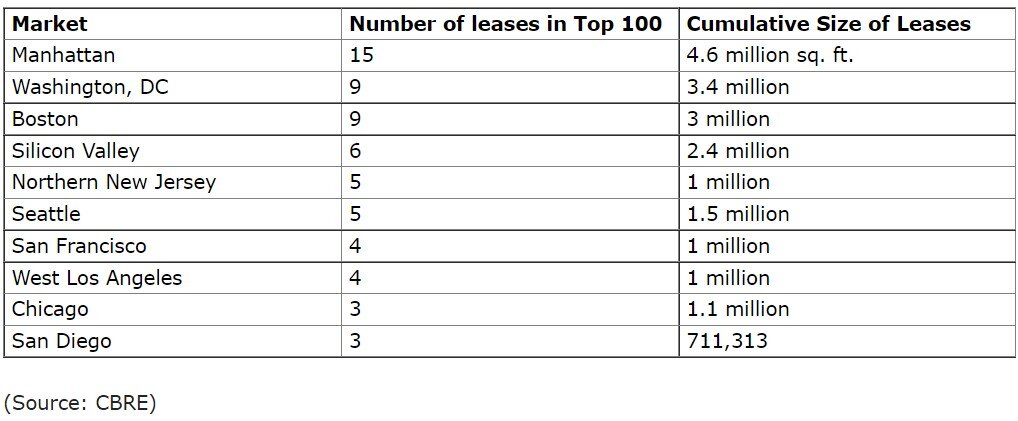

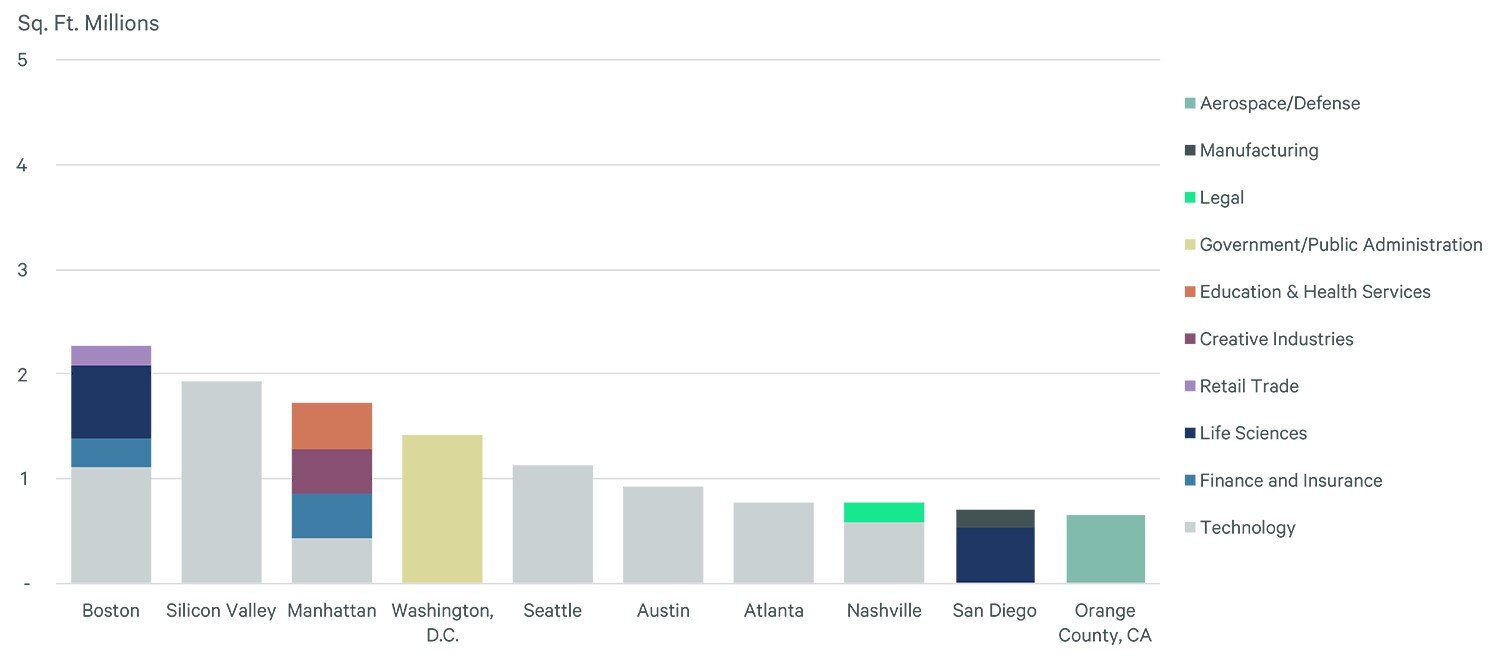

As is typical, big, gateway markets registered the biggest shares of the top-100 office leases of last year. Manhattan, Washington, D.C., and Boston notched big leases by the tech and government sectors.

Leading Markets for Largest 100 Office Leases of 2021

"Companies are increasingly getting comfortable with making long-term commitments like office leases, given job gains in office-using sectors and the slowdown of COVID-19's omicron variant," said Julie Whelan, CBRE's Global Head of Occupier Research. "Rising optimism should be tempered with caution even with the pandemic seemingly easing. Still, the runway seems clear for leasing momentum to continue in 2022."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3