The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Top U.S. Markets for Largest 100 Office Leases of 2020 Revealed

Commercial News » New York City Edition | By Michael Gerrity | January 28, 2021 8:10 AM ET

COVID Drove Office User Preferences in U.S. Towards Renewals, Smaller Footprints

Based on new research from global commercial property consultant CBRE, office renewals claimed a significantly bigger portion of the largest 100 U.S. office leases in 2020 than a year earlier, underscoring that many companies opted to postpone relocations, contractions and other real-estate changes until they get more clarity on how the economic recovery and pandemic response will play out.

In many ways, the largest 100 U.S. office leases signed in 2020 reflect trends in the broader office market as well as the findings of CBRE's latest survey of office-using companies. Renewals accounted for 43 percent of the combined square footage of those 100 leases, up from 33 percent in 2019. The cumulative square footage of those big leases (29 million sq. ft.) marked a 32 percent decline from a year earlier, mirroring the 36 percent decline in all U.S. office leasing last year.

Similarly, the average size of leases in the largest 100 declined to 290,000 sq. ft. in 2020 from 422,000 a year prior.

"Office leasing was tentative last year for well-known reasons," said Whitley Collins, Global President of CBRE Advisory & Transaction Services. "Activity likely will perk up in 2021 along with the continued rollout of COVID-19 vaccines, an improving economy, and a gradual return to the office by a growing number of workers. Meanwhile, companies will map out their long-term office strategies with new emphasis on determining the most efficient use of workspace with more employees working flexibly from multiple locations."

As it has for the past several years, the technology industry last year claimed the largest share by square footage (roughly 24 percent) of the largest 100 leases. Tech kept its lead even as the industry's office-leasing activity declined by more than half from 2019. Claiming the second-largest share was the government and nonprofit sector (16 percent), followed by the legal industry in third.

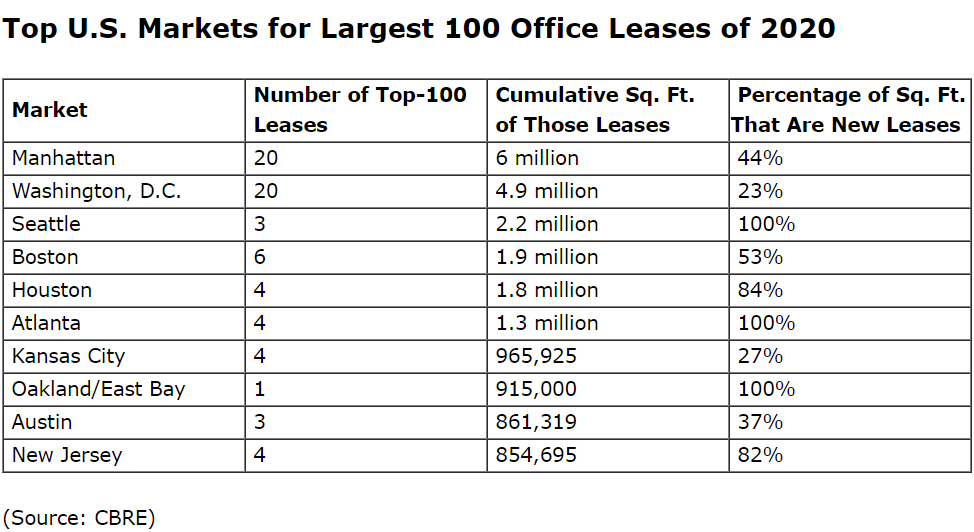

On a market basis, Manhattan and Washington, D.C., were the clear leaders for share of the largest 100 office leases by square footage at 21 percent and 17 percent, respectively. Seattle claimed the third-largest share with 2.2 million sq. ft. in new leases by tech firms.

Based on new research from global commercial property consultant CBRE, office renewals claimed a significantly bigger portion of the largest 100 U.S. office leases in 2020 than a year earlier, underscoring that many companies opted to postpone relocations, contractions and other real-estate changes until they get more clarity on how the economic recovery and pandemic response will play out.

In many ways, the largest 100 U.S. office leases signed in 2020 reflect trends in the broader office market as well as the findings of CBRE's latest survey of office-using companies. Renewals accounted for 43 percent of the combined square footage of those 100 leases, up from 33 percent in 2019. The cumulative square footage of those big leases (29 million sq. ft.) marked a 32 percent decline from a year earlier, mirroring the 36 percent decline in all U.S. office leasing last year.

Similarly, the average size of leases in the largest 100 declined to 290,000 sq. ft. in 2020 from 422,000 a year prior.

"Office leasing was tentative last year for well-known reasons," said Whitley Collins, Global President of CBRE Advisory & Transaction Services. "Activity likely will perk up in 2021 along with the continued rollout of COVID-19 vaccines, an improving economy, and a gradual return to the office by a growing number of workers. Meanwhile, companies will map out their long-term office strategies with new emphasis on determining the most efficient use of workspace with more employees working flexibly from multiple locations."

As it has for the past several years, the technology industry last year claimed the largest share by square footage (roughly 24 percent) of the largest 100 leases. Tech kept its lead even as the industry's office-leasing activity declined by more than half from 2019. Claiming the second-largest share was the government and nonprofit sector (16 percent), followed by the legal industry in third.

On a market basis, Manhattan and Washington, D.C., were the clear leaders for share of the largest 100 office leases by square footage at 21 percent and 17 percent, respectively. Seattle claimed the third-largest share with 2.2 million sq. ft. in new leases by tech firms.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More