Commercial Real Estate News

Northeast U.S. Logistics Rents Skyrocket from E-commerce Explosion

Commercial News » New York City Edition | By Michael Gerrity | August 27, 2021 9:06 AM ET

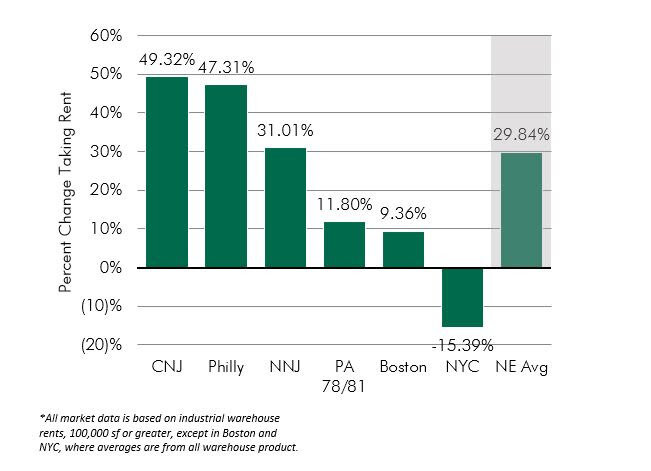

Global property consultant CBRE is reporting this week that the average industrial taking rents rose nearly 30% in the first half of 2021 compared to the first half of 2019 in the U.S. Northeast Corridor.

The Covid-19 Pandemic created a catalyst for companies shifting towards e-commerce strategies, culminating in significant demand for logistics space and a subsequent spike in higher taking rents. E-commerce and third-party logistics (3PL) users accounted for more than half of all industrial leasing activity in H1 2021. High demand is not the only driver behind increased taking rents; supply chain constraints, delayed construction timelines, and upended budgets resulted in low availability and contributed to bidding wars as occupiers compete for suitable space across the Northeast.

Vacancy within the Northeast Corridor dropped more than 70 basis points during the first six months of 2021, settling at a record low 3.3%. Nearly 50% of current construction was pre-leased as more retailers expanded their omnichannel strategies, often outsourcing to 3PLs to reduce delivery time to consumers and to keep up with demand.

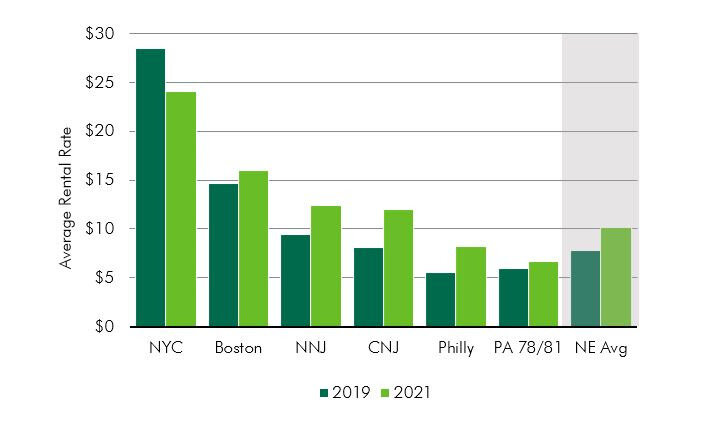

In H1 2019, overall average taking rents in the Northeast markets were $7.81 per-square- foot NNN, compared to $10.14 NNN in H1 2021. NYC saw a slight decrease in taking rents; during 2019, landlords traded moderate amounts of free rent for higher contract rents while current market fundamentals preclude these opportunities. The Central NJ and Philadelphia markets saw nearly a 50% rent growth from H1 2019 to H1 2021 as more companies targeted developable land south of Northern NJ where land is more available and rents are less expensive.

According to CBRE Research, nationally, average rent grew by 5%, year-over-year, in Q2 2021, as a comparison. The Northeast Corridor markets are among the top-performing industrial markets in the country. With e-commerce and 3PL occupier demand projected to remain high, availability is expected to remain low, and rents are likely to continue increasing through the rest of the year in the Northeast.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.