Commercial Real Estate News

U.S. Commercial Property Market Primed for Growth in 2025

Commercial News » New York City Edition | By Michael Gerrity | January 24, 2025 8:13 AM ET

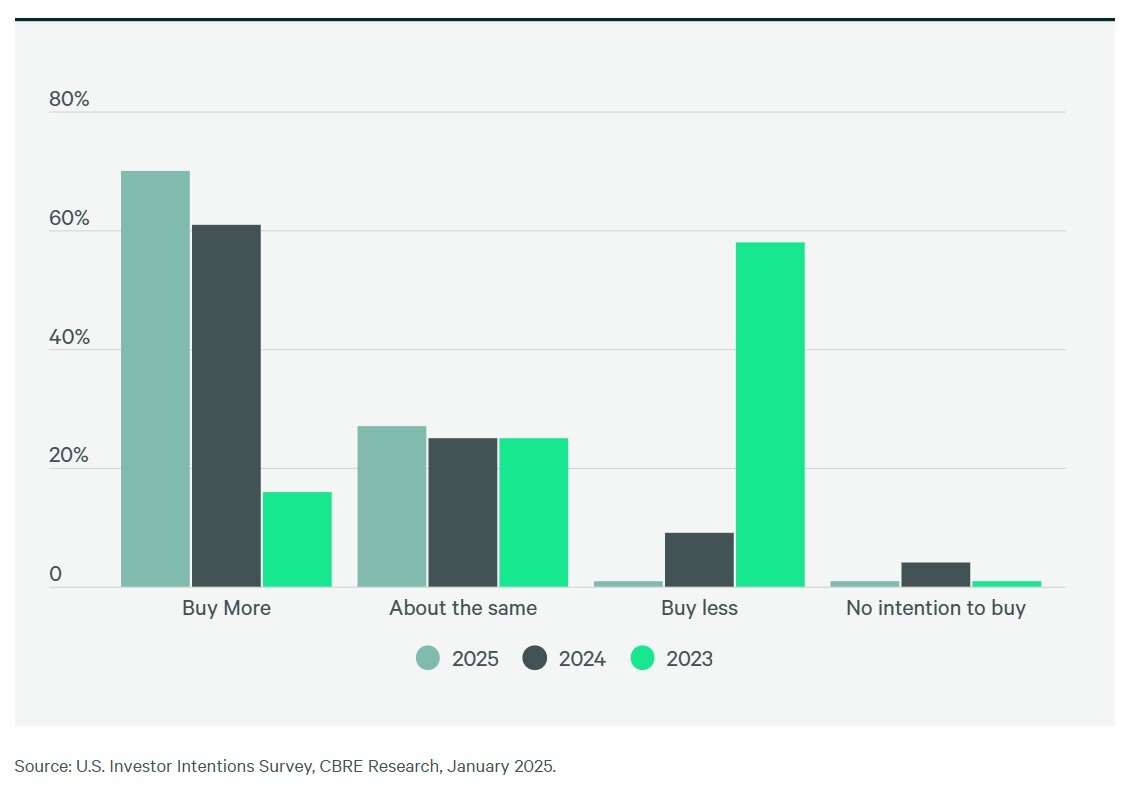

Investor Confidence Jumps in 2025, 70 Percent Plan to Acquire More Assets

According to CBRE's 2025 U.S. Investor Intentions Survey, property investors are preparing to allocate more capital into the U.S. commercial real estate market. This optimism is driven by attractive pricing opportunities, even amidst challenges from fluctuating interest rates.

The survey, which spans all asset types, reveals a strong belief in the continued recovery of real estate fundamentals. Notably, 70% of respondents plan to increase their acquisitions in 2025 compared to the previous year. Additionally, 75% expect their investment activity to rebound by mid-year, with over half already experiencing signs of recovery.

"Investors are positioning themselves to take advantage of favorable pricing and strong market fundamentals," said Kevin Aussef, Americas President of Investment Properties for CBRE. "Interestingly, investors are more confident about their own prospects than the broader market outlook, viewing the current pricing reset as an opportunity to gain a first-mover advantage as recovery progresses."

Top U.S. Markets for Investment

- Gateway and Sun Belt Markets Dominate: Investors remain focused on traditional gateway markets and high-growth Sun Belt regions.

- Dallas Leads for the Fourth Year: Dallas retains its top spot as the most preferred market, with Miami ranking second.

- Boston Gains Appeal: Boston joins Washington, D.C., and San Francisco in the top 10 preferred markets.

- Sun Belt Hotspots: Atlanta, Raleigh-Durham, Austin, and Phoenix continue to attract strong investor interest due to their growth potential.

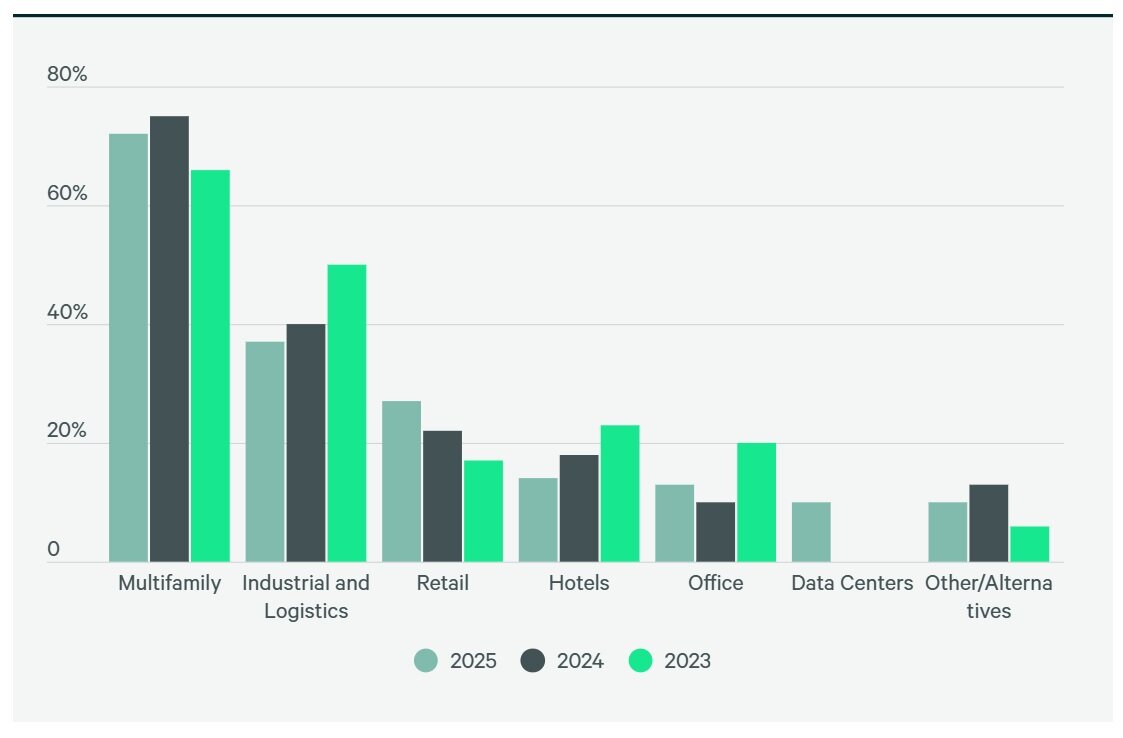

Preferred Property Types

- Multifamily Leads: Multifamily assets remain the most sought-after, with 75% of investors targeting this segment.

- Industrial & Logistics in Demand: These assets rank second, with 37% investor interest.

- Retail Gains Momentum: Investor interest in retail is rising, outpacing last year's levels.

- Office Assets Stabilize: Office properties see renewed interest due to greater certainty around utilization rates and appealing pricing.

- Traditional Assets Prevail: Interest in alternative investments has declined as investors refocus on traditional real estate assets following price adjustments.

Investment Strategies

- Value-Add and Core-Plus Strategies Lead: Two-thirds of investors favor these strategies, seeking opportunities for higher returns with moderate risk.

- Declining Interest in Opportunistic and Distressed Assets: Strategies like core, distressed, and debt-focused investments have seen a drop compared to last year.

Key Challenges for Investors

- Interest Rate Volatility: Elevated and unpredictable long-term interest rates remain a top concern.

- Higher Operating Costs: Rising costs are impacting investor decision-making.

- Easing Recession Fears: Concerns about a recession and buyer-seller expectation gaps have diminished, reflecting improved sentiment around economic fundamentals.

Debt and Financing Trends

- Stable Debt Strategies: About 70% of investors plan to maintain their current debt-to-equity ratios.

- Confidence Amid Negative Leverage: More than half (56%) are willing to endure a year of negative leverage, highlighting confidence in recovery.

- Mortgage and Mezzanine Financing Stay Strong: Interest in mortgage financing (33%) and mezzanine debt (25%) remains robust.

- Interest Rate Challenges Persist: Uncertainty around interest rates and higher borrowing costs continue to pose challenges for debt-seeking investors.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.