Commercial Real Estate News

Rising Inflation, U.S. Economic Volatility Cooled Commercial Real Estate Lending in Q3

Commercial News » New York City Edition | By Michael Gerrity | November 8, 2022 8:45 AM ET

According to new data from global property consultant CBRE, ongoing market volatility from rising inflation and interest rates cooled U.S. commercial real estate lending activity in the third quarter of 2022.

The CBRE Lending Momentum Index, which tracks the pace of CBRE-originated commercial loan closings in the U.S., declined by 11.1% from the second quarter and 4.7% from the third quarter of last year. The index closed Q3 2022 at a value of 359.

"The Federal Reserve's hawkish stance to reduce inflation resulted in higher borrowing costs, more conservative underwriting and lower loan closing volume in the third quarter. We expect debt capital to be constrained and demand for loans to be weak for the balance of the year. In a tight lending environment, relationships with borrowers and capital sources become all the more critical," said Rachel Vinson, President of Debt & Structured Finance, U.S. for Capital Markets at CBRE.

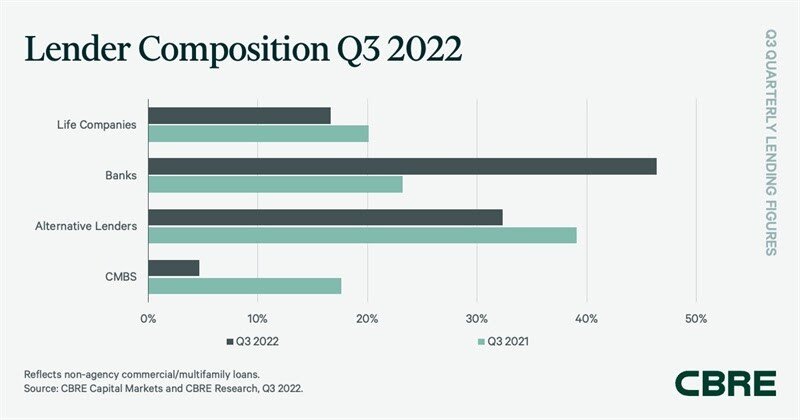

CBRE's lender activity indicates that banks had the largest share of non-agency loan closings for the second consecutive quarter at 46.4%-- up from 38.1% in Q2 2022 and double the share from a year ago. Banks funded a broad mix of permanent, bridge and construction loans across property types in Q3 2022. Banks are expected to remain cautious due to market conditions and regulatory pressures.

Alternative lenders, such as debt funds and mortgage REITs, were the second-most active lending group in Q3 2022 with 32.3% of loan closings, matching the share from Q2 2022 but down from 39% in Q3 2021. Rising spreads and interest rate cap costs slowed Collateralized Loan Obligations (CLOs) issuance to $3.39 billion in Q3 2022 from $12.3 billion in the previous quarter.

Life companies accounted for 16.7% of closed non-agency loans in Q3 2022--down from 26.2% in Q2 2022 and 20.1% a year ago. After a strong first half of 2022, life companies will likely be more selective in the remainder of the year as they near annual allocation targets.

CMBS conduit loans accounted for the remaining 4.6% of non-agency loan volume in Q3 2022--down from 17.6% a year ago. Industrywide CMBS origination volume fell to $13.3 billion in Q3 2022 from $20.8 billion in the previous quarter and $29.2 billion in Q1 2022. CMBS spreads have widened, making loan quotes less competitive.

Loan underwriting criteria has become more conservative in recent quarters. Higher mortgage rates and loan constants contributed to lower loan-to-value (LTV) ratios in Q3 2022, while underwritten cap rates and debt yields increased. Despite these changes, the percentage of loans carrying interest-only terms increased to an average of 63.8% in Q3 2022.

Government agency lending of multifamily assets remained robust, totaling $30.6 billion in Q3 2022--down 8.4% from Q2 2022. Year-to-date production volume through Q3 2022 totaled $94.9 billion, slightly ahead of last year's year-to-date total of $93.5 billion.

CBRE's Agency Pricing Index, which reflects the average agency fixed mortgage rates for closed permanent loans with a seven- to 10-year term, increased by 74 basis points (bps) in Q3 2022 and 148 bps from a year ago to average 4.61%. This rate is the highest since Q3 2018.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.