Commercial Real Estate News

Commercial Real Estate Lending Slowdown Continues in U.S.

Commercial News » New York City Edition | By Michael Gerrity | May 30, 2023 8:18 AM ET

Based on the latest research from CBRE, stress in the banking system and financial market volatility continued to slow commercial real estate lending activity in the first quarter of 2023.

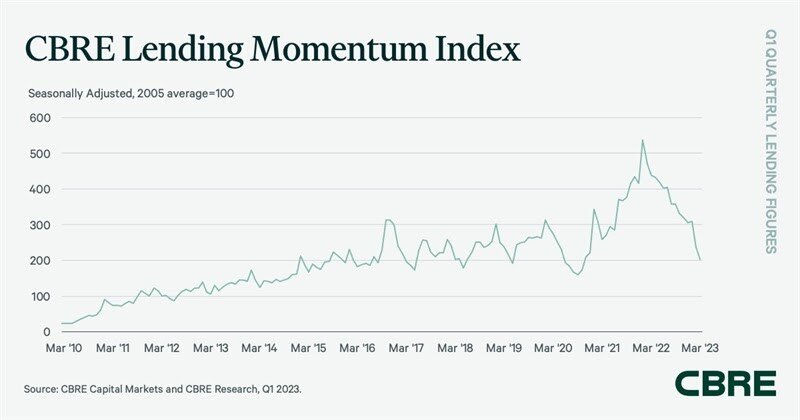

The CBRE Lending Momentum Index, which tracks the pace of CBRE-originated commercial loan closings in the U.S., declined by 33% from the fourth quarter of 2022 and 53.5% when compared with the strong loan volume of a year earlier. The index closed Q1 2023 at a value of 204.

"The Federal Reserve's commitment to reduce inflation with aggressive rate hikes continued to heighten market uncertainty through the first quarter. While plenty of debt capital remains available, increased borrowing costs coupled with credit tightening continues to put downward pressure on lending activity," said Rachel Vinson, President of Debt & Structured Finance, U.S. for Capital Markets at CBRE. "Borrowers will continue to opt for shorter-term, fixed-rate debt with shortened call protection until volatility begins to normalize."

Despite some high-profile failures, banks had the largest share of CBRE's non-agency loan closings for the fourth consecutive quarter at 41.1%--down from 58% in Q4 2022. This was driven by a diverse set of smaller local and regional banks, as well as credit unions. About one-third of bank loans were for construction projects, the majority of which were multifamily. The remainder was split between acquisition loans and refinancings.

Life companies were the second-most active lending group in Q1 2023 with 23% of closed non-agency loans--slightly above their Q4 2023 share. Loan closings in Q1 2023 included a high proportion of five-year deals, with an overall average loan-to-value ratio (LTV) of 52%.

Alternative lenders, such as debt funds and mortgage REITs, accounted for 20.2% of loan closings in Q1 2023, close to their Q4 2022 share. Higher spreads and interest rate cap costs created a challenging environment for financing floating-rate bridge loans. Collateralized loan obligation (CLO) issuance was limited to two deals totaling $1.1 billion in Q1 2023, compared with a total of $15.2 billion in Q1 2022.

CMBS conduit loans accounted for 15.7% of non-agency loan volume in Q1 2023--up from 2% in Q4 2022. Industrywide CMBS origination volume was limited to $5.9 billion in Q1 2023, down from $29.1 billion in Q1 2022.

Higher mortgage rates and loan constants were a key feature of loan underwriting criteria in Q1 2023. Average mortgage rates increased by 38 basis points (bps) quarter-over-quarter. Loan constants increased by only 13 bps to 77.6% due to an increase in the share of loans that carried partial or full interest-only terms. Underwritten debt yields and cap rates on closed loans rose by 29 basis points from the previous quarter to an average of 5.61%, while the average LTV ratio increased to 59.9% from 58.2%.

Government agency lending to multifamily assets totaled $16.5 billion in Q1 2023--down from $30.9 billion in Q1 2022.

CBRE's Agency Pricing Index, which reflects the average agency fixed mortgage rates for closed permanent loans with a seven- to 10-year term, increased by 11 bps in Q1 2023 and 184 bps from a year ago to average 5.32%.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Delinquencies Rise in Q2, CMBS Loans Lead the Surge

- Tokenization-Focused Real Estate Investment Bank Announced

- Commercial Cap Rates Edge Lower in U.S., Hinting at Market Turn

- WPV Targets New $6 Trillion Digital Real Estate Tokenization Opportunity

- $1 Trillion in Data Center Development Underway Through 2030

- WORLD PROPERTY VENTURES: The 'Anti-VC' of Real Estate Plans Major Capital Raise

- Multifamily Sector Enjoys Record Absorption in U.S. as Supply Slows, Vacancies Drop

- Employee Back-to-Office Attendance Surges in U.S.

- Phnom Penh Commercial Property Sectors Face Crosswinds in 2025

- World Property Bank Announced to Capitalize on Coming Trillion-Dollar Tokenization Boom

- REAL ESTATE PREDICTIONS: Decentralized Events Contract Exchange in Development

- U.S. Architecture Billings Improve Slightly in May

- Tokyo Office Demand Spills into Non-Core Wards in 2025

- AI Hyperscalers Drive Record Data Center Leasing in Early 2025

- Commercial, Multifamily Mortgage Debt in U.S. Hits Record $4.81 Trillion in Early 2025

- U.S. Multifamily Market Rebounds in Early 2025

- U.S. Office Market Experiences Historic Conversion Shift

- New York City Enters New Era of Office-to-Residential Conversions

- World Property Ventures Plans New Capital Raise

- U.S. Commercial Real Estate Lending Rebounds Sharply in Early 2025

- U.S. Multifamily Housing Confidence Declines in Early 2025

- Asia Pacific Commercial Investment Holds Steady in Early 2025

- Carnival Plans New Miami Headquarters Spanning Over 600,000 Square Feet

- Hong Kong Property Investors Take a Wait-and-See Approach Due to U.S. Tariffs

- U.S. Multifamily Buyer and Seller Sentiment Improves in Early 2025

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3