Commercial Real Estate News

Global Commercial Investment Returns with a Vengeance in 2021

Commercial News » New York City Edition | By Michael Gerrity | August 6, 2021 8:15 AM ET

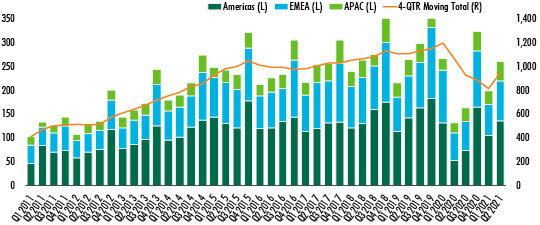

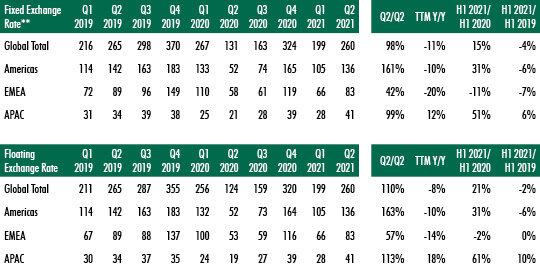

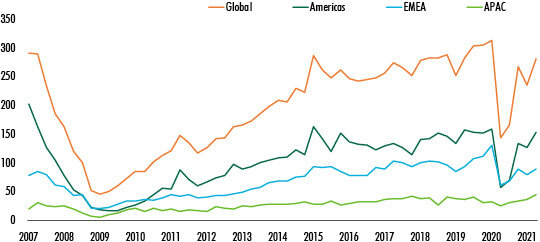

According to global property consultant CBRE, with vaccinations ramping up and economies reopening worldwide, global commercial real estate investment volume grew by 98% year-over-year to $260.4 billion in Q2 2021.

The rebound was robust in both the Americas and APAC, bringing volume back to pre-COVID levels. EMEA lagged slightly but maintained a positive outlook due to successful vaccination rollouts. The U.K., for example, recorded a strong quarter of investment activity, even by pre-COVID standards.

Key Global Investment Takeaways:

- Global commercial real estate investment volume in Q2 grew by 98% year-over-year to $260.4 billion, bringing the H1 2021 total to $459 billion--up by 15% from H1 2020.

- Americas and APAC volumes returned to pre-COVID levels in Q2, while European volume is expected to return in H2 on the back of economic recovery and widespread COVID-19 vaccinations.

- Capital continued to flow primarily to industrial and multifamily assets, while office investors remained focused on core assets.

- Investors favored markets with strong population growth, including those in the U.S. Sun Belt, German and Nordic urban centers and Tier I cities in Asia-Pacific.

H1 2021 global investment grew by 15% from a year ago to $459 billion. The office sector had the largest share with 26% of total investment in H1 2021, followed by industrial at 22% and multifamily at 20%, reflecting accelerated consumer and demographic trends.

The Americas

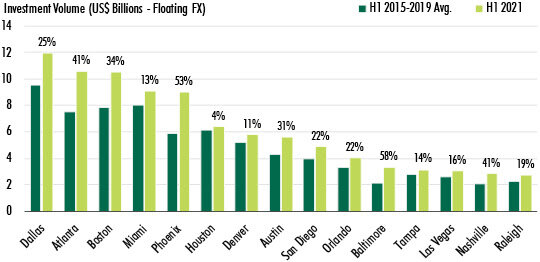

Americas investment volume surged by 161% year-over-year in Q2 to $136.5 billion. Excluding entity-level transactions, investment volume grew by 151% year-over-year and was fully back to pre-pandemic levels. The better-than-expected Q2 volume offset a soft Q1, resulting in a 31% year-over-year increase in H1 2021 volume to $241 billion, down by 6% from H1 2019.

Investment volume grew significantly from a low base across all sectors year-over-year. Industrial and multifamily accounted for nearly 60% of investment volume in the region, growing by 127% and 217% year-over-year, respectively, in Q2. The hotel sector had its most active Q2 since 2007. Blackstone and Starwood's $6 billion acquisition of Extended Stay America represented 44% of Q2's total hotel volume. Excluding entity-level transactions, Q2 hotel investment increased by 691% year-over-year and was up 5% from Q2 2019.

Office and retail investors remained focused on core assets. The office sector's share of total investment dropped to 18% in Q2 from an average 27% from 2015 to 2019. The retail sector's share dropped to 10% from its 15% average between 2015 and 2019. In both sectors, suburban locations outperformed urban locations, mainly driven by higher returns.

Sun Belt markets continue to be the key targets for U.S. investors as population growth drives demand for real estate space. When comparing Q2 2021 investment volume with Q2 2019, Orlando (+83%), Nashville (+73%), Raleigh (+63%) and Miami (+45%) were top metros in terms of growth, while Tier I cities like New York (-41%) and Boston (-28%) fell short. With higher population density and greater reliance on public transport, Tier I cities have taken more time to fully reopen, thus subduing their investment activity.

EMEA

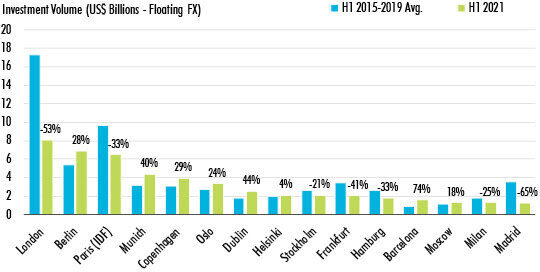

EMEA investment volume grew by 42% year-over-year in Q2 to $83 billion. H1 2021 investment volume fell by 11% year-over-year due to a record-setting Q1 2020. H2 volume is expected to grow once parts of the region reach herd immunity to COVID-19.

The U.K. (+39%), Norway (+38%) and Denmark (+55%) recorded strong year-over-year growth in H1, as they led the region in vaccination rates. Germany remained on solid footing, with H1 volume exceeding the 2015-to-2019 averages in Berlin and Munich. Population growth has played an important role in these markets' resilience. The Nordic countries and the U.K. boast higher population growth than the Euro Area, and their primary markets like London and Copenhagen are top destinations of cross-border capital.

The office sector's share of total investment dropped to 30% from roughly 40% pre-COVID, as capital shifted to multifamily and industrial assets. Compared with Q2 2019, industrial investment more than doubled in Q2 2021, illustrating the effect of e-commerce growth in Europe. Multifamily investment grew by 3% from Q2 2019. Meanwhile, office (-19%), retail (-27%), and hotel (-34%) had further to go in investment activity recovery. Highly contagious COVID variants may have weighed on investor sentiment and increased uncertainty about the pace of reopening plans.

APAC

APAC investment volume grew by 99% year-over-year in Q2 to $41 billion and by 51% in H1 2021 to $69 billion. Vaccination rates picked up in the region and investment activity largely returned to normal. Assuming no large-scale COVID-19 resurgence later this year, 2021 likely will be a phenomenal year for commercial real estate investments based on the region's economic performance.

Large-ticket transactions greatly contributed to the recovery in Q2. Deals of $1 billion or more accounted for 25% of the region's investment volume. Additionally, cross-border transactions grew by 65% year-over-year in Q2. Mainland China investment volume (+117%) more than doubled year-over-year in Q2, partially driven by Brookfield's $1.4 billion portfolio purchase of prime shopping centers. India's investment volume grew by 354% year-over-year in Q2, driven by Blackstone's $700 million investment in industrial parks in emerging Indian cities like Hyderabad and Pune. Australia (+196%), Hong Kong SAR (+270%) and South Korea (+69%) also saw robust capital flows.

On balance, investors preferred Tier I cities in the region, with Seoul (+56%), Beijing (+113%) and Melbourne (+48%) seeing significant investment volume growth in H1 2021 compared to the H1 average from 2015 to 2019. Indian markets like New Delhi and Bangalore have also seen sharply higher investment activity, particularly in the office sector.

Retail investment accounted for 31% of APAC's total investment volume in Q2, compared with a 10% Q2 average between 2015 and 2019. Australia and China were driven by strong office investment, with the SK Tower in Beijing selling for $1.4 billion. Industrial assets remained highly sought after in the region, with Q2 investment volume totaling $10.6 billion--the largest quarterly total on record.

Going Forward Forecast

Based on the stronger-than-expected performance in H1, CBRE now forecasts that annual global investment volume will increase by approximately 20% to 25% in 2021 (up from 15% to 20% earlier). COVID resurgences likely will delay a full return to pre-pandemic investment volumes, but policymakers are unlikely to reinstitute broad lockdowns. Short-term restrictions to avoid widespread transmission of delta and other new variants will be more likely.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.