Commercial Real Estate News

New Sublease Office Space in Manhattan Has Begun to Decline in June

Commercial News » New York City Edition | By Michael Gerrity | June 9, 2021 8:22 AM ET

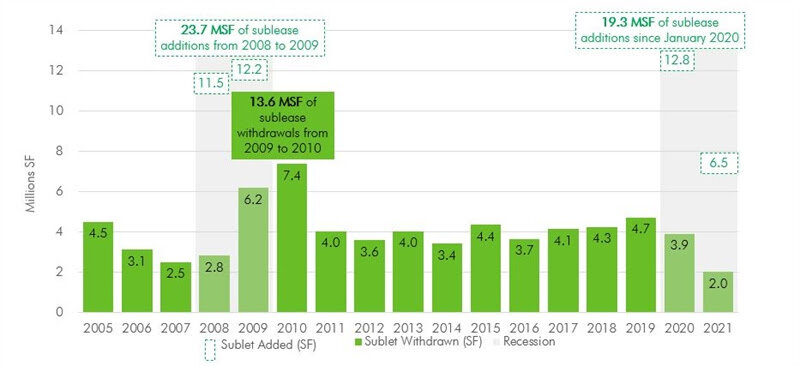

According to global property consultant CBRE, the amount of sublease space in Manhattan ballooned during the Covid-19 pandemic, as tenants looked to cut costs by shedding space they thought they would not need. Since the beginning of 2020, 19.3 million sq. ft. of gross sublease space has been added to the Manhattan office market, and sublease space now accounts 26% of all available space as of June 1, 2021. The Great Financial Crisis saw an even more dramatic increase in sublease space, with 23.7 million sq. ft. of gross space added in 2008-2009, accounting for 31% of all available space in the market at that time.

A flood of sublease space tends to be a drag on the market, causing the availability rate to rise and dragging down pricing, since sublessors often price their space at a discount to landlords' direct space offerings. For this reason, trends in the sublease market are considered a bellwether for the overall market performance and changes in the momentum of the sublease market are closely monitored.

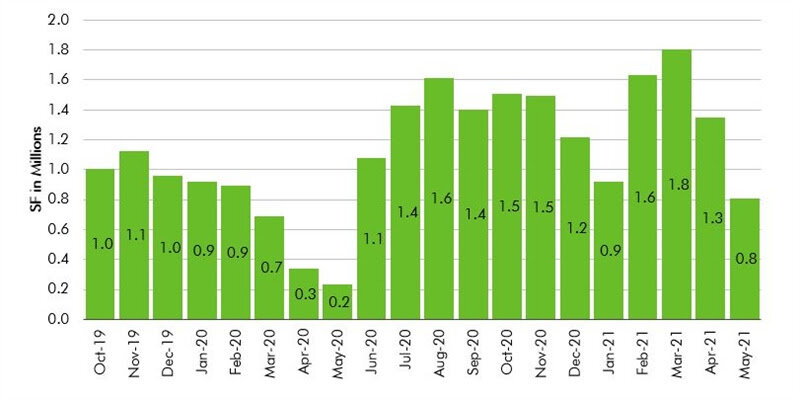

CBRE says a change appears to be underway in Manhattan. First, the amount of new sublease additions has begun to slow. Second, some tenants that listed sublease space after the pandemic hit are now pulling them off the market, in anticipation of reoccupying the space as their workers return to the office and hiring resumes.

In 2009-2010, following the Great Financial Crisis, 13.6 million sq. ft., or 57% of the gross sublease space added during the recession was eventually withdrawn from the market, says CBRE.

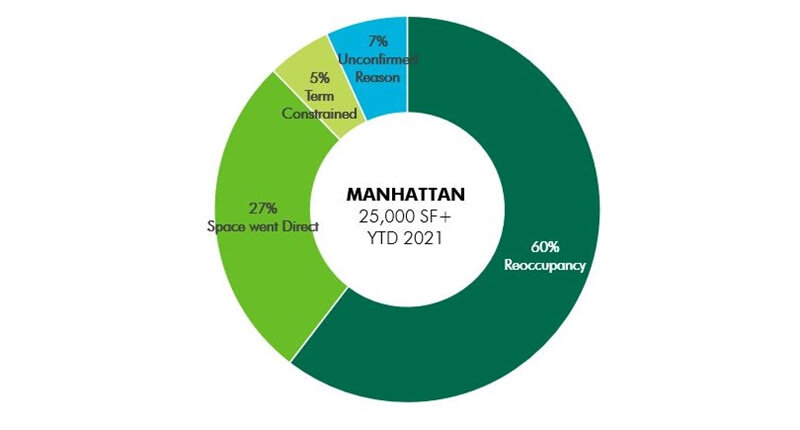

A similar sublease withdrawal trend appears to have commenced in Manhattan today. Thus far in 2021, 2.0 million sq. ft. of sublease space has been withdrawn from the market, with more than half of that occurring in April and May. Notably, 60% of all sublease spaces 25,000 sq. ft. or larger withdrawn from the market were recaptured for re-occupancy by the original tenant(see figure 3). As companies bring more workers back to the office-- most for the majority of the work week--sublease offerings are being trimmed or withdrawn altogether.

There is still a long way to go to absorb the large volume of sublease space currently on the market, but with the volume of new additions slowing down, the pace of space withdrawals picking up, and the economy adding back office-using jobs at a steady clip - there is more cause for optimism that the office market is nearing the beginning of the end of its downturn, says CBRE.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.