The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Latest PropTech Index Shows Investor Confidence Still Runs High as Industry Matures

Commercial News » New York City Edition | By Michael Gerrity | February 10, 2020 10:07 AM ET

Despite the fallout from WeWork in 2019, venture investors now see the PropTech sector going through a healthy normalization and rationalization period, as strong tailwinds persist for the sector moving into 2020.

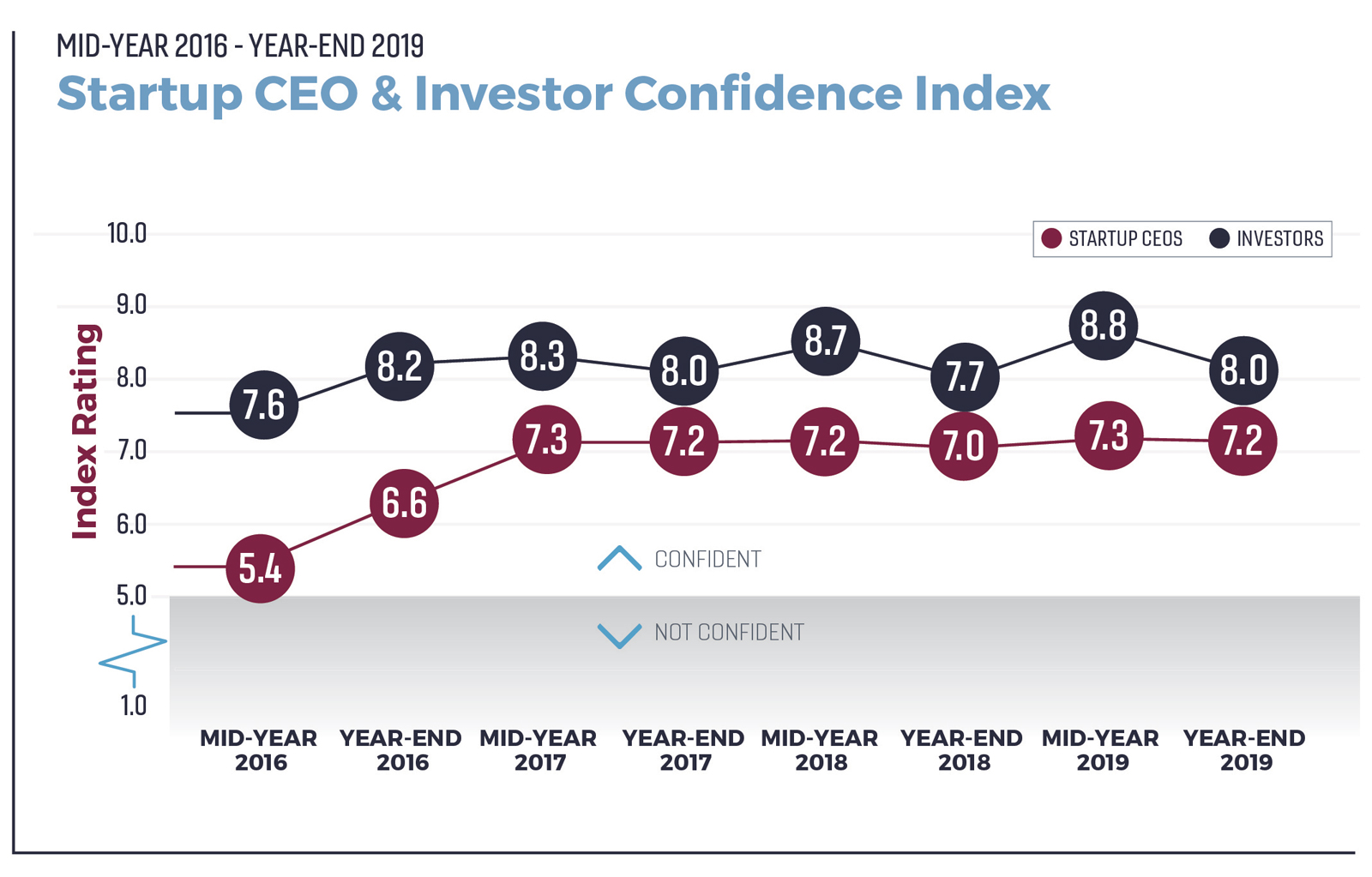

Aaron Block, co-founder and Managing Partner at New York City-based MetaProp tells The World Property Journal, "The Investor Index was driven down from an all-time high of 8.8 at Mid-Year 2019 to 8.0 at Year-End 2019. This decline can be attributed to a combination of market forces including the failed WeWork IPO, as well as the uncertainty of heading into an election year but most notably, investor deal volume is beginning to level off. This trend is supported by our finding that only 45% of investors plan on making more investments in 2020, compared to 2019, down from 64% six months ago. Although this is a considerable drop-off, as the market matures, we're seeing PropTech deals being done at a later stage and at a higher dollar amount, causing the total number of deals to plateau year over year. It's important to note that strong portfolio performance, robust deal flow, and increasing M&A activity have kept investor optimism high for 2020."

Aaron Block, co-founder and Managing Partner at New York City-based MetaProp tells The World Property Journal, "The Investor Index was driven down from an all-time high of 8.8 at Mid-Year 2019 to 8.0 at Year-End 2019. This decline can be attributed to a combination of market forces including the failed WeWork IPO, as well as the uncertainty of heading into an election year but most notably, investor deal volume is beginning to level off. This trend is supported by our finding that only 45% of investors plan on making more investments in 2020, compared to 2019, down from 64% six months ago. Although this is a considerable drop-off, as the market matures, we're seeing PropTech deals being done at a later stage and at a higher dollar amount, causing the total number of deals to plateau year over year. It's important to note that strong portfolio performance, robust deal flow, and increasing M&A activity have kept investor optimism high for 2020."

The two major PropTech market takeaways

Investor confidence continues to ride high behind robust deal flow, increasing M&A expectations and strong portfolio performance. The fallout from the failed WeWork IPO, as well as moving into an election year brings some uncertainty to the space which may explain the drop from 6 months ago.

Aaron Block

The two major PropTech market takeaways

Investor confidence continues to ride high behind robust deal flow, increasing M&A expectations and strong portfolio performance. The fallout from the failed WeWork IPO, as well as moving into an election year brings some uncertainty to the space which may explain the drop from 6 months ago.

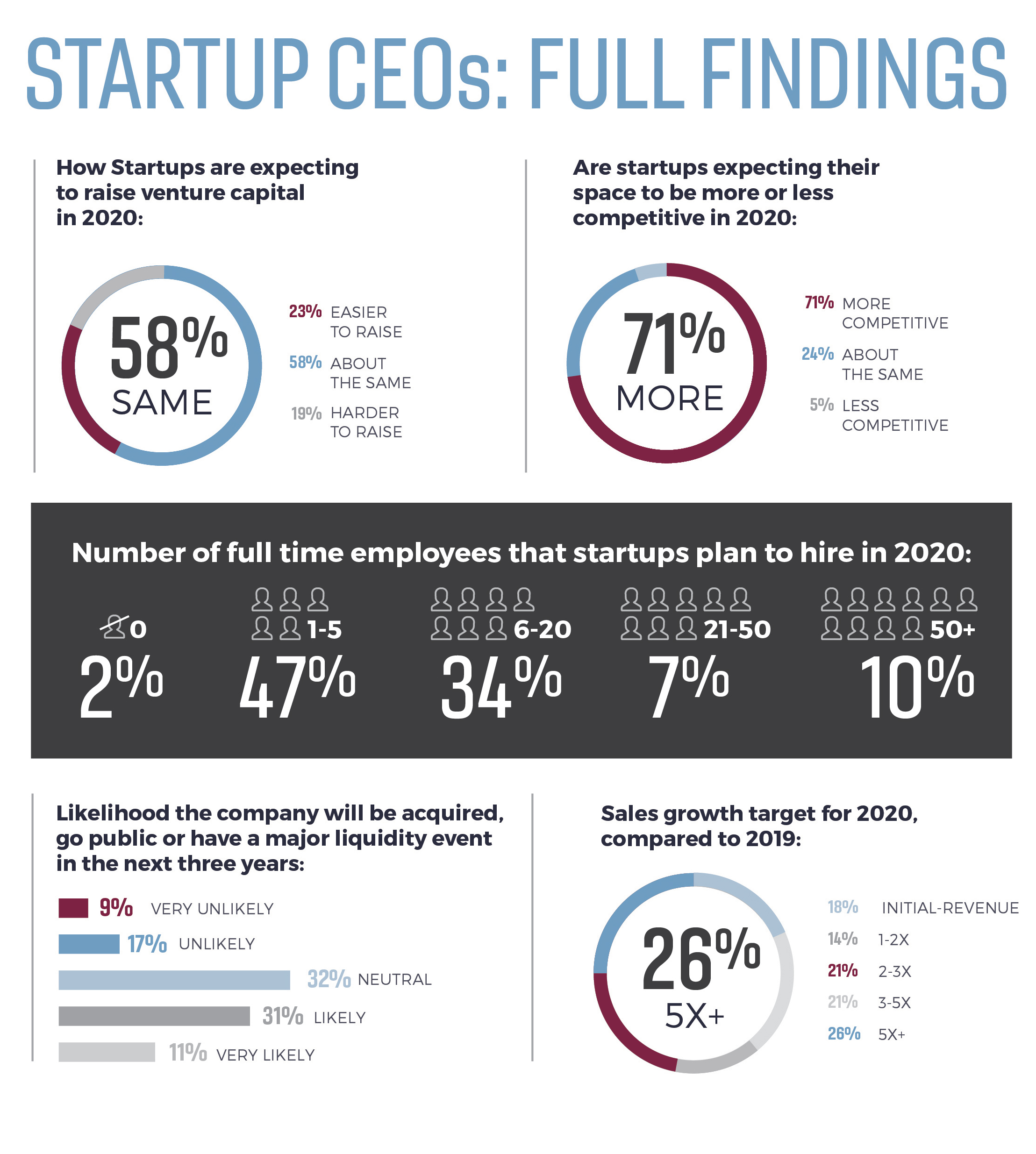

As the space begins to mature, we're seeing PropTech startups hire more employees and hit elevated yearly revenue numbers. With startups continuing to flood in the market, consolidation will remain high. An increasing sentiment in the ability to raise capital is met with concerns of bloated valuations from around the space.

"The Global PropTech Confidence Index shows continued strong investor interest in PropTech," said Christopher Beach, REBNY's Chief Technology Officer. "This report demonstrates that New York City remains a global hub for technology development and innovation, providing the solutions needed to address the challenges facing the real estate industry."

Year-End 2019 Global PropTech Confidence Index Highlights:

"The Global PropTech Confidence Index shows continued strong investor interest in PropTech," said Christopher Beach, REBNY's Chief Technology Officer. "This report demonstrates that New York City remains a global hub for technology development and innovation, providing the solutions needed to address the challenges facing the real estate industry."

Year-End 2019 Global PropTech Confidence Index Highlights:

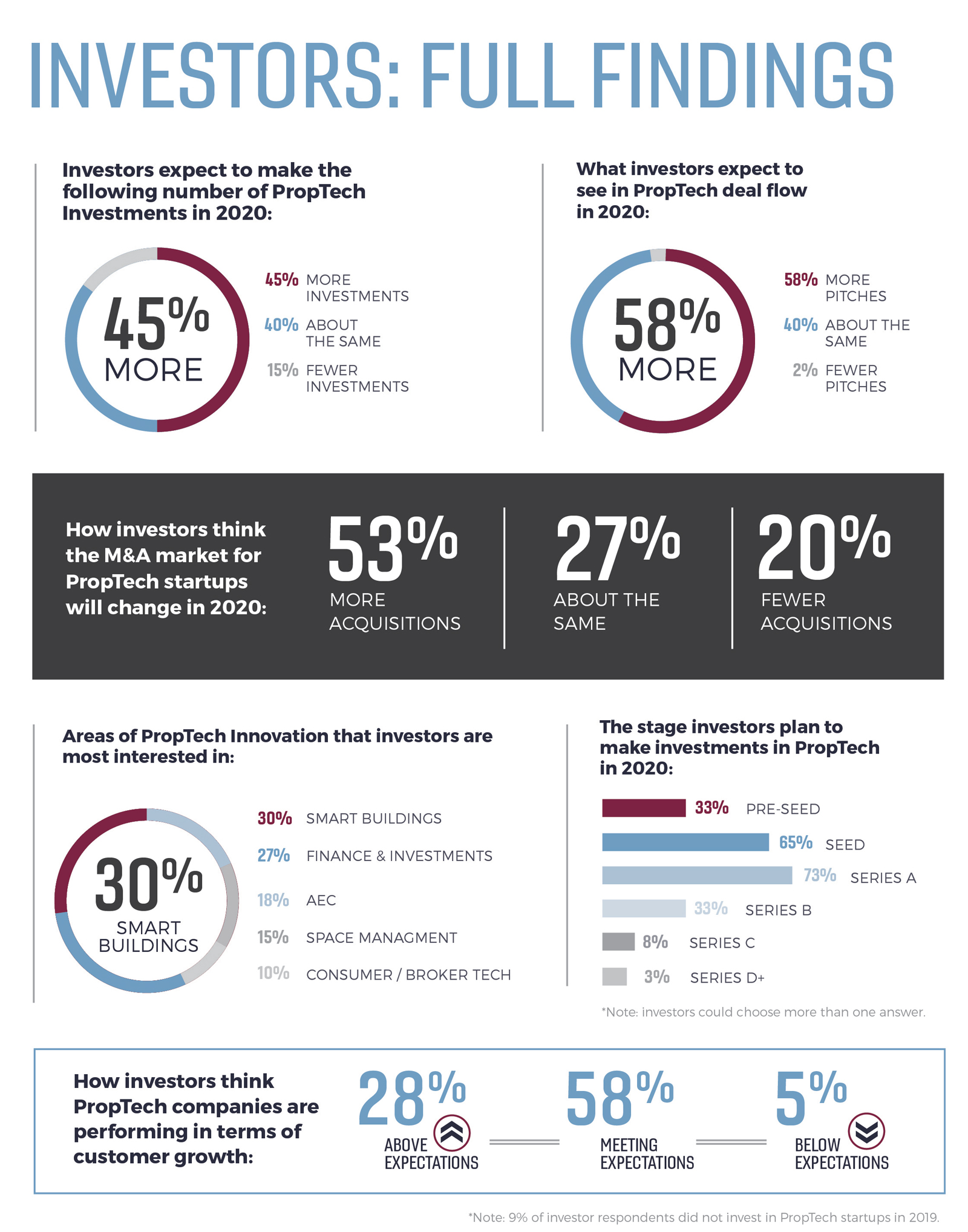

- 80% of Investor respondents expect to see either more acquisitions or about the same number of acquisitions in 2020 compared to 2019

- 81% of Startups expect it to be either easier to raise venture capital or about the same in 2020 compared to 2019, up from 45% at Year-End 2017

- 45% of Investors plan to make more investments in 2020 compared to 2019, down from an all-time high of 64% six months ago

- 42% of Startups said it was either likely or very likely that their company would either be acquired, go public or have a major liquidity event in the next 3 years. This number is up from 28% in Mid-Year 2018

- 16% of the Startup respondents are founded by females, an all-time high and double the number at Year-End 2016

- 86% of Investors said that PropTech companies in their portfolio are currently performing above expectations or meeting expectations in terms of customer growth

- 34% of Startup respondents had $1+ million in total annual revenues in 2019, up from 24% a year ago

- 42% of Startups are targeting mixed-use assets for commercial deployment, a major increase from 23% at Year-End 2017

Source: MetaProp

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More