Commercial Real Estate News

Commercial Mortgage Delinquencies Decline to Pre-Pandemic Lows in U.S.

Commercial News » New York City Edition | By WPJ Staff | June 7, 2021 8:41 AM ET

According to the Mortgage Bankers Association, delinquency rates for mortgages backed by commercial and multifamily properties continue to decline in May 2021.

The summary of findings come from MBA's Commercial Real Estate Finance (CREF) Loan Performance Survey for May, and the latest quarterly Commercial/Multifamily Delinquency Report for the first quarter of 2021. The CREF Loan Performance Survey was developed by MBA to better understand the ways the pandemic is impacting commercial mortgage loan performance. MBA's regular quarterly analysis of commercial/multifamily delinquency rates is based on third-party numbers covering each of the major capital sources.

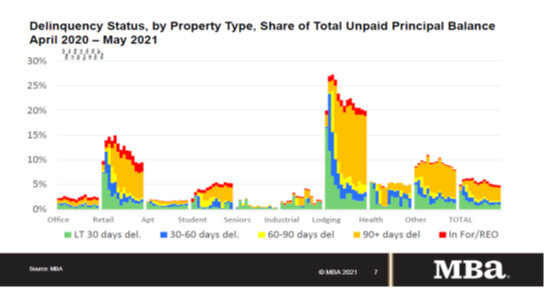

"Commercial and multifamily mortgage delinquency rates ticked down last month to the lowest level since the onset of the COVID-19 pandemic," said Jamie Woodwell, MBA's Vice President of Commercial Real Estate Research. "Pockets of elevated stress remain in loans backed by lodging and retail properties, driven by loans in the later-stages of delinquency and foreclosure or REO. Quarterly measures of delinquency rates between last year's fourth quarter and this year's first quarter show a drop in distress across nearly every capital source.

Key Findings from MBA's CREF Loan Performance Survey for May 2021:

- 95.2% of outstanding loan balances were current, up from 95.1% in April.

- 3.1% were 90+ days delinquent or in REO, down from 3.2% a month earlier.

- 0.2% were 60-90 days delinquent, down from 0.3% a month earlier.

- 0.5% were 30-60 days delinquent, up from 0.4% a month earlier.

- 1.0% were less than 30 days delinquent, down from 1.1%.

Loans backed by lodging and retail properties continue to see the greatest stress.

- 20.0% of the balance of lodging loans were delinquent, down from 20.2% a month earlier.

- 9.5% of the balance of retail loan balances were delinquent, up from 9.3% a month earlier.

- Non-current rates for other property types were at lower levels during the month.

- 1.9% of the balances of industrial property loans were non-current, unchanged from a month earlier.

- 2.4% of the balances of office property loans were non-current, down from 2.6% a month earlier.

- 1.8% of multifamily balances were non-current, up from 1.7% a month earlier.

Because of the concentration of hotel and retail loans, CMBS loan delinquency rates are higher than other capital sources.

- 8.2% of CMBS loan balances were non-current, down from 8.5% a month earlier.

- Non-current rates for other capital sources were more moderate.

- 2.4% of FHA multifamily and health care loan balances were non-current, up from 2.1% a month earlier.

- 2.0% of life company loan balances were non-current, unchanged from a month earlier.

- 1.2% of GSE loan balances were non-current, up from 1.1% a month earlier.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher