Commercial Real Estate News

Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

Commercial News » New York City Edition | By Michael Gerrity | October 21, 2024 7:06 AM ET

According to CommercialEdge's latest U.S. office market report, despite the attention garnered by return-to-office mandates from prominent companies, office utilization has remained largely unchanged. Remote and hybrid work continue to dominate, with many companies reducing their office space.

While some businesses have tried to lure employees back with perks and incentives, these efforts have generally fallen short. As a result, some companies are now turning to stricter measures. For example, Amazon CEO Andy Jassy announced that, starting in January, workers are expected to be in the office five days a week. Dell has stated that remote workers will no longer be considered for promotions, and Meta has warned employees that failure to be in the office at least three days a week could lead to termination.

Despite these high-profile mandates, vacancy rates and office utilization remain relatively unchanged. Kisi Access Control, which uses aggregated data from office unlocks to track occupancy, reported a national average of 50.2% for the week ending September 30. Illinois (56.1%), Texas (54.7%), and Florida (53.2%) had occupancy rates above the national average, while California (49.2%), Pennsylvania (47.8%), New York (47.2%), and Washington, D.C. (36.6%) fell below. Kastle's Back to Work Barometer, which tracks office badge swipes, showed similar results, with office utilization at 51.4%, consistent with earlier readings this year.

Although many firms are pushing for a return to the office, remote and hybrid work remain prevalent. A recent KPMG survey of 1,300 CEOs found that 83% expect to return to five-day office weeks within three years, up from 64% last year. However, leasing data and office badge swipe statistics continue to reflect a different reality. While CBRE reported that the total number of leases signed in early 2024 was comparable to pre-pandemic levels, the average lease size has decreased by over 25%. Additionally, new job creation has slowed, keeping office demand low. The Bureau of Labor Statistics reported that office-using sectors of the labor market grew only 0.4% year-over-year.

Peter Kolaczynski, Director at CommercialEdge, noted, "With office occupancy remaining persistently low, it highlights the issue of excessive office space. Approximately 20% of the 7 billion square feet of office space remains vacant."

Distressed Office Demand and Rising Vacancies

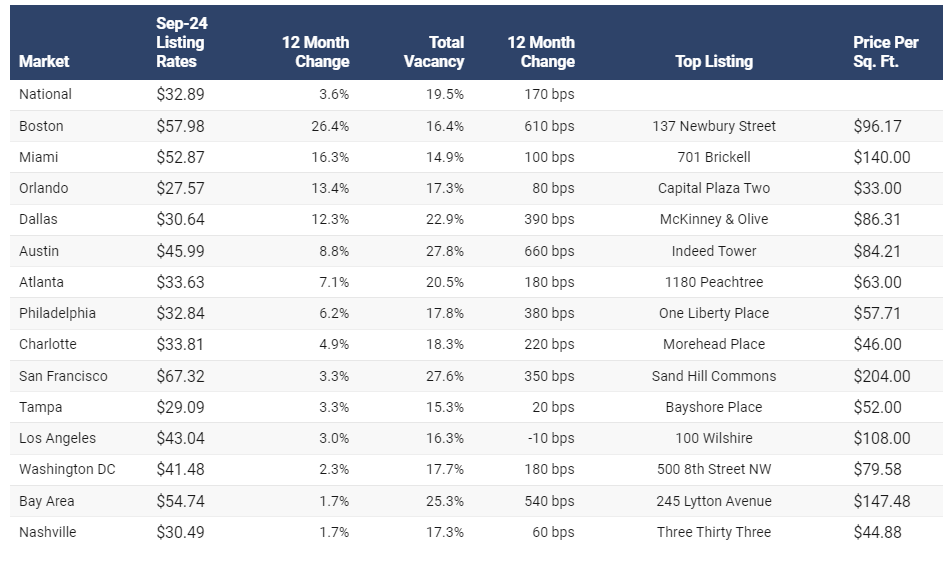

The national average full-service equivalent listing rate in September was $32.89 per square foot, up 11 cents from the previous month. The national vacancy rate stood at 19.5%, an increase of 170 basis points year-over-year. As pre-pandemic leases expire, many companies are downsizing, leading to rising vacancy rates and increasing distress in the office sector. Austin, Boston, the Bay Area, and Denver saw some of the largest year-over-year vacancy rate increases, with Austin up by 660 basis points, Boston by 610, the Bay Area by 540, and Denver by 400.

Two key tech markets have experienced significant shifts in their development pipelines. Austin and Seattle, which saw steady office development during the first two years of the pandemic, have seen new development slow dramatically in 2023. Layoffs in the tech sector, rising capital costs, and the widespread adoption of remote and hybrid work have contributed to this slowdown. In Austin, 13.8 million square feet of office space began construction between 2019 and 2022, averaging 3.5 million square feet annually. However, since 2023 began, only 1.4 million square feet have started construction. Similarly, Seattle saw an average of 2.6 million square feet of office space begin construction annually between 2019 and 2022, but only 696,000 square feet have been built over the past seven quarters.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher