The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Global Commercial Property Investment Hits $200 Billion in Q3

Commercial News » New York City Edition | By Michael Gerrity | October 28, 2016 12:44 PM ET

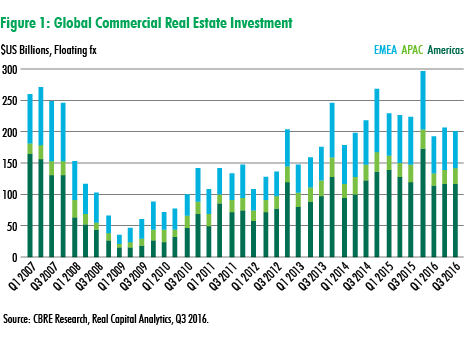

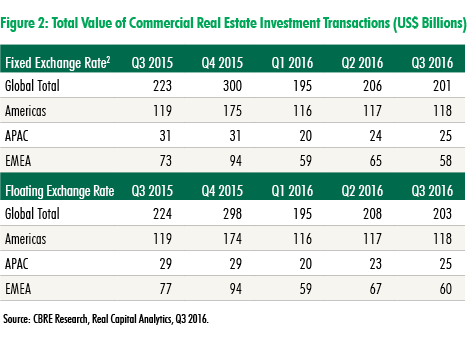

Global real estate consultant CBRE Group, Inc. is reporting this week that the worldwide value of commercial real estate investment transactions stayed above $200 billion in Q3 2016, suggesting that the market has stabilized after a drop in transactions at the start of the year.

Globally, risk aversion among investors lowered transaction levels across all asset classes in the first half of the year. Bond and equity markets settled down in H1 2016, and this is also showing through in the real estate sector. Quarter on quarter, transaction value1 was down by 1% in Q3 2016; versus Q3 2015, it was down 9%.

EMEA Region Activity

Activity in the EMEA region (dominated by Europe) continued to show a downward trend, falling by 8% compared to Q2 2016 and by 18% compared to Q3 2015. Due to exchange rate effects, the EMEA decline is greater when measured in U.S. dollars, and particularly over the longer term--21% versus Q3 2015. Weakness in the UK market has been a significant driver of the drop in EMEA activity. Investment transactions have been slowing since mid-2015, but that trend accelerated in H1 2016 and continued after the referendum result at the end of June. Excluding UK transactions, EMEA showed a year-over-year decline of 14%.

The Americas

Transactions in the Americas rose by 1% during Q3 2016. For the Americas, a feature of H1 2016 was the extent to which the value of portfolio and entity level transactions dropped off. Values were more resilient among single-asset transactions while dropping significantly for more complex deals. The aggregate value of entity and portfolio transactions showed a year-over-year drop of 36% in Q2 2016; in Q3 2016 there were some early signs of a reversal, with the rate of decline falling to 8%.

Asia Pacific

Investment in the APAC region has rebounded quite strongly over the past two quarters. Over the past two years, the trend in APAC has differed from the Americas and EMEA. In 2015, transaction levels showed no increase from 2014. In 2016, investment has bounced back after a particularly low total in Q1 2016, which seems to have represented a low point. Quarter over quarter, transactions were up by 4% in Q3, (local currencies), after an 18% increase the previous quarter. In contrast to EMEA, exchange rate movements mean that these increases are even bigger when measured in U.S. dollars, as the Japanese Yen and the Australian dollar have both strengthened against U.S. currency.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

- Commercial Property Investment in Japan Implodes 57 Percent Annually in Late 2023

- Green Energy Companies Flocking to New York City Office Space

- Asia Pacific Commercial Property Investment Upticks 3 Percent in Q4

- U.S. Commercial, Multifamily Borrowing to Hit $576 Billion in 2024

- Japan is Top Cross Border Commercial Property Investment Target in 2024

- U.S. Delinquency Rates for Commercial Properties Increased 6 Percent in Q4 of 2023

- Commercial Property Investment in Japan to Weaken in 2024

- Office Landlords Nationwide Increasing Concessions to Lure Tenants in U.S.

- Hong Kong's Commercial Property Market Faces Ongoing Challenges in 2024

- Online Returns in the U.S. Could Total $82 Billion This Holiday Season

- More Pain Expected in 2024 for America's Commercial Property Sector

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More