The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Vacation Real Estate News

Slower Growth Expected for U.S. Hotel Industry in 2017 and 2018

Vacation News » Orlando Edition | By Monsef Rachid | January 26, 2017 8:00 AM ET

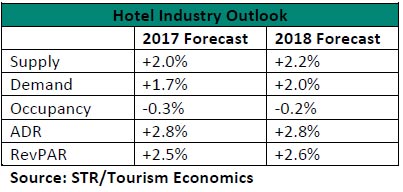

According to STR and Tourism Economics' first forecast of 2017, the U.S. hotel industry is projected to see slower but steady growth through 2018.

"Demand has outpaced supply in terms of growth for seven consecutive years, but we expect that to change in 2017 and continue in 2018," said Amanda Hite, STR's president and CEO. "In an environment where occupancy is flat or slightly declining, ADR is the lone driver of RevPAR, which is why we expect RevPAR growth in 2017 and 2018 to be slower than the industry average of the past 30 years (+3.3%).

"Demand has outpaced supply in terms of growth for seven consecutive years, but we expect that to change in 2017 and continue in 2018," said Amanda Hite, STR's president and CEO. "In an environment where occupancy is flat or slightly declining, ADR is the lone driver of RevPAR, which is why we expect RevPAR growth in 2017 and 2018 to be slower than the industry average of the past 30 years (+3.3%)."That said, growth of any rate continues to push industry performance to all-time highs."

2017

For total-year 2017, the U.S. hotel industry is predicted to report a 0.3% decrease in occupancy to 65.3%, a 2.8% rise in average daily rate (ADR) to US$127.34 and a 2.5% increase in revenue per available room (RevPAR) to US$83.20. RevPAR grew more than 3.0% for each year from 2010 to 2016.

Among Chain Scales, the Midscale segment is expected to see the only year-over-year increase in occupancy (+0.1%). The Independent segment is projected to report the largest increases in ADR (+3.0%) and RevPAR (+2.7%). The lowest rate of overall performance growth is expected in the Upscale segment (RevPAR +1.3%).

2018

For 2018, STR and Tourism Economics project the U.S. hotel industry to report a 0.2% decrease in occupancy to 65.2% but increases in ADR (+2.8% to US$130.95) and RevPAR (+2.6% to US$85.36). All seven Chain Scale segments are expected to see a decrease in occupancy. The Luxury segment is projected to report the largest increases in ADR (+3.0%) and RevPAR (+2.8%).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

- London Hotels Set to Weather High Inflation in 2022

- Almost 55 Million People to Travel This Thanksgiving Holiday in America

- Düsseldorf Hotels Enjoy Growing Corporate Demand in 2022

- Global Hotel Investment Activity in Asia Pacific to Rise 80 Percent in 2022

- Japan Lifts Foreign Inbound Covid Travel Restrictions in October

- Demand for Second Vacation Homes in the U.S. Decline

- Amsterdam Hotels Enjoy Comeback Post Covid Travel Restrictions

- 47.9 Million Americans Will Travel This July 4th Weekend

- High Prices, Rising Rates, Economic Uncertainty Ends Vacation Home Boom in America

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More