The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Vacation Real Estate News

U.S. Tourism to Enjoy Continued Growth Through 2017

Vacation News » Orlando Edition | By Monsef Rachid | June 7, 2016 8:14 AM ET

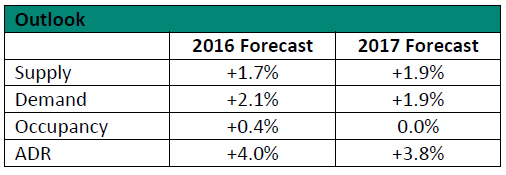

According to STR and Tourism Economics' most recent forecast released this week at the NYU International Hospitality Industry Investment Conference, the U.S. hotel industry is projected to experience continued performance growth through 2017.

For total-year 2016, the U.S. hotel industry is predicted to report a 0.4% increase in occupancy to 65.7%, a 4.0% rise in average daily rate to $124.86 and a 4.4% increase in revenue per available room to $82.07. During that same period, demand growth (+2.1%) is expected to outweigh supply growth (+1.7%).

"Albeit at a lower growth rate than in previous years, we expect RevPAR in the U.S. to continue to reach record levels through 2017," said Amanda Hite, STR's president and CEO. "The gap between demand growth and supply growth continues to lessen, and occupancy growth has decelerated, but rate will continue to drive RevPAR barring any unforeseen circumstances."

Among the Chain Scale segments in the U.S., the Independent segment is expected to report the largest year-over-year increases in each of the three key performance metrics in 2016: occupancy (+0.7%), ADR (+4.2%) and RevPAR (+4.9%). Two other segments are projected to report RevPAR growth above 4.0%: Upper Upscale (+4.3%) and Luxury (+4.2%).

Of the Top 25 Markets, 16 are expected to experience RevPAR performance between 0% and +5.0% in 2016. Six markets are expected to see RevPAR growth in the range of 5.0% to 10.0%: Dallas, Texas; Los Angeles/Long Beach, California; Nashville, Tennessee; Norfolk/Virginia Beach, Virginia; San Francisco/San Mateo, California; and Tampa/St. Petersburg, Florida.

For 2017, STR and Tourism Economics project the U.S. hotel industry to report flat occupancy, a 3.8% rise in ADR to $129.66 and a 3.8% increase in RevPAR to $85.22.

Also in 2017, supply (+1.9%) and demand (+1.9%) are expected to grow at the same pace.

Demand growth in the U.S. has outpaced supply growth each year dating back to 2010.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

- London Hotels Set to Weather High Inflation in 2022

- Almost 55 Million People to Travel This Thanksgiving Holiday in America

- Düsseldorf Hotels Enjoy Growing Corporate Demand in 2022

- Global Hotel Investment Activity in Asia Pacific to Rise 80 Percent in 2022

- Japan Lifts Foreign Inbound Covid Travel Restrictions in October

- Demand for Second Vacation Homes in the U.S. Decline

- Amsterdam Hotels Enjoy Comeback Post Covid Travel Restrictions

- 47.9 Million Americans Will Travel This July 4th Weekend

- High Prices, Rising Rates, Economic Uncertainty Ends Vacation Home Boom in America

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More