Commercial Real Estate News

Demand for Life Sciences Lab Space Heats Up in 2021

Commercial News » San Diego Edition | By Michael Gerrity | July 1, 2021 8:00 AM ET

Boosted by Development and Manufacturing of New Medicines and Vaccines in the U.S.

According to a new report from CBRE, life-science lab space in the U.S. has emerged as a coveted sector of commercial real estate as hefty increases in funding and employment have fueled both demand for lab space and construction of it in leading U.S. life-science markets.

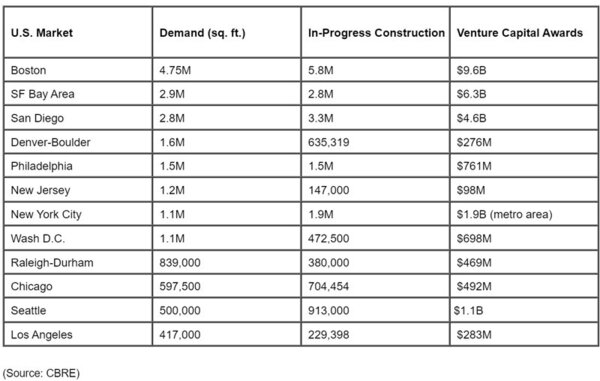

Companies actively seeking life-science real estate in the first quarter targeted a cumulative 19.3 million sq. ft. of lab space in the top 12 U.S. life-science markets, according to CBRE's Midyear U.S. Life Sciences report. This represents more than 12 percent of the total existing life sciences space across these markets--a rate of demand that is fueling ongoing construction of lab space.

U.S. lab space under construction totaled 18.9 million sq. ft. at the end of this year's first quarter. Meanwhile, tight vacancy--averaging just 5.6 percent across those markets -- is causing lab rents to rise to record levels in the leading life-science hubs of Boston, the San Francisco Bay Area and San Diego.

"Several factors have boosted the life-science industry in recent years--and even more so in the last 18 months--including keen interest from governments and capital sources in developing and manufacturing new medicines to address pandemics like COVID-19 and demographic shifts such as the aging population," said Ian Anderson, CBRE's Americas Head of Office Research. "That, in turn, has resulted in a race for more lab space. Construction of new labs, including conversions of regular offices to lab space, has ramped up significantly. But demand has grown even faster."

The $10 billion in venture capital awarded to U.S. life sciences companies in the first quarter marked a record, exceeding the previous high in last year's fourth quarter by roughly 60 percent, according to the PwC Moneytree Explorer survey. U.S. life-sciences employment has risen by 15.6 percent since April 2017, outpacing the growth of the larger tech industry.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher