Commercial Real Estate News

Tech Accounts for 22 Percent of Office Leasing Activity in North America

Commercial News » San Diego Edition | By Michael Gerrity | October 29, 2021 8:10 AM ET

Up from 17 percent share in 2020

Based on CBRE's latest annual Tech-30 Report, the tech industry led a rebound in U.S. office-leasing activity in 2021, fueled by increased hiring and demand for tech products and services. Tech companies claimed a 22 percent share of U.S. office-leasing activity in the second and third quarters combined, up from 17 percent for all of 2020.

This year, tech companies' office leasing activity increased by 122 percent on average in the second and third quarters, compared to the first. In addition, more than two thirds of the top 30 North American tech markets registered office-rent growth from the second quarter of 2019.

Over this two-year period, four markets posted double-digit percentage gains in office rents: Seattle, Charlotte, Vancouver and Austin. Separately, six markets posted gains in net absorption - the net amount of office space newly occupied or vacated - since mid-2019. Those are Charlotte, Raleigh-Durham, Nashville, Salt Lake City, Indianapolis and Phoenix.

The gains in tech's office leasing underscore the industry's resilience during the pandemic. U.S. tech employment now exceeds its pre-crisis level by 3.3 percent, surpassed only by the life sciences industry (6.9 percent). The tech industry expanded by 219,000 jobs in the U.S. since May 2020. The top Tech-30 markets for tech-job growth in 2019 to 2020 are Toronto (a gain of 26 percent), Seattle (22 percent), Vancouver (21 percent), New York (18 percent) and Austin (16 percent).

"Over the past year, the tech industry has proven to be a resilient industry that grew throughout the pandemic," said Colin Yasukochi, Executive Director of CBRE's Tech Insights Center. "Many tech companies are, like other industries, embracing hybrid work formats to provide their employees flexibility. But the industry also values the collaborative environment of the physical office and its role in bringing employees together to foster innovation."

Sublease Situation

Yet the tech industry still poses a challenge for office markets in one regard: sublease space. Office space listed for sublease by tech companies in the Tech-30 markets nearly doubled from last year's first quarter to this year's third, now totaling 134 million sq. ft. Tech companies currently account for 23 percent of all office space listed for sublease in those markets, up from 14 percent in 2019. Still, indicators of leasing activity show that the U.S. total of sublease space likely peaked last quarter.

Submarkets Shining

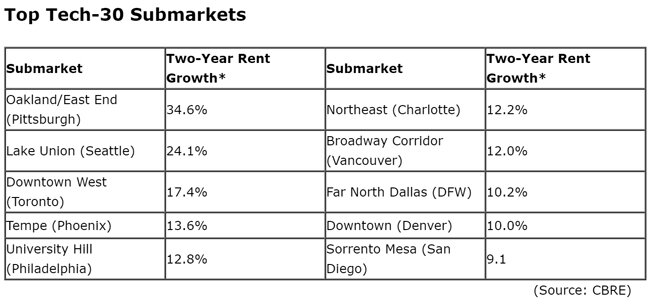

Among the most resilient office markets in this downturn are leading tech submarkets, which often are located near universities. CBRE has found that office lease rates in leading tech submarkets carry a 25 percent premium, on average, to rates for their cities as a whole. Those with the largest premiums are East Cambridge in Boston (114 percent), Palo Alto in Silicon Valley (66 percent) and Santa Monica in Southern California (63 percent). Tech submarkets also tend to generate some of the strongest rent gains and office-space absorption in their cities.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- One Trillion Dollars of America's Commercial Property Loans Mature in 2025

- U.S. West Coast Dominates Self Storage Demand

- Phoenix, Orange County and Inland Empire Emerge as Leading U.S. Industrial Markets

- U.S. Mega Distribution Centers Leasing Activity Grew in 2024

- U.S. Commercial Borrowing to Increase to $583 Billion in 2025, Up 16 Percent Annually

- Demand for U.S. Life Sciences Space Spikes 28 Percent Annually in Late 2024

- Multifamily Property Sector in America Rebounding

- Asia Pacific Commercial Property Investment Spikes 23 Percent in 2024

- U.S. Commercial Property Market Primed for Growth in 2025

- Architecture Industry Sees Mixed Signals as 2025 Approaches

- Global Data Center Demand Spikes in 2025

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.