Residential Real Estate News

Record Number of U.S. Home Sellers Gave Concessions to Buyers in Late 2022

Residential News » San Diego Edition | By David Barley | January 17, 2023 8:29 AM ET

San Diego top market for home buyer concessions in Q4

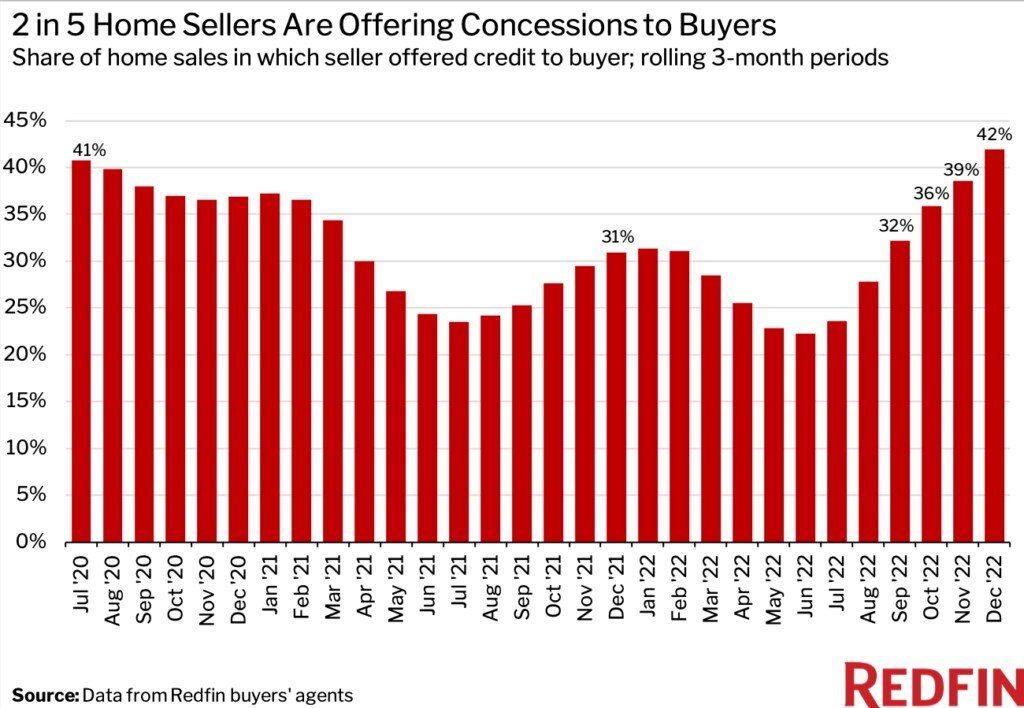

According to national property broker Redfin, home sellers gave concessions to buyers in 41.9% of home sales in the fourth quarter of 2022 --the highest share of any three-month period in Redfin's records.

That's up from just over 30% in both the previous quarter and the fourth quarter of 2021, and outpaces the prior 40.8% high from the three months ending July 2020, when the housing market nearly ground to a halt due to the onset of the coronavirus pandemic. Redfin's concessions records date back to July 2020 and are based on data submitted by Redfin buyers' agents.

Concessions have made a comeback as rising mortgage rates, inflation and economic uncertainty have dampened homebuying demand, giving the buyers who remain in the market increased negotiating power.

That's a stark shift from the pandemic home buying frenzy of late 2020 and 2021, when record-low mortgage rates fueled fierce competition, forcing most buyers to bid over the asking price and waive every contingency just to have their offers taken seriously.

"Buyers are asking sellers for things that were unheard of during the past few years," said Van Welborn, a Redfin real estate agent in Phoenix. "They're feeling empowered, partly because their offer is often the only one, and partly because they know sellers have built up so much equity during the pandemic that they can afford to dole out sizable concessions."

Welborn continued: "I recently helped one of my buyers negotiate a $10,000 credit for a new roof and a handful of other repairs. We originally asked for $15,000, but were happy with $10,000 because the homeowner also agreed to sell for less than their asking price."

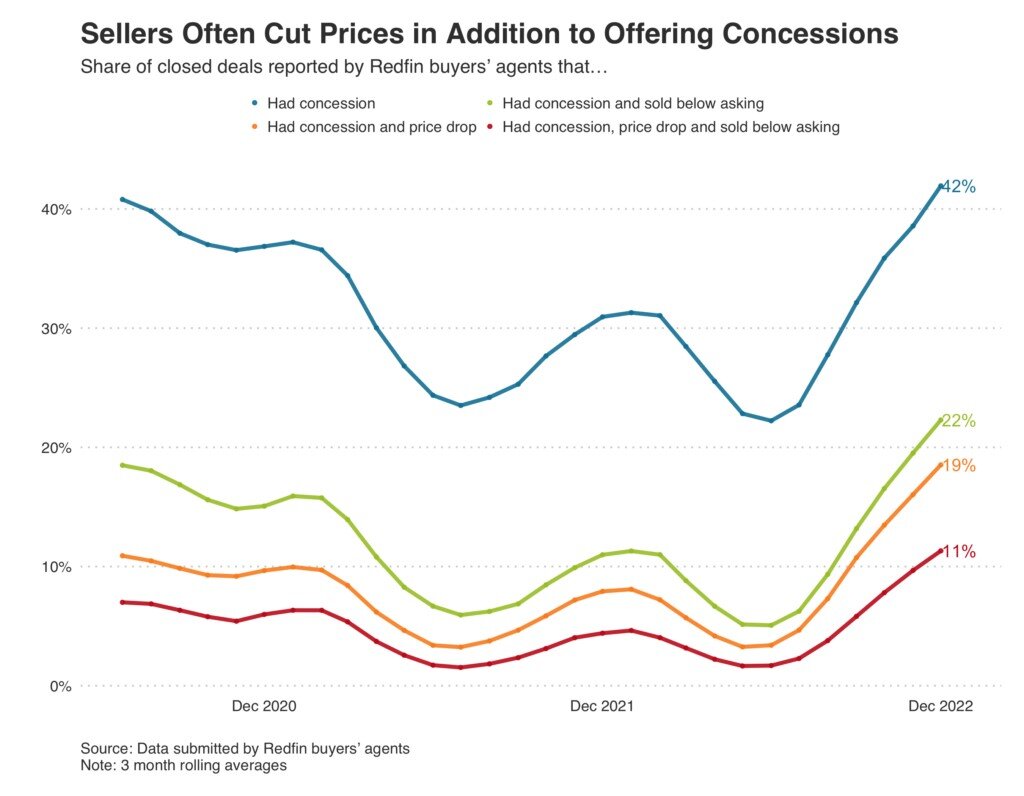

Homeowners are increasingly selling for below their desired price as the housing market slows. A record 22% of home sales recorded by Redfin buyers' agents in the fourth quarter included both a concession and a final sale price below the listing price, while a record 19% included both a concession and a listing-price cut that occurred while the home was on the market. A record 11% included all three.

Phoenix Saw the Biggest Jump in Concessions

In Phoenix, sellers gave concessions to buyers in 62.9% of home sales in the fourth quarter, up from 33.2% a year earlier. That 29.7-percentage-point increase is the largest among the 25 U.S. metropolitan areas for which data was available. Next came Seattle (25.6 ppts), Las Vegas (22.2 ppts), San Diego (20.7 ppts) and Detroit (20.4 ppts).

Phoenix and Las Vegas are among the fastest cooling markets after they soared in popularity during the pandemic as scores of remote workers moved in, searching for relative affordability and warm weather.

"It took a while, but seller expectations are coming back down to earth. Concessions were common before the pandemic, and we may be returning to that norm," Welborn said. "Sellers realize they're not going to get $80,000 over the asking price like their neighbor did last year."

Welborn said he has recently seen sellers offer credits of as much as $25,000 to cover repairs and closing costs, and that they're also offering to pay for 2-1 mortgage-rate buydowns and warranties on household appliances.

There were four metros in which concessions were less common compared with a year ago. In Austin, TX, sellers gave concessions to buyers in 33.3% of home sales, down from 38.1% a year earlier (-4.8 ppts). Next came Philadelphia (-2.7 ppts), New York (-2.4 ppts) and Chicago (-1.6 ppts).

Concessions Are Most Common in San Diego

In San Diego, sellers gave concessions to buyers in 73% of home sales in the fourth quarter--the highest share among the metros Redfin analyzed (San Diego also had the highest share a year ago). Next came Phoenix (62.9%), Portland, OR (61.6%), Las Vegas (61.3%) and Denver (58.4%).

In New York, sellers gave concessions to buyers in 13.4% of home sales--the lowest share among the metros Redfin analyzed. It was followed by San Jose, CA (14.4%), Boston (17.5%), Philadelphia (22%) and Austin (33.3%).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years