Vacation Real Estate News

High Prices, Rising Rates, Economic Uncertainty Ends Vacation Home Boom in America

Vacation News » San Diego Edition | By Michael Gerrity | June 29, 2022 9:10 AM ET

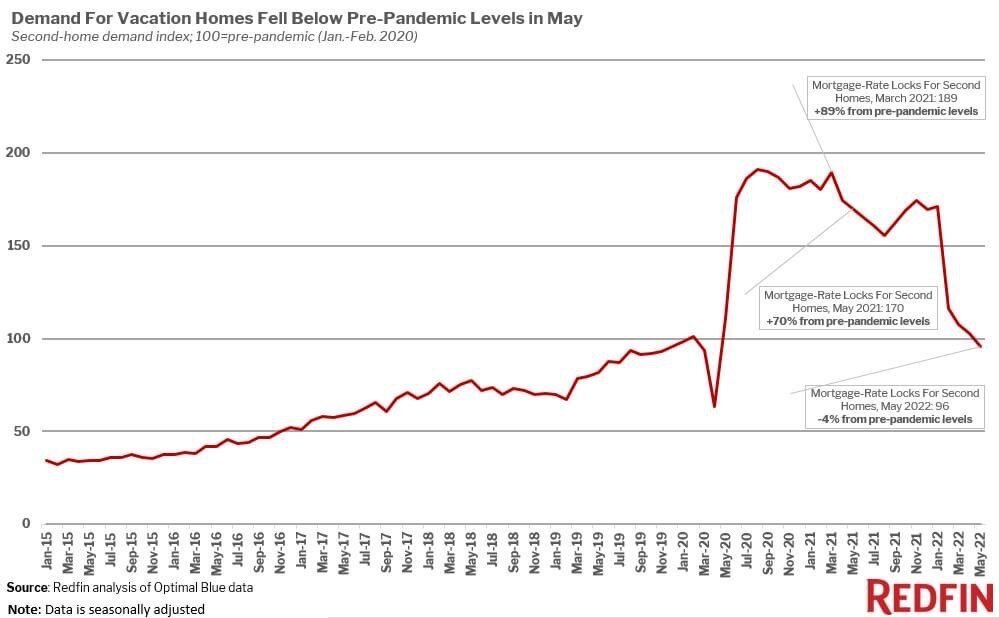

Based on a new report by national property broker Redfin, consumer demand for U.S. vacation homes has fallen below the pre-pandemic baseline for the first time in two years, with mortgage-rate locks for second homes down 4% from before the pandemic in May 2022. That's down from a revised rate of 3% above pre-pandemic levels a month earlier, and 70% above pre-pandemic levels a year earlier.

Demand for second homes is declining due to high home prices, mortgage rates that have rapidly risen to nearly 6% and a slumping stock market-factors that are also cooling the rest of the housing market. Another deterrent to second-home buyers is the fact that the federal government increased loan fees for second homes in April, adding roughly $13,500 to the cost of purchasing a $400,000 home.

"Skyrocketing monthly payments, along with higher loan fees, have priced many second-home buyers out of the market," said Redfin Deputy Chief Economist Taylor Marr. "Many would-be second-home buyers are also deterred by turmoil in the stock markets, high inflation and recession fears, and they can be quicker to pull back from the market because vacation homes aren't a necessity the way primary homes are. The cool down in the second-home market is likely to continue as long as mortgage rates are elevated and the stock market is slumping."

The drop in vacation-home demand marks a drastic change from the second half of 2020 and 2021, when mortgage-rate locks for second homes skyrocketed due to record-low mortgage rates and the flexibility to work from anywhere thanks to remote work. Demand peaked in March 2021, when it was about 90% above pre-pandemic levels.

Interest in vacation homes started declining sharply in February 2022 as mortgage rates began their ascent. The average 30-year fixed mortgage rate reached 5.81% in the week ending June 23, 2022.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Vacation Real Estate Headlines

- Despite Geopolitical Uncertainty, European Hotel Values Rise

- Record 119 Million Americans Traveling Over the Christmas Holidays

- 80 Million Americans to Hit the Road, Skies and Seas for 2024 Thanksgiving Holiday

- Asia Pacific Hotel Investment to Exceed $12 Billion in 2024

- Asia Pacific Hotel Investment Tops $12 Billion in 2024

- Seattle, Orlando and New York Top Labor Day Destinations in 2024

- Record 71 Million Americans Traveling Over July Fourth Week

- Major Hotel Operators Expanding Rapidly Across Asia Pacific in 2024

- 44 Million Traveling Memorial Day Weekend, Second Most in History

- South Korea is Asia Pacific's Top Performing Hotel Market

- Florida Dominates Top 10 U.S. Cities List to Invest in Short Term Rentals

- Investment in South Korea Hotels Dipped in 2023

- European Hotel Values Still Below Pre-Covid Prices

- Over 115 Million Americans Traveling Over Christmas Holidays

- 55.4 Million Americans on the Move Thanksgiving Holiday

- Asia Pacific Tourism to Approach Full Recovery in 2024, Driving Hotel Sector Growth

- Asia Pacific Hotel Revenues to Rise in 2024 Despite Economic Volatility

- Tourist Bookings to Hawaii Down 50 Percent Since Maui Wildfires

- Demand for Vacation Homes in U.S. Hit 7-Year Low in August

- International Travel for Americans Jumps Over 200 Percent in 2023

- U.S. Labor Day Weekend Travel To Uptick in 2023

- Asia Pacific Hotel Investment Collapses 51 Percent in 2023

- As Summer Travel Season Winds Down, U.S. Gas Prices Rise Again

- Record Setting 50.7 Million Americans to Travel This July Fourth Holiday

- Israel Hotels Poised for Growth as International Visitors Set to Return

- Over 42 Million Americans to Travel This Memorial Holiday Weekend

- European Hotel Transactions Decline 18 Percent in 2022 as Interest Rates Surge

- U.S. Vacation Home Demand Dives 50 Percent from Pre-Pandemic Levels

- European Hotel Values Upticked 3 Percent in 2022

- U.S. Vacation Rental Bookings Rise 27 Percent Annually in January

- Third-Party Hotel Operators Set to Increase Across Europe in 2023

- 113 Million People Traveling in the U.S. During the 2022 Holiday Season

- London Hotels Set to Weather High Inflation in 2022

- Almost 55 Million People to Travel This Thanksgiving Holiday in America

- Düsseldorf Hotels Enjoy Growing Corporate Demand in 2022

- Global Hotel Investment Activity in Asia Pacific to Rise 80 Percent in 2022

- Japan Lifts Foreign Inbound Covid Travel Restrictions in October

- Demand for Second Vacation Homes in the U.S. Decline

- Amsterdam Hotels Enjoy Comeback Post Covid Travel Restrictions

- 47.9 Million Americans Will Travel This July 4th Weekend