Commercial Real Estate News

AI Driving Significant Global Data Center Growth in 2024

Commercial News » San Francisco Edition | By Michael Gerrity | July 3, 2024 8:48 AM ET

A new report from CBRE reveals that ongoing power shortages are creating opportunities for development in emerging global data center markets and driving up rents in established markets worldwide. Companies aiming to secure data center capacity are increasingly investing in emerging markets like Northern Indiana, Boise (Idaho), Mumbai (India), Rio de Janeiro (Brazil), and Oslo (Norway), which are experiencing a surge in demand for hyperscale development. CBRE anticipates that the availability of power and land resources in these areas will continue to attract investment and promote growth in the future.

"Global power shortages are driving an unprecedented surge in data center rental rates, particularly in North America, while AI advancements are having a significant impact on data center demand," said Pat Lynch, executive managing director for CBRE's Data Center Solutions. "Preleasing data center space well in advance of completion is commonplace across the globe, which underscores the robust demand in the market and the need for ongoing investment in development."

CBRE's Global Data Center Trend Report 2024 examined key variables like total inventory, vacancy rates, net absorption, pricing and rental rates, and availability in both established and emerging markets across North America, Europe, Asia Pacific, and Latin America.

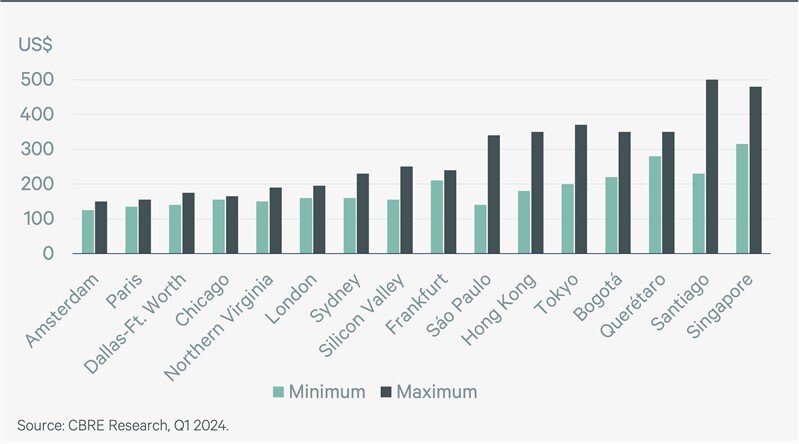

One significant trend highlighted in the report is the rise in rental rates in the global data center market. Declining vacancy rates in major markets such as Northern Virginia, Chicago, Dallas-Ft. Worth, Santiago (Chile), London (UK), and Amsterdam (Netherlands) have led to rapid increases in rental rates, with some regions experiencing up to 50% hikes since Q1 2023.

North America recorded the highest global increase, with average asking rates surging by 20% year over year. In Chicago, rental rates increased by 33%, rising to $155-$165 per kW/month in Q1 2024 from $115-$125 per kW/month in Q1 2023.

On a global scale, Singapore has one of the highest rental rates, exceeding $330 per kW/month. In Santiago, rates are as high as $500 per kW/month.

The growth of artificial intelligence is driving record levels of data center demand and increasing the need for innovative data center designs and technologies. This trend is leading to new developments or conversions of unused industrial spaces.

"Sourcing power is the top priority for data center operators across the globe," said Gordon Dolven, director of CBRE Americas Data Center Research. "Markets with accessible, cost-effective power are becoming hotspots for data center expansion. However, the growth we're witnessing in established markets like Northern Virginia despite power supply constraints is impressive."

Data center inventory is steadily increasing in markets where local governments are incorporating renewable energy into the grid or utility companies are enhancing transmission lines. For instance, inventory in Paris (France) grew by 40.6% from Q1 2023 to Q1 2024, while Chicago saw a 57.2% increase, the largest in any North American market.

In Dallas, inventory rose by 31.9% from Q1 2023 to Q1 2024, reaching 573 MW, solidifying its position as the second-largest North American market. Notably, Dallas is experiencing record-high preleasing and construction levels, with 372 MW currently under construction and 91.8% already preleased. Globally, markets like Frankfurt (Germany), Mumbai (India), and Oslo (Norway) are also witnessing significant construction activity.

Despite this new development, vacancy rates have declined as strong demand continues to outpace supply growth. This trend is particularly evident in Northern Virginia, where vacancy rates fell to 0.1% in Q1 2024 from 1.8% a year earlier, the lowest in any North American market, even as inventory grew by 21%. In Amsterdam, vacancy dropped to 11.5% in Q1 2024 from 19.4% a year earlier.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher