Residential Real Estate News

Homebuyer Demand in America Drops to 5-Year Low in Early 2025

Residential News » Seattle Edition | By Michael Gerrity | February 14, 2025 8:26 AM ET

U.S. Housing Supply Hits Highest Levels Since 2020

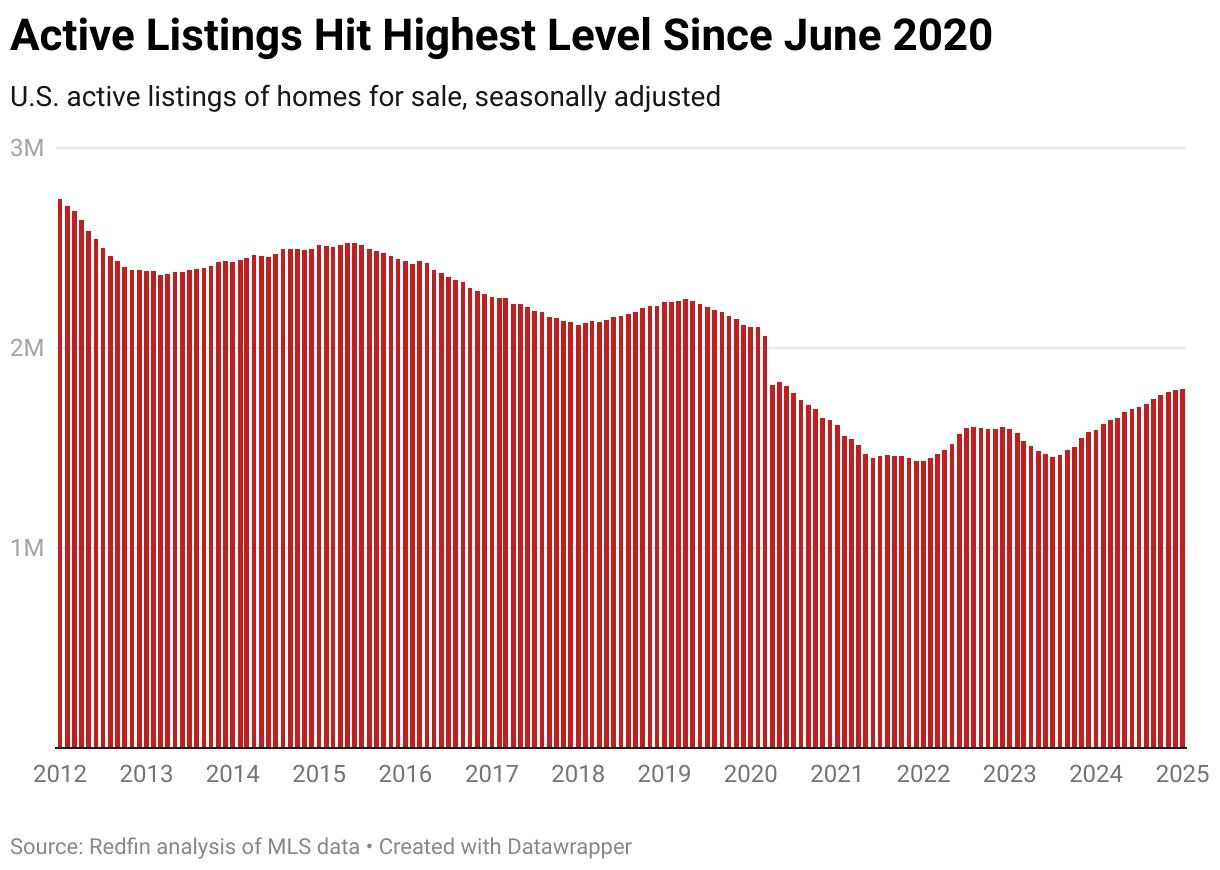

According to national brokerage Redfin, U.S. homebuyers currently have the most options available since 2020. However, rising housing costs are deterring many from making purchases, making monthly mortgage payments increasingly difficult.

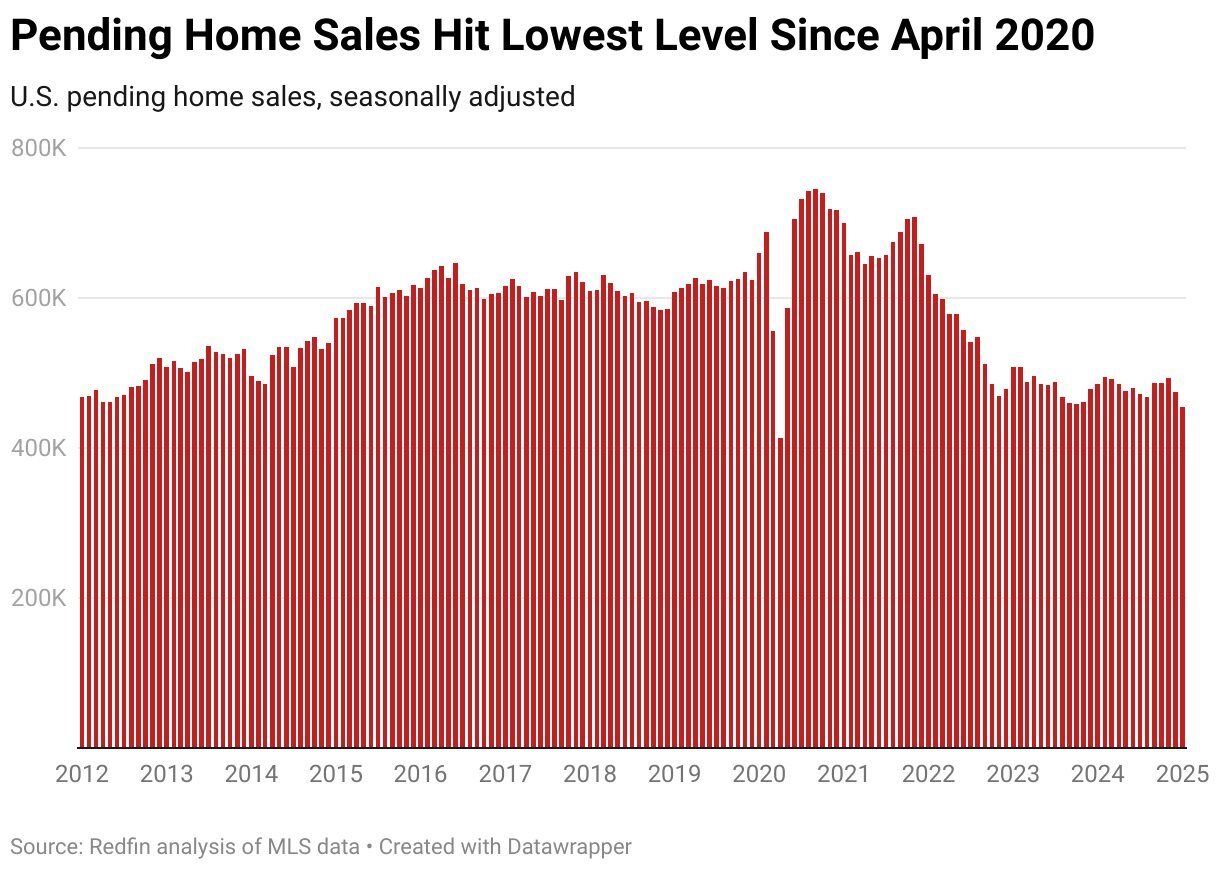

In January 2025, pending U.S. home sales dropped to their lowest level on record, aside from the early pandemic period. They declined 4.2% from the previous month -- the steepest seasonally adjusted drop since August 2023 -- and fell 6.3% year over year.

Meanwhile, active home listings reached their highest point since the early days of the pandemic. They inched up 0.3% month over month and surged 12.9% compared to last year. New listings also hit their highest level since July 2022, rising 1.9% from December and 4.7% year over year.

Why Housing Supply is Increasing

Several factors are contributing to the rise in available homes:

- Mortgage rate lock-in effect is easing. Many homeowners who secured historically low mortgage rates during the pandemic had been reluctant to sell, fearing higher rates on a new loan. However, staying put indefinitely isn't always an option.

- Homes are sitting on the market longer. The typical home sold in January spent 56 days on the market--seven days longer than a year ago and the longest for any January since 2020.

- Demand is weakening. Fewer buyers mean more unsold homes. Existing home sales fell 1.7% in January to a seasonally adjusted annual rate of 4.3 million -- the biggest monthly decline since October 2023.

Why Housing Demand is Declining

On the flip side, several factors are making it harder for buyers to commit:

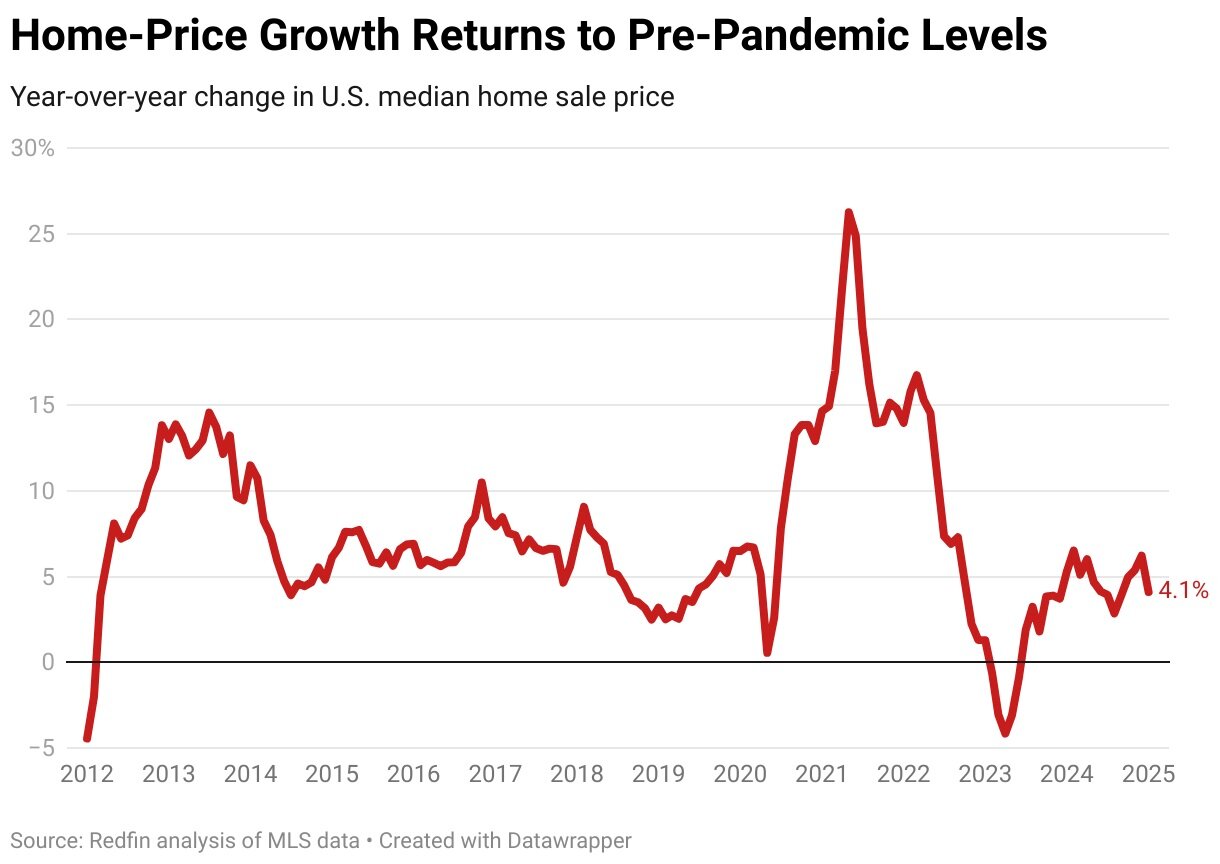

- Mortgage rates hit an eight-month high. The average 30-year fixed mortgage rate reached 6.96% in January, up from 6.72% the previous month and the highest level since May. Meanwhile, the median home price climbed 4.1% year over year to $418,581 -- 45% higher than in January 2020.

- More deals are falling through. Approximately 41,000 home-purchase agreements were canceled in January -- 14.3% of all contracts signed that month and the highest January rate on record since 2017.

- Economic uncertainty. Factors like potential tariffs, federal workforce reductions, return-to-office mandates, and fluctuating mortgage rates are making both buyers and sellers hesitant.

A Changing Market: Insights from Agents

"I'm seeing a lot more inventory hit the market than in past years, but it's still not enough," said Charles Wheeler, a Redfin Premier real estate agent in San Diego. "Economic concerns are front and center for many people. Some sellers feel like we're at the top of the market and are cashing out to reinvest elsewhere. Buyers should know they have more negotiating power now, while sellers should focus on pricing competitively and presenting their homes well."

Though home prices continue to rise, growth has returned to pre-pandemic levels of around 4%-5% annually, a shift from the double-digit gains seen in 2021-2022. This moderation is partly due to a more balanced supply-and-demand dynamic, as more listings hit the market. However, prices remain high because the overall housing supply is still insufficient.

"Nationally, we're seeing an increase in sellers and a decrease in buyers, which is bringing supply and demand closer to balance," said Redfin Senior Economist Elijah de la Campa. "But this trend varies widely by region. In expensive coastal markets like San Jose and Seattle, pending sales are rising, while in former pandemic boomtowns like Miami and Austin, they're seeing double-digit declines. Newark has near-record-low inventory, whereas San Antonio has near-record-high listings."

Additionally, winter storms in January 2025 may have dampened sales activity in some areas.

Metro-Level Highlights: January 2025

Home Prices (Year-over-Year Change)

- Biggest Increases: Pittsburgh (+15.4%), St. Louis (+13.2%), Anaheim, CA (+13.1%)

- Biggest Declines: Tampa, FL (-4%), Austin, TX (-3.7%), San Francisco (-2.2%), Jacksonville, FL (-1.3%)

Pending Sales (Year-over-Year Change)

- Biggest Gains: Portland, OR (+11.4%), San Jose, CA (+8.2%), Milwaukee (+4.7%)

- Biggest Drops: Detroit (-19.2%), Miami (-18.1%), Atlanta (-17.4%)

Closed Sales (Year-over-Year Change)

- Biggest Gains: Portland, OR (+12.8%), Providence, RI (+10%), Boston (+9.9%)

- Biggest Declines: Detroit (-11.3%), Miami (-9.4%), Fort Lauderdale, FL (-8.2%)

New Listings (Year-over-Year Change)

- Biggest Gains: Seattle (+30.8%), Oakland, CA (+27.7%), Sacramento, CA (+25%)

- Biggest Declines: Kansas City, MO (-11.2%), Detroit (-9.1%), Pittsburgh (-8.4%)

Active Listings (Year-over-Year Change)

- Biggest Increases: Oakland (+31.1%), Seattle (+29.1%), Cincinnati (+28.1%)

- Biggest Declines: New York (-3.9%), Newark, NJ (-1.9%), Chicago (-1.5%)

Homes Sold Above List Price

- Highest Share: Newark (56.7%), San Jose (52.7%), Nassau County, NY (49%)

- Lowest Share: West Palm Beach, FL (5.5%), Fort Lauderdale (5.9%), Miami (7.5%)

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

- Meet HAL, Real Estate Agent of the Future

- U.S. Homes Are Selling at Slowest Pace in 5 Years in Early 2025

- Pending Home Sales Dive Across America in December

- Greater Miami Residential Sales Uptick 3 Percent Annually in 2024

- U.S. Mortgage Applications Downtick in late January

- Under Biden, 2024 Marked the Slowest U.S. Home Sales Period in 30 Years

- Single-family Rent Growth in U.S. Slows to Lowest Rate in 14 Years

- Housing Starts Spike 15 Percent in America in Late 2024

- Day One: Trump Issues Executive Order on Emergency Price Relief for U.S. Housing

- 89 Percent of Homes Destroyed by Los Angeles Fires Were Single-Family Residences

- New AI-Powered Global Listings Service Under Construction

- World Property Media to Commence Industry Funding Round to Launch WPC TV

- Mortgage Rates in America Above 7 Percent, Again

- U.S. Residential Foreclosures Dip 10 Percent Annually in 2024

- U.S. Residential Asking Rents End 2024 at Lowest Levels in 3 Years

- World Property Markets to Commence Industry-wide Joint Venture Fundraise

- One Third of U.S. Homeowners Say They Will Never Sell

- Catastrophic Wildfires Devastating Tens of Billions of Dollars of Southern California Properties

- Is Greenland Soon Going to be Trump's Biggest Real Estate Deal?

- Greater Las Vegas Home Sales Jump 19 Percent Annually in December

- Active U.S. Residential Listings Spike 22 Percent in December

- U.S. Mortgage Rates Rise in Early 2025, Reach 6-Month High

- Greater Palm Beach Area Condo, Home Sales Collapse in November

- U.S. Pending Home Sales Increase Four Straight Months in November

- Global Real Estate Podcasts Coming to WPC TV Next Year

- Ireland Home Prices Spike 9 Percent in 2024

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December