Residential Real Estate News

U.S. Home Sales to Hit Historic High of $2.5 Trillion In 2021

Residential News » Seattle Edition | By Michael Gerrity | May 17, 2021 9:22 AM ET

Value of U.S. home sales equal to the GDP of France, or combined market value of Amazon and Facebook

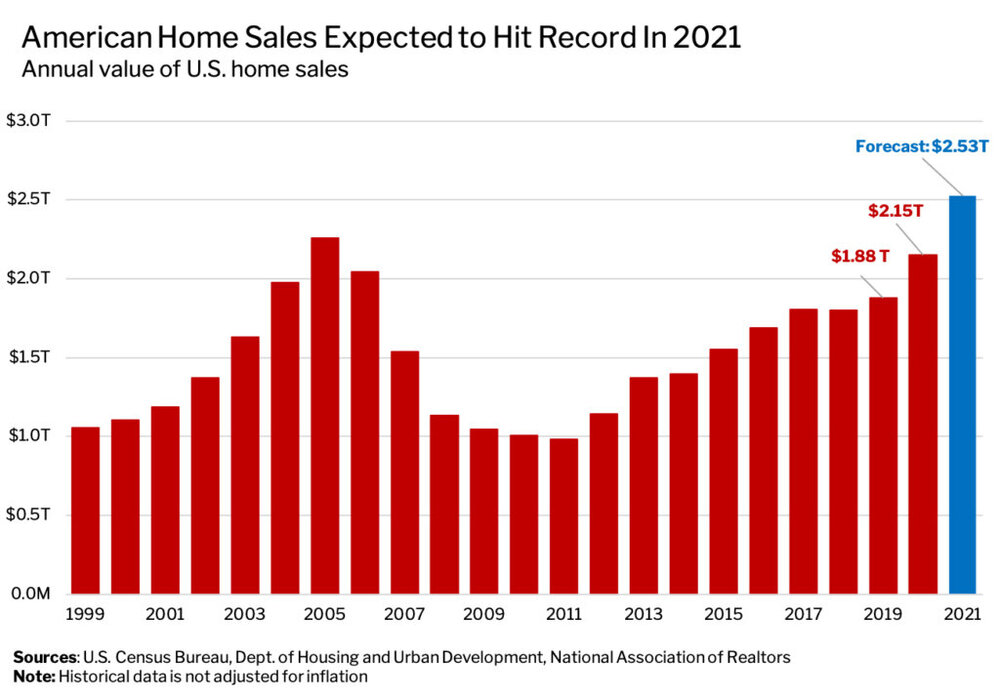

National U.S. property broker Redfin forecasts a record $2.53 trillion worth of home sales in America in 2021--a 17% year-over-year gain that would mark the largest annual increase in percentage terms since 2013. To put $2.53 trillion into perspective, it's roughly equal to the value of Amazon.com Inc. and Facebook Inc. combined, or the 2020 gross domestic product (GDP) of France.

The U.S. housing market has undergone a meteoric rise during the coronavirus pandemic, fueled by record-low mortgage rates and a wave of migration made possible by remote work. Almost two-thirds (60%) of people expect to continue working from home at least part time after the pandemic, according to an April survey of Redfin.com visitors who have moved to a different metro area in the last year. These factors--alongside an acute housing shortage--helped March become the hottest month in housing history, with home values, price growth and selling speed all hitting new heights.

In short, the combination of rising demand (home sales) and surging home prices is fueling the increase. While home prices could grow more slowly if mortgage rates rise, that would result in a more balanced housing market, which could actually lead to more home sales, according to Redfin Chief Economist Daryl Fairweather.

"We expect 2021 to be an even more active year for the housing market than 2020 because homebuyers have a better sense of what the future looks like," said Fairweather. "Employers are providing clarity on permanent remote-work policies, the economy is recovering and mortgage rates remain low. All of these factors mean that we'll likely see even more buyers enter the market this year and in 2022."

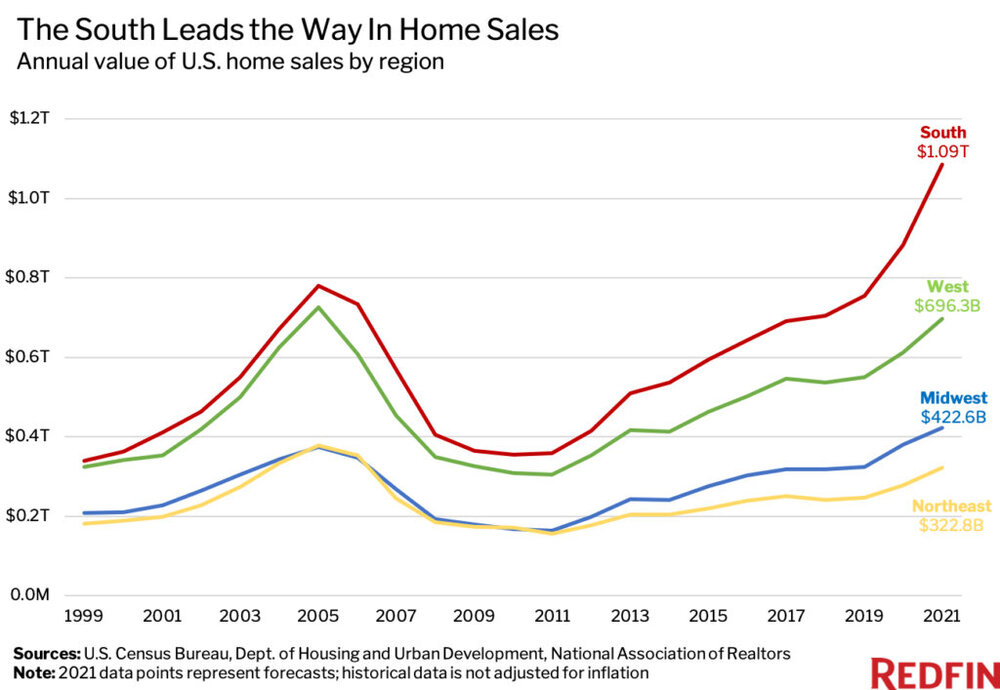

The South is expected to lead the way with $1.09 trillion of home sales forecast for 2021, followed by the West with $696.3 billion, the Midwest with $422.6 billion and the Northeast with $322.8 billion.

The South has consistently held the top spot, but has inched further ahead in recent years. This is likely because it has more vacant land on which to build, and has attracted scores of out-of-town homebuyers who are in search of affordability and space, Fairweather said. Seven of the 10 U.S. metros with the biggest net inflows in the first quarter were in the South. Net inflow is a measure of how many more Redfin.com home searchers looked to move into a metro than leave.

"A lot of wealth from the coasts is shifting South," said Fairweather. "Affluent homebuyers from New York and San Francisco have moved to places like Florida and Texas during the pandemic, which has fueled home sales and driven up prices in those areas."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October