Residential Real Estate News

$2 Trillion of U.S. Home Value Gains Enjoyed in 2023

Residential News » Seattle Edition | By Michael Gerrity | February 29, 2024 10:30 AM ET

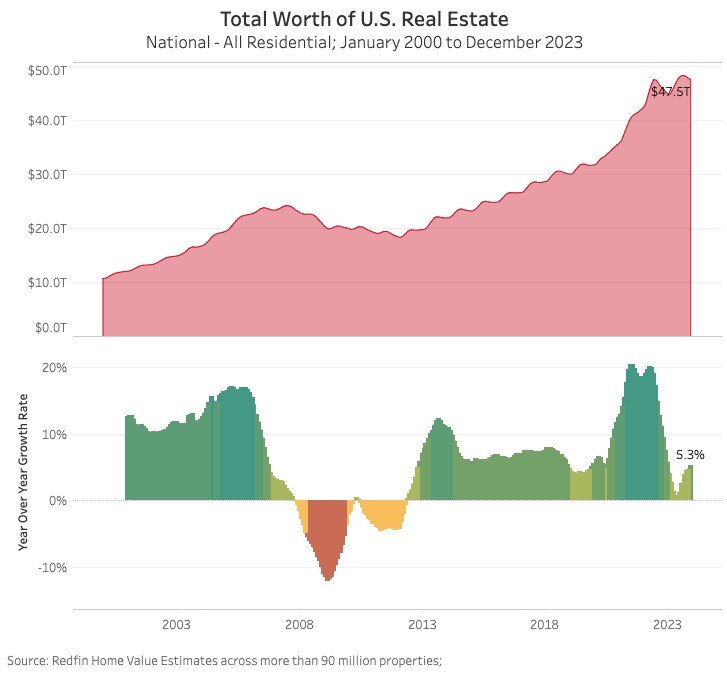

Total value of U.S. homes jumped 5% in 2023 to $47.5 trillion

National property broker Redfin is reporting this week that the U.S. housing market gained $2.4 trillion over the last year, bringing its total value to $47.5 trillion. That's based on an analysis of the Redfin Estimate for more than 90 million U.S. residential properties as of December 2023.

In percentage terms, the total value of U.S. homes increased 5.3% from a year earlier in December 2023, the biggest increase in 11 months, and was up 13.3% ($5.6 trillion) from two years earlier.

Housing demand is sluggish due to elevated mortgage rates and affordability challenges, yet home values keep rising. There are three primary reasons:

- There's a shortage of homes for sale. Many homeowners are hesitant to put their houses on the market because they scored an ultra low mortgage rate in recent years, and selling would mean giving it up. Supply is even more constrained than demand, meaning buyers are competing for a limited pool of homes. That's propping up values for both homes that are already for sale and those that could hit the market in the future.

- Home values hit a low about a year ago. The total value of U.S. homes was nearing a trough at the end of 2022, which is part of the reason year-over-year growth at the end of 2023 was so large. It's typical for home values to cool in the winter, but they experienced an abnormally large slowdown in 2022 as the shock of surging mortgage rates sent a freeze through the housing market.

- More homes were built. While America is grappling with a housing shortage, it continues to build homes, which contributed to the gain in total home value last year.

"America's homeowners are sitting pretty. They're holding a massive amount of housing wealth, despite lackluster demand from buyers, because home values skyrocketed during the pandemic and now a supply shortage is preventing those values from falling," said Redfin Economics Research Lead Chen Zhao. "Prospective buyers aren't as lucky. The combination of elevated mortgage rates, high home prices and a limited pool of homes for sale means homeownership is about as unaffordable as ever. One bright spot for buyers is that mortgage rates should start declining before the end of 2024."

The average U.S. home was valued at $495,183 as of December, up from $474,740 a year earlier. The average home value jumped past $500,000 in both the summer of 2023 and the summer of 2022, meaning the typical homeowner who bought during those times has lost value.

Metros close to but more affordable than New York City post largest jumps in home value; Midwest also sees gains

The total value of homes in Newark, NJ rose 12.8% year over year to $359.6 billion in December--a larger gain than any other metro. Next come two other East Coast metros: New Haven, CT (11.9%) and Camden, NJ (10.8%). Ranking fourth is Charleston, SC (10.8%), followed by three Midwest metros: Elgin, IL (10.4%), Grand Rapids, MI (9.8%) and Milwaukee (9.7%).

Places like Newark and Camden are likely seeing home values jump in part because they're attracting demand from people who are priced out of New York and can now work remotely. Midwestern metros like Milwaukee and Grand Rapids are experiencing home value gains for a similar reason: They're affordable, and when mortgage rates and home prices are elevated, demand for affordable homes goes up.

Home values aren't holding up as well in pricey metros and pandemic boomtowns

Four metros saw declines in overall home value: Boise, ID (-3.8%), New York (-1%), New Orleans (-0.8%) and Stockton, CA (-0.7%). The metros with the smallest increases were Philadelphia (0.3%), Honolulu (0.8%), Austin, TX (1%), Denver (1.3%) and Riverside, CA (1.6%).

Most of the metros above have something in common: They've become unaffordable for many homebuyers, so home values no longer have much room, if any, to rise, because there's a cap on demand. New York, Honolulu, Riverside and Denver all have median home sale prices of at least $550,000--well above the national median of $402,343. And in Boise and Austin, which also have median sale prices above the national level, many people are priced out because an influx of out-of-towners caused home values to skyrocket during the pandemic.

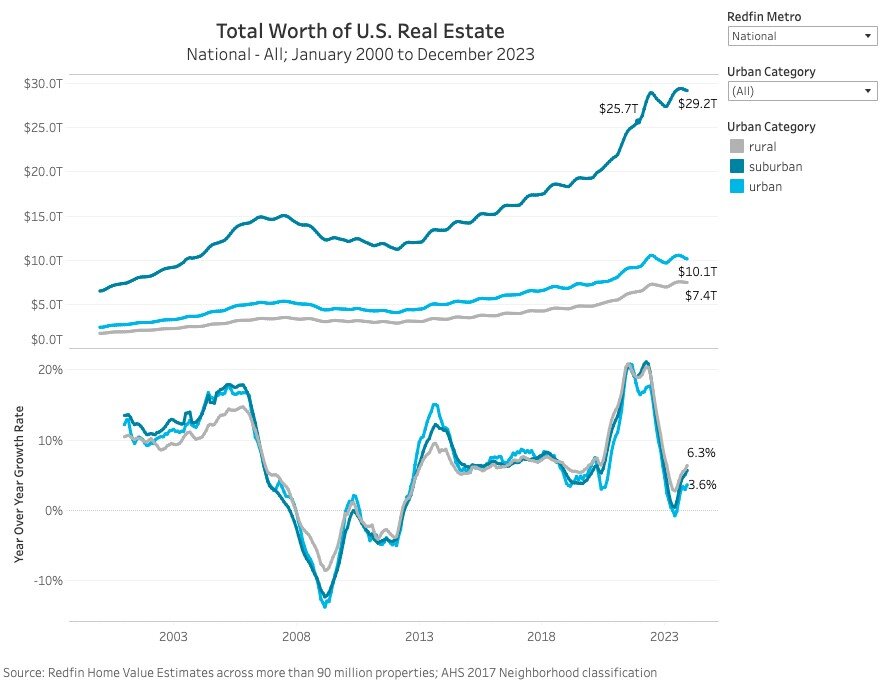

Home values in urban areas aren't holding up as well as those in the suburbs, rural areas

The total value of homes in urban areas rose 3.6% year over year to $10.1 trillion in December. Meanwhile, the value of homes in the suburbs rose 5.6% to $29.2 trillion and the value of homes in rural areas increased 6.3% to $7.4 trillion.

The suburbs came back into vogue during the pandemic while cities fell out of favor--largely due to the shift to remote work and the housing affordability crisis. While cities have bounced back to some extent as employers have asked workers to return to the office, many Americans still work remotely, incentivizing homebuying and building in far-flung, affordable areas.

Suburban housing has a much higher total value than rural and urban housing simply because most Americans live in the suburbs. There are about 56 million residential properties in the suburbs, compared with just over 20 million each in rural and urban areas.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October