Residential Real Estate News

Home Prices Begin to Decline from Record Highs in the U.S.

Residential News » Seattle Edition | By WPJ Staff | July 20, 2022 8:55 AM ET

Inflation, high mortgage rates leading to fewer sales and softening home prices nationwide

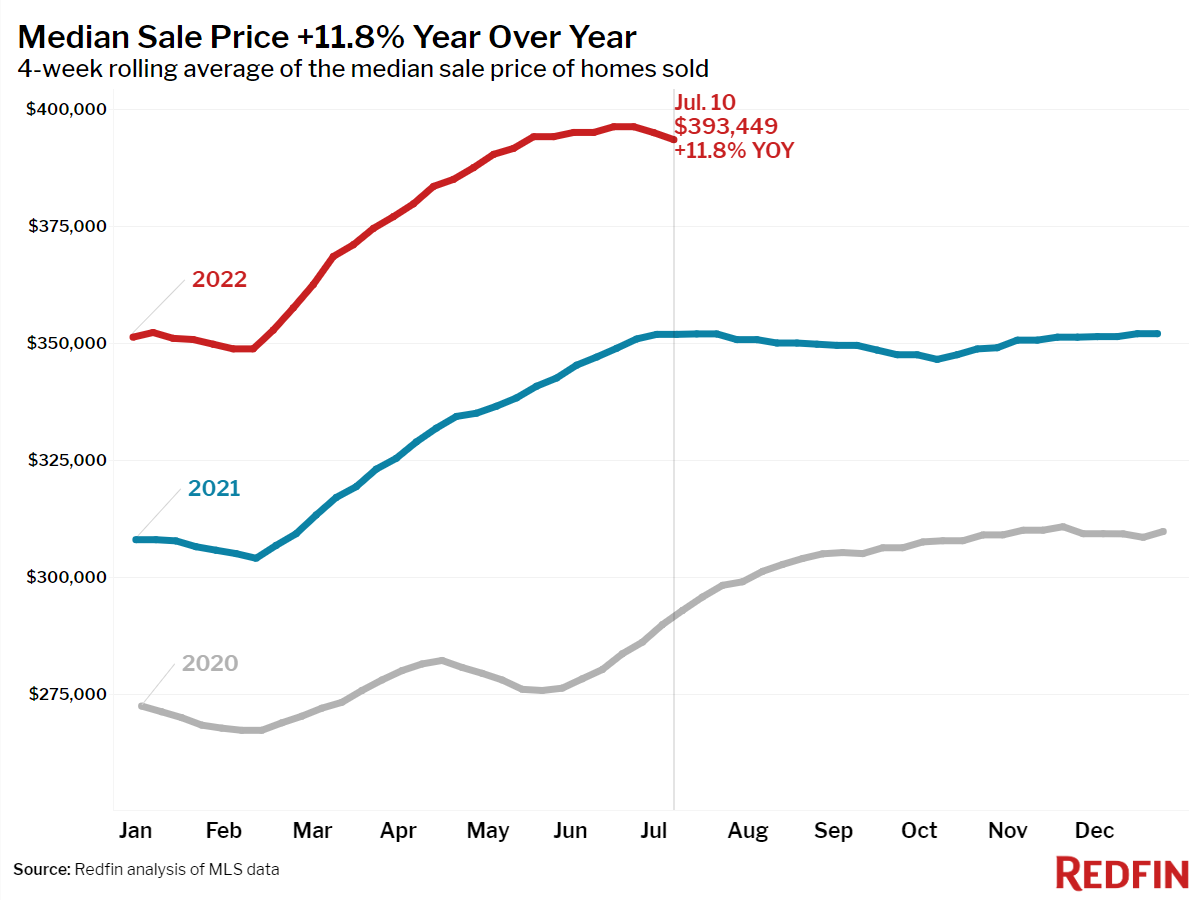

Based on a new report from national property broker Redfin, the median sale price for U.S. homes came down 0.7% from its record-breaking June 2022 peak during the four weeks ending July 10, 2022.

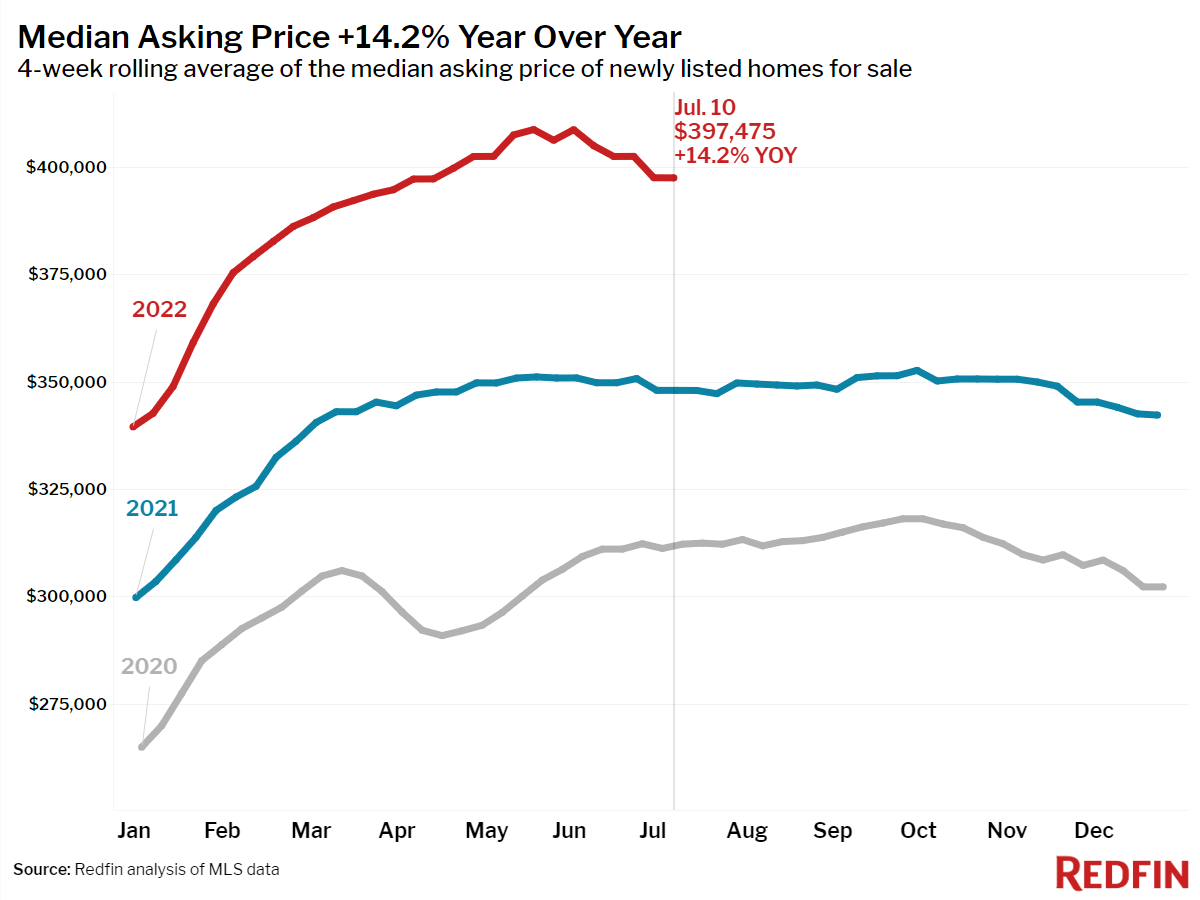

Sellers' asking prices also came down 3% from their May peak as the share of homes with price drops hit another new high. Home supply posted its first year-over-year increase since August 2019 as pending sales continued to slide. These changes in the housing market can be attributed to buyers reaching their limit on costs--not just of homes and mortgages, but also food, transportation and energy.

"Inflation and high mortgage rates are taking a bite out of homebuyer budgets," said Redfin Chief Economist Daryl Fairweather. "Few people are able to afford homes costing 50% more than just two years ago in some areas, so homes are beginning to pile up on the market. As a result, prices are starting to come down from their all-time highs. We expect this environment of reduced competition and declining home prices to continue for at least the next several months."

Leading indicators of homebuying activity:

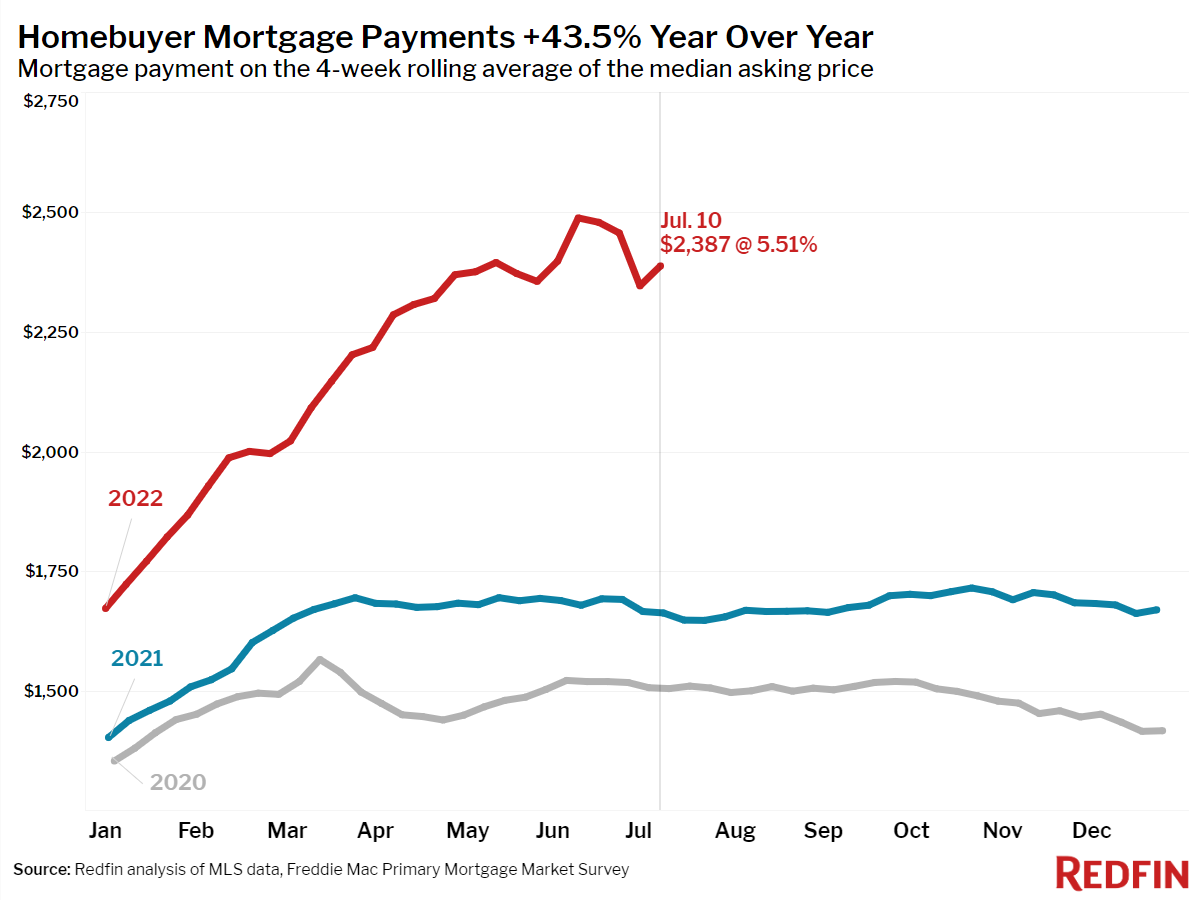

- For the week ending July 14, 30-year mortgage rates rose to 5.51%. This was down from a 2022 high of 5.81% but up from 3.11% at the start of the year.

- Fewer people searched for "homes for sale" on Google--searches during the week ending July 9 were down 5% from a year earlier.

- The seasonally-adjusted Redfin Homebuyer Demand Index--a measure of requests for home tours and other home-buying services from Redfin agents--was down 18% year over year during the week ending July 10.

- Touring activity as of July 10 was up 1% from the start of the year, compared to a 23% increase at the same time last year, according to home tour technology company ShowingTime.

- Mortgage purchase applications were down 18% from a year earlier during the week ending July 8, while the seasonally-adjusted index was down 4% week over week.

Key housing market takeaways for 400+ U.S. metro areas:

- The median home sale price was up 12% year over year to $393,449. This was down 0.7% from the peak during the four-week period ending June 19. A year ago the median price rose 0.9% during the same period. The year-over-year growth rate was down from the March peak of 16%.

- The median asking price of newly listed homes increased 14% year over year to $397,475, but was down 2.8% from the all-time high set during the four-week period ending May 22. Last year during the same period median prices were down just 0.9%.

- The monthly mortgage payment on the median asking price home hit $2,387 at the current 5.51% mortgage rate, up 44% from $1,663 a year earlier, when mortgage rates were 2.88%. That's down slightly from the peak of $2,487 reached during the four weeks ending June 12.

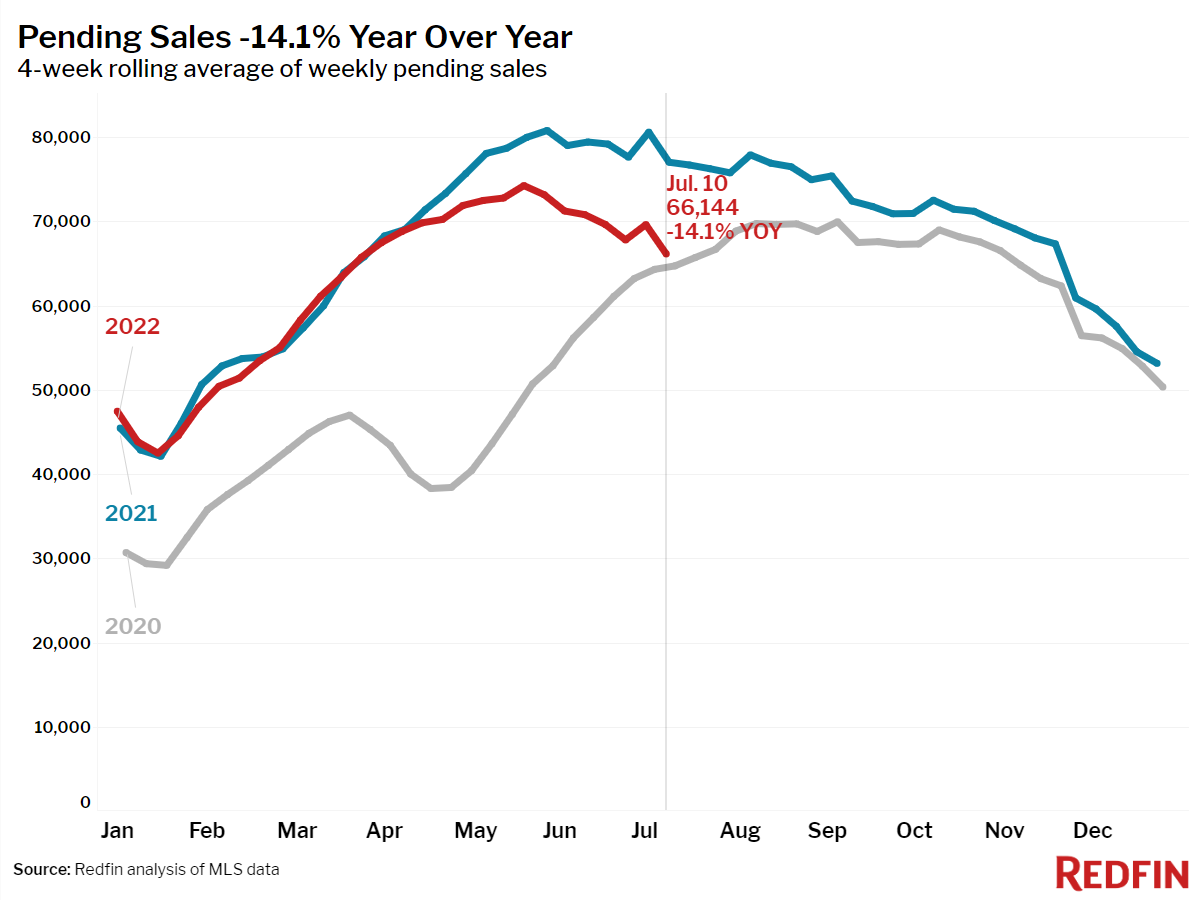

- Pending home sales were down 14% year over year, the largest decline since May 2020.

- New listings of homes for sale were down 1.7% from a year earlier.

- Active listings (the number of homes listed for sale at any point during the period) rose 1.3% year over year--the largest increase since August 2019.

- 43% of homes that went under contract had an accepted offer within the first two weeks on the market, down from 47% a year earlier.

- 29% of homes that went under contract had an accepted offer within one week of hitting the market, down from 33% a year earlier.

- Homes that sold were on the market for a median of 18 days, flat from a year earlier and up slightly from the record low of 15 days set in May and early June.

- 51% of homes sold above list price, down from 54% a year earlier.

- On average, 7.1% of homes for sale each week had a price drop, a record high as far back as the data goes, through the beginning of 2015.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, declined to 101.6%. In other words, the average home sold for 1.6% above its asking price. This was down from 102.2% a year earlier.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years