Residential Real Estate News

U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

Residential News » Seattle Edition | By WPJ Staff | March 3, 2025 8:49 AM ET

January recorded the highest home sales cancellation rate in 8 years

New data from Redfin reveals a growing trend of canceled home purchases across the U.S., with the highest rates in the Southeast. In January 2025, more than 41,000 home-purchase agreements fell through, representing 14.3% of all contracts signed that month. This marks an increase from 13.4% a year earlier and the highest cancellation rate for this time of year since at least 2017.

Why Are Buyers Backing Out?

Redfin reports key factors contributing to the rise in cancellations:

- Increased Supply, Declining Demand: Housing inventory has reached its highest level since 2020, providing buyers with more options. Meanwhile, pending home sales hit a record low in January (excluding the early pandemic period). With more choices, buyers are increasingly backing out during the inspection period, hoping to find a better deal.

- Economic Uncertainty: Many buyers--and even some sellers--are hesitating due to concerns over economic and political instability. Factors such as tariffs, layoffs, and federal policy changes are making people think twice before committing.

- High Costs & Mortgage Rates: Despite slight recent declines, mortgage rates remain elevated, with January's average at 6.96%, the highest in eight months. Home prices are also up, with the median sale price rising 4.1% year-over-year. This combination of high costs and economic uncertainty is prompting some buyers to reconsider.

"I'm seeing more buyers back out than usual, and I'm hearing the same from other agents and lenders," said Sam Brinton, a Redfin agent in Salt Lake City. "But there are still plenty of buyers out there. Desirable homes in prime locations are selling fast, and those buyers are less likely to cancel."

Since cancellations are more common, some Redfin agents advise buyers to monitor properties they previously lost in bidding wars. "It's worth checking with the listing agent a week after a home goes under contract," said Alison Williams, a Redfin Premier agent in Sacramento. "I've had clients successfully get their offers accepted after an original buyer backed out."

Where Are Cancellations Happening the Most?

While cancellations remain above typical early-year levels, they are lower than the spikes seen during the pandemic onset and in late 2022, when mortgage rates exceeded 7% for the first time in two decades.

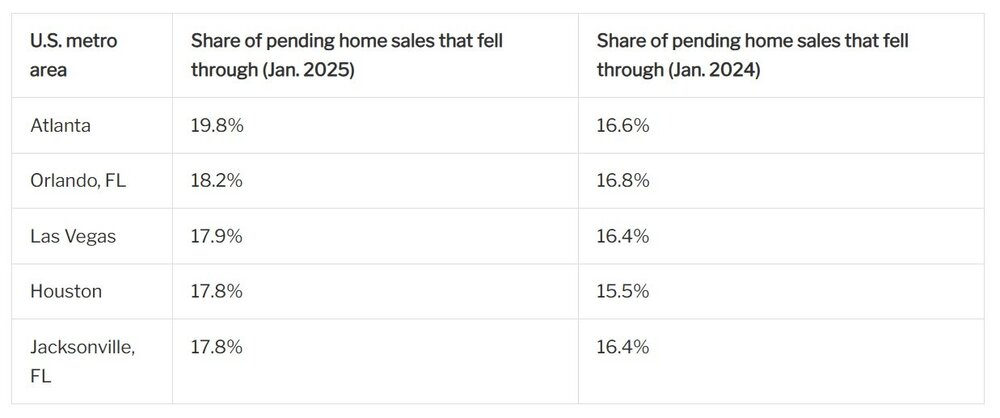

Highest Cancellation Rates:

- Atlanta, GA: 19.8%

- Orlando, FL: 18.2%

- Las Vegas, NV: 17.9%

- Houston, TX: 17.8%

- Jacksonville, FL: 17.8%

Florida's housing market, in particular, is cooling due to rising insurance and HOA fees, as well as increasing concerns over natural disasters. The state's growing housing inventory is also emboldening buyers to walk away if inspection issues arise, knowing they have plenty of alternatives.

Lowest Cancellation Rates:

- San Francisco, CA: 4.1%

- San Jose, CA: 5.9%

- Nassau County, NY: 6.8%

- Oakland, CA: 8.4%

- Seattle, WA: 8.7%

These markets currently favor sellers, as limited inventory means buyers have fewer alternatives if they withdraw from a deal.

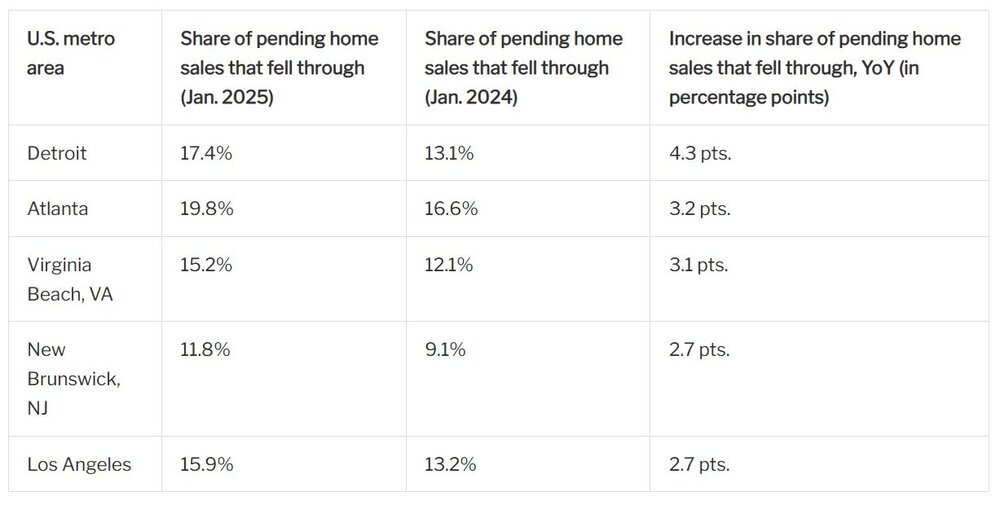

Los Angeles Cancellations Hit Eight-Year High Amid Wildfires

Los Angeles saw 15.9% of pending home sales fall through in January, the highest for this time of year since 2017. The devastating Palisades and Eaton wildfires, which destroyed thousands of homes, have significantly disrupted the local housing market.

Other major metros with rising cancellation rates include:

- Detroit, MI: 17.4% (up from 13.1% a year ago)

- Atlanta, GA: 19.8% (up from 16.6%)

- Virginia Beach, VA: 15.2% (up from 12.1%)

- New Brunswick, NJ: 11.8% (up from 9.1%)

- Los Angeles, CA: 15.9% (up from 13.2%)

In contrast, home-purchase cancellations have declined in some areas, including Fort Worth, TX (down to 16.2%), Fort Lauderdale, FL (17.2%), and Philadelphia, PA (11.8%).

With buyers gaining more leverage in certain markets, the trend of home purchase cancellations may continue in the coming months.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024