Residential Real Estate News

Buyer Activity Upticks in U.S. as Home Prices Decline in March

Residential News » Seattle Edition | By Michael Gerrity | April 3, 2023 8:33 AM ET

According to Redfin, U.S. house hunters are beginning to wade into the market in bigger numbers as mortgage rates and home prices continue to decline in late March 2023.

Mortgage-purchase applications increased for the fourth week in a row and Redfin's Homebuyer Demand Index--a seasonally adjusted measure of requests to tour homes, make an offer and/or talk to a Redfin agent about a home search--jumped to its highest level since last May during the week ending March 26.

"My phone is ringing, and it's usually first-time buyers or investors," said San Francisco Redfin agent Ali Mafi. "First-time buyers are interested in looking at homes because prices have come down, though they're still concerned about high mortgage rates. Investors who can pay in cash are honing in on luxury San Francisco condos because prices on those have dropped even more significantly than the overall market."

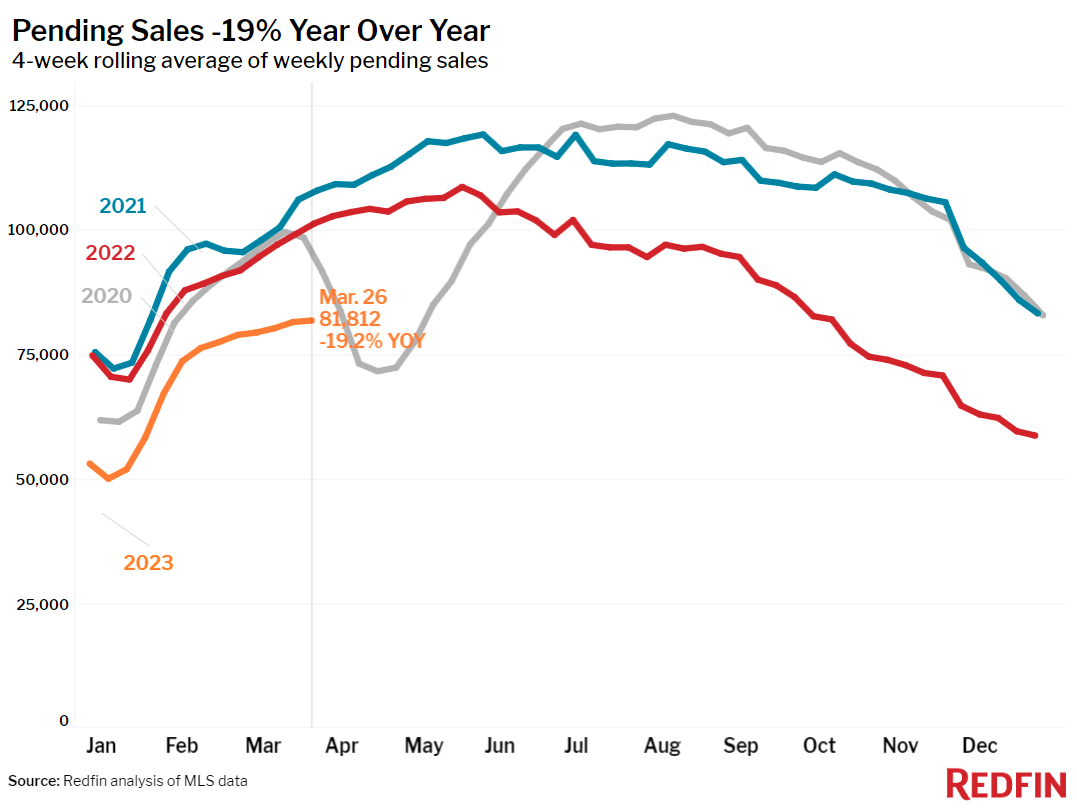

The uptick in early-stage demand has yet to translate into more home sales. Pending sales dropped 19% year over year nationwide in the four weeks ending March 26, the biggest decline in about two months. Demand for homes hasn't yet translated into an improvement in sales mainly because would-be buyers are limited by lack of supply.

New listings of homes for sale declined 22%, one of the biggest drops since the start of the pandemic; homeowners are reluctant to sell because they don't want to give up a low mortgage rate. The lack of new listings is causing a growing share of homes to fly off the market quickly: Nearly half of homes are selling within two weeks, the largest share since June.

Home prices drop in over half of the country, but rise in some areas

While the scarcity of new listings is holding back sales nearly everywhere in the U.S., prices are dropping fast in some parts of the country and increasing in others.

Home prices dropped in more than half (28) of the 50 most populous U.S. metros, with the biggest drop in Austin, TX (-15.2% YoY). Next come four northern California metros: San Jose, CA (-12.9%), San Francisco (-11.7%), Sacramento, CA (-11.4%), and Oakland, CA (-10.8%). Those are the biggest annual declines since at least 2015 for Austin and Sacramento.

On the flip side, sale prices increased most in Milwaukee, where they rose 14.1% year over year. Next come Fort Lauderdale, FL (8.5% YoY), Virginia Beach, VA (6.9%), West Palm Beach, FL (6.7%) and Providence, RI (6.4%).

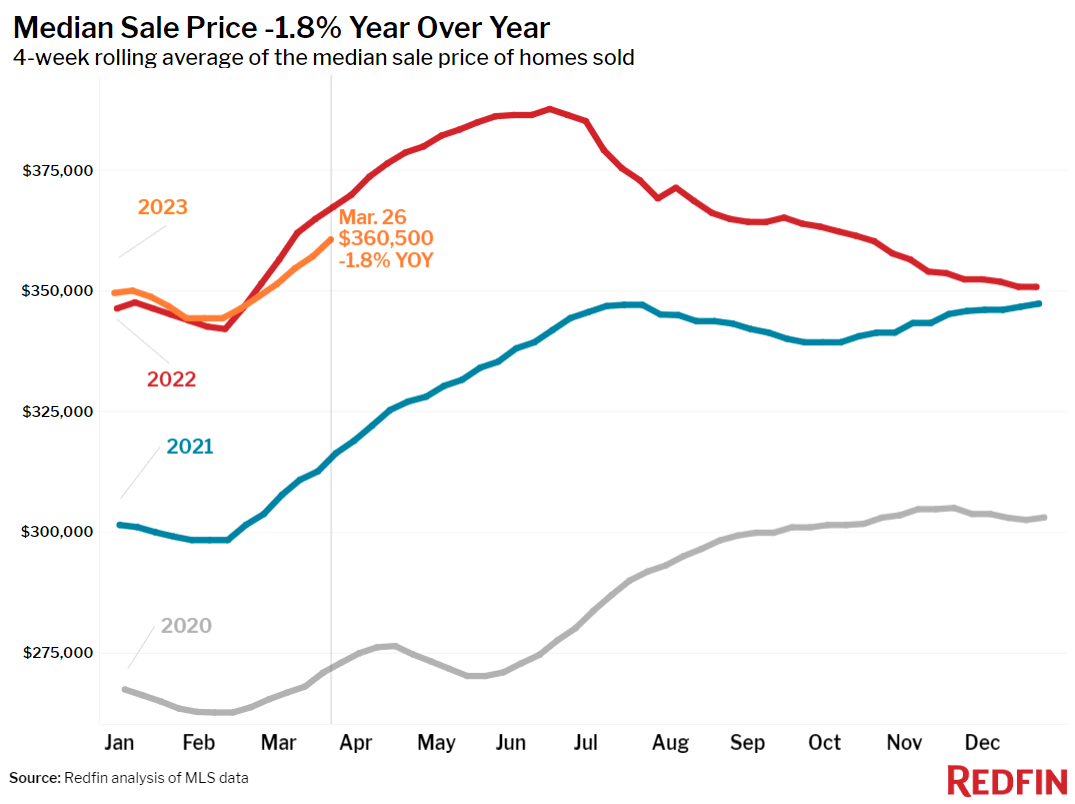

On a national level, the median U.S. home-sale price fell 1.8% year over year to $360,500, marking the sixth straight week of declines after more than a decade of increases.

"Prices are still rising quickly in some places while they are down by double digits in big tech hubs, so it's important for prospective buyers to work with an expert local agent," said Redfin Deputy Chief Economist Taylor Marr. "One thing that's true almost everywhere: It's difficult to find a desirable, well-priced home for sale, so offer and negotiation strategies differ depending on where you're looking."

Leading indicators of homebuying activity:

- For the week ending March 30, average 30-year fixed mortgage rates dropped to 6.32%, the third straight week of declines. The daily average was 6.59% on March 30.

- Mortgage-purchase applications during the week ending March 24 increased 2% from a week earlier, seasonally adjusted, marking the fourth straight week of increases. Purchase applications were up 19% from a month earlier, but down 35% from a year earlier.

- The seasonally adjusted Redfin Homebuyer Demand Index jumped to its highest level since September during the week ending March 26. It was up 6% from a week earlier, but down 24% from a year earlier.

- Google searches for "homes for sale" were up about 44% from the trough they hit in December during the week ending March 25, but down about 17% from a year earlier.

- Touring activity as of March 26 was up about 20% from the start of the year, compared with a 24% increase at the same time last year, according to home tour technology company ShowingTime.

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, this data covers the four-week period ending March 26

- The median home sale price was $360,500, down 1.8% from a year earlier. That's the sixth week in a row of prices declining annually after more than a decade of increases. The latter is according to Redfin's monthly dataset, which goes back through 2012.

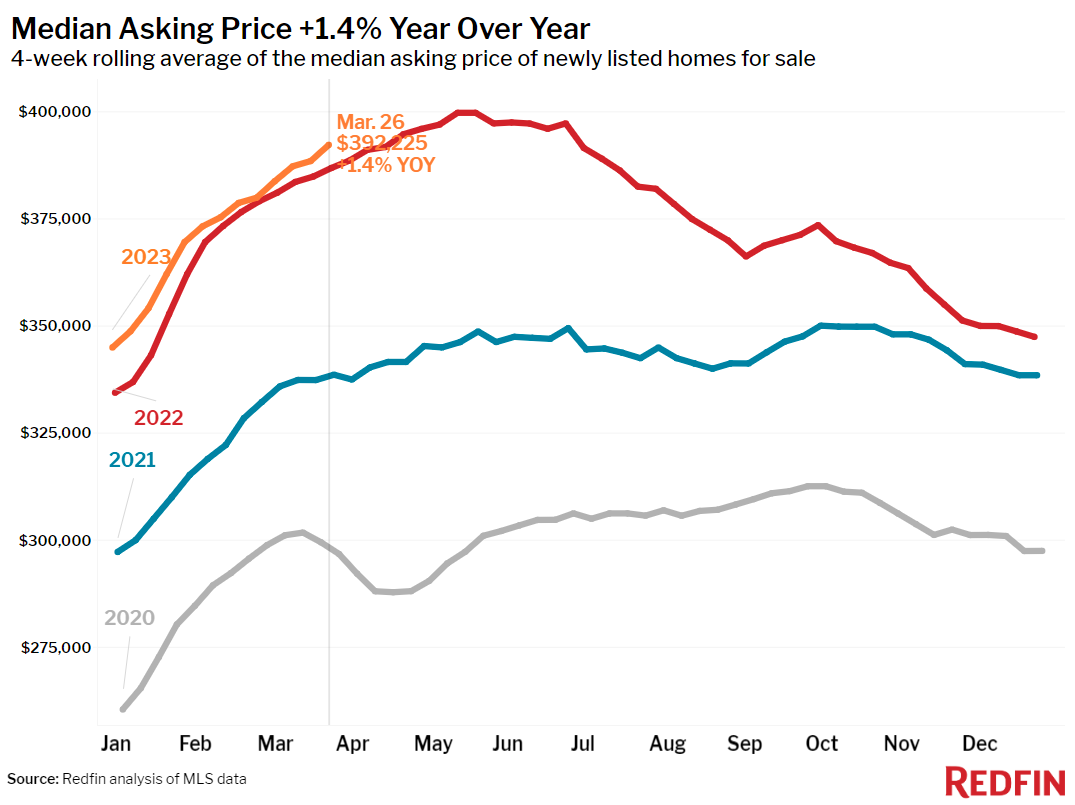

- The median asking price of newly listed homes was $392,225, up 1.4% year over year.

- The monthly mortgage payment on the median-asking-price home was $2,518 at a 6.32% mortgage rate, the current weekly average. Monthly mortgage payments are down slightly from the peak they reached three weeks ago, but up 16% ($354) from a year ago.

- Pending home sales were down 19.2% year over year, the biggest decline in nearly two months.

- Pending home sales fell in all 50 of the most populous U.S. metros. They fell most in Las Vegas (-52.6% YoY), Sacramento (-48.6%), San Jose (-46.4%), Oakland (-45.4%) and Seattle (-45.2%).

- New listings of homes for sale fell 21.7% year over year. New listings have been dropping by about 21% to 22% on a year-over-year basis for the last month.

- New listings declined in all 50 of the most populous U.S. metros, with the biggest declines in Sacramento (-48.8% YoY), Oakland (-44.3%), San Francisco (-41.8%), Riverside, CA (-39.7%) and San Diego, CA (-37.9%). New listings declined least in the South: Nashville, TN (-1.1% YoY) saw the smallest drop, followed by Dallas (-3.3%), Fort Worth, TX (-3.4%), Austin (-4.8%) and Houston (-9.3%).

- Active listings (the number of homes listed for sale at any point during the period) were up 13.9% from a year earlier, the smallest increase in more than four months.

- Months of supply--a measure of the balance between supply and demand, calculated by the number of months it would take for the current inventory to sell at the current sales pace--was 2.8 months, down from 3.5 months a month earlier and up from 1.9 months a year earlier.

- 47% of homes that went under contract had an accepted offer within the first two weeks on the market, the highest level since June, but down from 53% a year earlier.

- Homes that sold were on the market for a median of 41 days. That's up from 24 days a year earlier and the record low of 18 days set in May.

- 26% of homes sold above their final list price, the highest share in more than three months but down from 49% a year earlier.

- On average, 4.9% of homes for sale each week had a price drop, up from 2.2% a year earlier.

- The average sale-to-list price ratio, which measures how close homes are selling to their final asking prices, was 98.6%, the highest level in four months but down from 101.7% a year earlier.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October