Residential Real Estate News

U.S. Home Buyer Monthly Payments Hit Record High in March

Residential News » Seattle Edition | By Monsef Rachid | March 10, 2023 8:59 AM ET

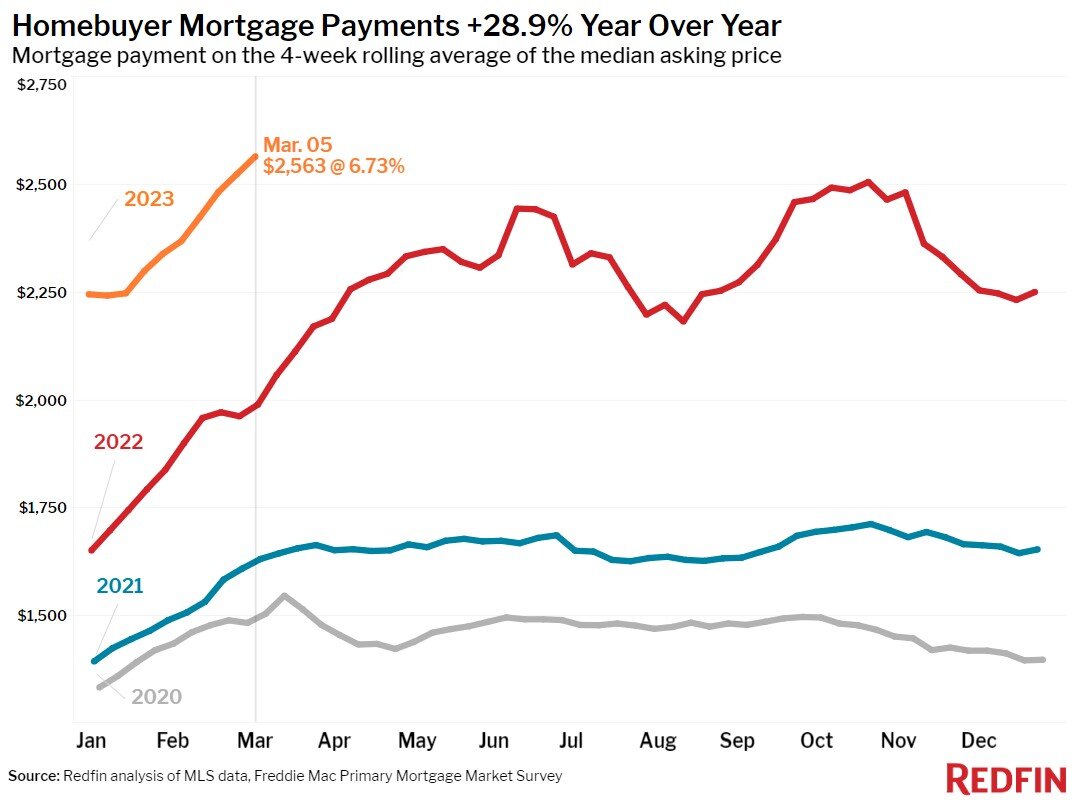

National property broker Redfin is reporting this week that the typical U.S. homebuyer's monthly payment hit a new all-time high of $2,563 this week, up 29% from $1,988 a year ago. That's dampening demand and preventing many would-be sellers from listing their homes.

Rising mortgage rates sent monthly payments to new heights this week despite home prices dropping: The typical U.S. home-sale price fell 1% year over year during the four weeks ending March 5.

To look at the hit on home buying affordability another way, a homebuyer on a $2,500 monthly budget can afford a $376,000 home with today's average rate. That's down from the $400,000 home a buyer on the same budget could have bought a month ago when rates dropped to 6%.

Spending power has declined even more dramatically when compared to a year ago, when mortgage rates were sitting at 3.85% and a buyer with a $2,500 monthly budget could afford a $480,000 home.

High monthly payments are deterring would-be homebuyers and sellers who want to hang onto their relatively low rates. Pending home sales declined 16.1% year over year and were essentially flat from a week earlier, defying seasonal trends; pending sales typically increase throughout March. New listings of homes for sale dropped 21.7%, the biggest decline in two months. That's a reversal from January and early February, when the drop-off in both pending sales and new listings was easing as the housing market started to thaw. Redfin's Homebuyer Demand Index--a measure of home tours and other buying services from Redfin agents--is down 4% from a week ago and 27% from a year ago.

"All eyes are on inflation as it continues to have a huge impact on mortgage rates and the housing market," said Redfin Deputy Chief Economist Taylor Marr. "The Fed said this week that it may hike interest rates more than anticipated to combat persistent inflation. That news kept mortgage rates propped up, but next week's official February inflation reading could send them meaningfully up or down. Homebuyers and sellers are ultra-sensitive to mortgage-rate fluctuations, so rates starting to decline would likely bring some buyers and sellers back--and rates rising would push more away."

Some measures of homebuying demand are up from the low points they reached last fall. Redfin's Homebuyer Demand Index is up 16% from its late-October trough and pending home sales aren't declining nearly as fast as they were in November.

Leading indicators of homebuying activity:

- For the week ending March 9, average 30-year fixed mortgage rates rose to 6.73%, according to Freddie Mac data, marking the fifth straight week of increases. The daily average was 7.05% on March 8, per Mortgage News Daily.

- Mortgage-purchase applications during the week ending March 3 increased 7% from a week earlier, seasonally adjusted--but mortgage activity is still quite slow; applications had dropped to a 30-year low the week before and they're down 3.7% from the low point they hit in October. Purchase applications were down 42% from a year earlier. This is according to the Mortgage Bankers Association.

- The seasonally adjusted Redfin Homebuyer Demand Index fell 4% from a week earlier and 2% from a month earlier during the week ending March 5. It was down 27% from a year earlier.

- Google searches for "homes for sale" were up about 48% from the trough they hit in December during the week ending March 4, but down about 13% from a year earlier.

- Touring activity as of March 4 was up about 16% from the start of the year, compared with a 23% increase at the same time last year, according to home tour technology company ShowingTime.

Key housing market takeaways for 400+ U.S. metro areas as of March 5, 2023:

- The median home sale price was $352,750, down 1.2% from a year earlier, the biggest decline in more than a decade. Redfin's monthly dataset, which goes back through 2012, shows that the last time home prices declined more was February 2012, when they dropped 1.5%.

- Median sale prices fell in 23 of the 50 most populous U.S. metros, with the biggest drops in pandemic homebuying hotspots and northern California. San Jose, CA (-14.6% YoY) experienced the biggest decline, followed by San Francisco (-12.2%), Austin, TX (-12.1%), Oakland, CA (-10.7%) and Phoenix (-8.3%). That's the biggest sale-price drop on record for all five of those metros.

- Sale prices increased most in Milwaukee (10.4% YoY), West Palm Beach, FL (10.3%), Columbus, OH (8.4%), Miami (7%) and Virginia Beach,VA (6.4%).

- The median asking price of newly listed homes was $386,262, up 1.2% year over year.

- The monthly mortgage payment on the median-asking-price home was $2,563 at a 6.73% mortgage rate, the current weekly average. That's an all-time high. Monthly mortgage payments are up 29% ($575) from a year ago.

- Pending home sales were down 16.1% year over year.

- Pending home sales fell in all 50 of the most populous U.S. metros. They fell most in Las Vegas (-54.9% YoY), Portland, OR (-47.5%), Riverside, CA (-46.7%), Seattle (-45.4%) and Sacramento, CA (-44.9%).

- New listings of homes for sale fell 21.7% year over year, the biggest decline in two months.

- New listings declined in all 50 of the most populous U.S. metros, with the biggest declines in Sacramento (-45.6%), Oakland (-44.5%), Portland, OR (-42.3%), San Jose (-42.1%), and Seattle (-41.2%).

- Active listings (the number of homes listed for sale at any point during the period) were up 18.2% from a year earlier, the smallest increase in three months.

- Months of supply--a measure of the balance between supply and demand, calculated by the number of months it would take for the current inventory to sell at the current sales pace--was 3.2 months, down from 4.1 months a month earlier and up from 2 months a year earlier.

- 45% of homes that went under contract had an accepted offer within the first two weeks on the market, the highest level since June, but down from 53% a year earlier.

- Homes that sold were on the market for a median of 48 days. That's up from 29 days a year earlier and the record low of 18 days set in May.

- 23% of homes sold above their final list price, down from 45% a year earlier.

- On average, 4.8% of homes for sale each week had a price drop, up from 2% a year earlier.

- The average sale-to-list price ratio, which measures how close homes are selling to their final asking prices, was 98.1%, the highest level in roughly three months but down from 100.9% a year earlier.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership