The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Wealth Divide Highlighted by Coronavirus Housing Rebound in U.S.

Residential News » Seattle Edition | By Monsef Rachid | June 25, 2020 8:00 AM ET

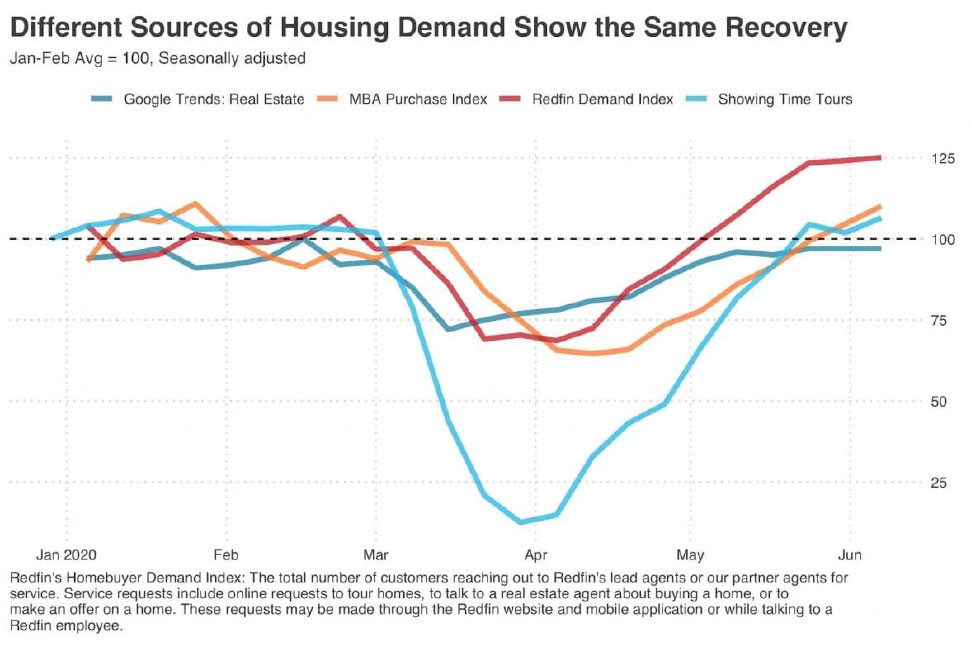

According to Redfin, the impact of coronavirus shutdowns on homebuyer demand has been short and muted, but the economic recovery will disproportionately benefit those who were already economically advantaged.

Since shutdowns began in mid-March 2020, tech and other white-collar workers with job security and access to cash and credit have been able to continue their home searches and take advantage of low mortgage interest rates. Struggling the most are those with low-income jobs in industries like service and hospitality--groups with a higher percentage of Blacks and other minorities--that had largely already been priced out of the housing market even before the economy stalled. Record unemployment for low-income jobs and a skyrocketing stock market only deepens the divide. Because of this inequality, the pain of the coronavirus recession is likely to be over relatively quickly for the economically privileged, even in areas where unemployment has soared.

"With record-low interest rates and relative job security in spite of the recession, higher-income homebuyers are already coming back into the housing market," said Redfin lead economist Taylor Marr. "Because of this quick bounce back in homebuying demand, this recession is playing out very differently than the Great Recession, and we're not seeing much impact on home prices so far."

The Haves vs. the Have-Nots

The trend we've seen in homebuying demand over the past two months is an exacerbation of the inequality in the housing market over the past decade. The housing market has mostly been driven by white households with higher incomes--households less likely to have been severely affected economically by the coronavirus shutdowns. One way to see this is in the data from a May Federal Reserve employment survey, which shows that the unemployment rate for those at the top of the income spectrum ($100,000 and above) was 10%, less than half of the 21% rate among those at the bottom end who are making less than $60,000.

In addition to the disparity in unemployment across income brackets, there is a large racial gap, which can be seen in the May unemployment data from the Bureau of Labor Statistics. The outsized impact of this recession on Black families is just the latest in a long string of inequities including segregation, redlining, and home lending discrimination that continue to impede their ability to build wealth. Even before the current surge in joblessness, the unemployment rate for Black families was three points higher than the rate for white families. Now that difference has doubled to six points.

This disparity highlights the need for serious action to address systemic racial inequality in housing and the economy as a whole. Unless the government takes aggressive, proactive steps to counteract the unequal impact this recession is already having on Black families, it is likely that the homeownership and wealth gaps will increase even more, continuing the pattern that followed the Great Recession.

Most and Least-Impacted Industries

The industries experiencing the worst unemployment were mostly those with lower wages such as service, hospitality, and retail. People working at bars reported a 60.6% unemployment rate in April. Hotels saw 48.7% unemployment, and the unemployment rate at restaurants was 34.8%. Because of this, the local economies in metro areas like Las Vegas that have large concentrations of people who have been hit the hardest are likely to see more of a lasting impact from this recession.

In contrast, some of the best-paying industries have barely seen an increase in their unemployment rate. The banking industry had just a 2.9% unemployment rate in April, while securities (3.4%) and "computer systems design" (i.e. software developers), (4.2%) were also among the least-impacted industries. Meanwhile, tech stocks have been hitting new highs throughout the pandemic, further lining the pockets of their well-paid workforce, whose compensation often includes large stock grants. As a result, areas like San Francisco and Seattle are likely to see a return to overall economic expansion much sooner than cities like Las Vegas.

Even within a single market, the disparity between the haves and the have-nots is becoming very clear. In the midst of the pandemic, Phoenix-based Redfin agent Kelly Khalil has been working with a client from Chicago who is buying a second home. "They aren't planning on retiring for two more years, but they want to buy their retirement home early to take advantage of what they feel is a low market," explained Khalil. "On the other hand, there are parts of Phoenix that have been hit really hard due to the total shutdown of tourism. We're seeing a lot of homes that were formerly rented on Airbnb hitting the market. I have one client who had three in the same neighborhood but has now begun to sell them because they can't afford to pay four mortgages without the rental income.

The great injustice of this recession is that it is likely to have deeper and longer-lasting impacts on the people who were already struggling. Those who were well-off and have maintained job security throughout the worst of the shutdowns are already practically back to business-as-usual, which is leading to a rapid recovery in homebuying demand.

The increase in demand from economically advantaged buyers over the past two months is an exacerbation of the inequality in the housing market over the past decade. The housing market has mostly been driven by white households with higher incomes--households less likely to have been severely affected economically by the coronavirus shutdowns. One way to see this is in the data from a May Federal Reserve employment survey, which shows that the unemployment rate for those at the top of the income spectrum ($100,000 and above) was 10%, less than half of the 21% rate among those at the bottom end who are making less than $60,000.

Since shutdowns began in mid-March 2020, tech and other white-collar workers with job security and access to cash and credit have been able to continue their home searches and take advantage of low mortgage interest rates. Struggling the most are those with low-income jobs in industries like service and hospitality--groups with a higher percentage of Blacks and other minorities--that had largely already been priced out of the housing market even before the economy stalled. Record unemployment for low-income jobs and a skyrocketing stock market only deepens the divide. Because of this inequality, the pain of the coronavirus recession is likely to be over relatively quickly for the economically privileged, even in areas where unemployment has soared.

"With record-low interest rates and relative job security in spite of the recession, higher-income homebuyers are already coming back into the housing market," said Redfin lead economist Taylor Marr. "Because of this quick bounce back in homebuying demand, this recession is playing out very differently than the Great Recession, and we're not seeing much impact on home prices so far."

The Haves vs. the Have-Nots

The trend we've seen in homebuying demand over the past two months is an exacerbation of the inequality in the housing market over the past decade. The housing market has mostly been driven by white households with higher incomes--households less likely to have been severely affected economically by the coronavirus shutdowns. One way to see this is in the data from a May Federal Reserve employment survey, which shows that the unemployment rate for those at the top of the income spectrum ($100,000 and above) was 10%, less than half of the 21% rate among those at the bottom end who are making less than $60,000.

In addition to the disparity in unemployment across income brackets, there is a large racial gap, which can be seen in the May unemployment data from the Bureau of Labor Statistics. The outsized impact of this recession on Black families is just the latest in a long string of inequities including segregation, redlining, and home lending discrimination that continue to impede their ability to build wealth. Even before the current surge in joblessness, the unemployment rate for Black families was three points higher than the rate for white families. Now that difference has doubled to six points.

This disparity highlights the need for serious action to address systemic racial inequality in housing and the economy as a whole. Unless the government takes aggressive, proactive steps to counteract the unequal impact this recession is already having on Black families, it is likely that the homeownership and wealth gaps will increase even more, continuing the pattern that followed the Great Recession.

Most and Least-Impacted Industries

The industries experiencing the worst unemployment were mostly those with lower wages such as service, hospitality, and retail. People working at bars reported a 60.6% unemployment rate in April. Hotels saw 48.7% unemployment, and the unemployment rate at restaurants was 34.8%. Because of this, the local economies in metro areas like Las Vegas that have large concentrations of people who have been hit the hardest are likely to see more of a lasting impact from this recession.

In contrast, some of the best-paying industries have barely seen an increase in their unemployment rate. The banking industry had just a 2.9% unemployment rate in April, while securities (3.4%) and "computer systems design" (i.e. software developers), (4.2%) were also among the least-impacted industries. Meanwhile, tech stocks have been hitting new highs throughout the pandemic, further lining the pockets of their well-paid workforce, whose compensation often includes large stock grants. As a result, areas like San Francisco and Seattle are likely to see a return to overall economic expansion much sooner than cities like Las Vegas.

Even within a single market, the disparity between the haves and the have-nots is becoming very clear. In the midst of the pandemic, Phoenix-based Redfin agent Kelly Khalil has been working with a client from Chicago who is buying a second home. "They aren't planning on retiring for two more years, but they want to buy their retirement home early to take advantage of what they feel is a low market," explained Khalil. "On the other hand, there are parts of Phoenix that have been hit really hard due to the total shutdown of tourism. We're seeing a lot of homes that were formerly rented on Airbnb hitting the market. I have one client who had three in the same neighborhood but has now begun to sell them because they can't afford to pay four mortgages without the rental income.

The great injustice of this recession is that it is likely to have deeper and longer-lasting impacts on the people who were already struggling. Those who were well-off and have maintained job security throughout the worst of the shutdowns are already practically back to business-as-usual, which is leading to a rapid recovery in homebuying demand.

The increase in demand from economically advantaged buyers over the past two months is an exacerbation of the inequality in the housing market over the past decade. The housing market has mostly been driven by white households with higher incomes--households less likely to have been severely affected economically by the coronavirus shutdowns. One way to see this is in the data from a May Federal Reserve employment survey, which shows that the unemployment rate for those at the top of the income spectrum ($100,000 and above) was 10%, less than half of the 21% rate among those at the bottom end who are making less than $60,000.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. New-Home Sales Surge in August as Mortgage Rates Ease

- Despite Increased Foreign Buyer Activity, Miami Residential Sales Dip 11 Percent in August

- California Home Sales Enjoy Modest Uptick as Mortgage Rates Ease

- U.S. Home-Flipping Profits Sink to Lowest Level Since 2008 Financial Crisis as Costs Climb

- Why the World's Rich Are Flocking to Europe in 2025

- Federal Reserve Delivers First Rate Cut of 2025 as Mortgage Relief Proves Limited

- Homebuilder Sentiment Holds Steady in U.S. as Rate-Cut Bets Lift Outlook

- U.S. Mortgage Rates Experience Sharpest Weekly Drop in Over a Year

- U.S. Foreclosures Rise for Sixth Straight Month as Affordability Pressures Mount

- Black U.S. Homeownership Rate Falls to Two-Year Low as Job Losses Mount

- Las Vegas Home Prices Flatten as Listings Surge, Sales Slow

- Cooling Miami Housing Market Sees 16 Percent Annual Sales Drop in July

- U.S. Mortgage Delinquencies Uptick in June Amid Regional Pressures

- California, Florida Top U.S. Housing Markets Most at Risk of Downturn

- 30-Year Mortgage Drops to 6.56 Percent in Late August, Lowest Since October 2024

- Investors Maintain Elevated Role in U.S. Housing Market Despite Slight Pullback

- Pending Home Sales Show Mixed Signals as U.S. Buyers Remain Cautious

- Canadian Home Sales Extend Recovery in July

- U.S. Home Sales Rise in July as Buyers Gain More Bargaining Power

- Zombie Foreclosures Edge Up Across U.S.

- 2.6 Million Homes at Wildfire Risk Across 14 Western States in 2025

- One in Five Americans Willing to Trade Personal Safety for Home Affordability

- U.S. Home Price Growth Slows as Affordability Pressures Mount in 2025

- U.S. Mortgage Rates Dip to Four Month Low in Early August

- U.S. Mortgage Applications Rise in Late July, Breaking Four-Week Slump

- Hong Kong's Housing Market Stuck in Stalemate as Bulls and Bears Face Off

- U.S. Condo Market Struggles in 2025

- U.S. Pending Home Sales Remain Sluggish in June

- Los Angeles Area Wildfires Destroyed Nearly $52 Billion in Homes Last January

- Greater Palm Beach Area Residential Sales Slip in June Amid Growing Inventory

- Economic Resilience Lifts U.S. Housing Outlook Going Forward

- New Home Sales Stagnate as Affordability Struggles Continue in America

- U.S. Housing Market Slips in June as Prices Hit New Highs

- Florida, California Continue to Reign Supreme as America's Ultraluxury Housing Markets

- Caribbean Housing Market Evolves into Global Second-Home Hotspot

- U.S. Home Sales See Highest June Cancellation Rate on Record

- Orlando Housing Market Cools in June as Listings Slide, Sales Slow

- Private Credit Surges in 2025 as Real Estate Developers Bypass Banks

- U.S. Condo Market Suffers Sharpest Price Drops in Over a Decade as Buyers Retreat

- Rising Taxes, Insurance Costs Undermine the Stability of U.S. Homeownership

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More