Residential Real Estate News

Less than 16 Percent of U.S. Homes For Sale Were Affordable for Typical Buyers in 2023

Residential News » Seattle Edition | By David Barley | December 28, 2023 9:54 AM ET

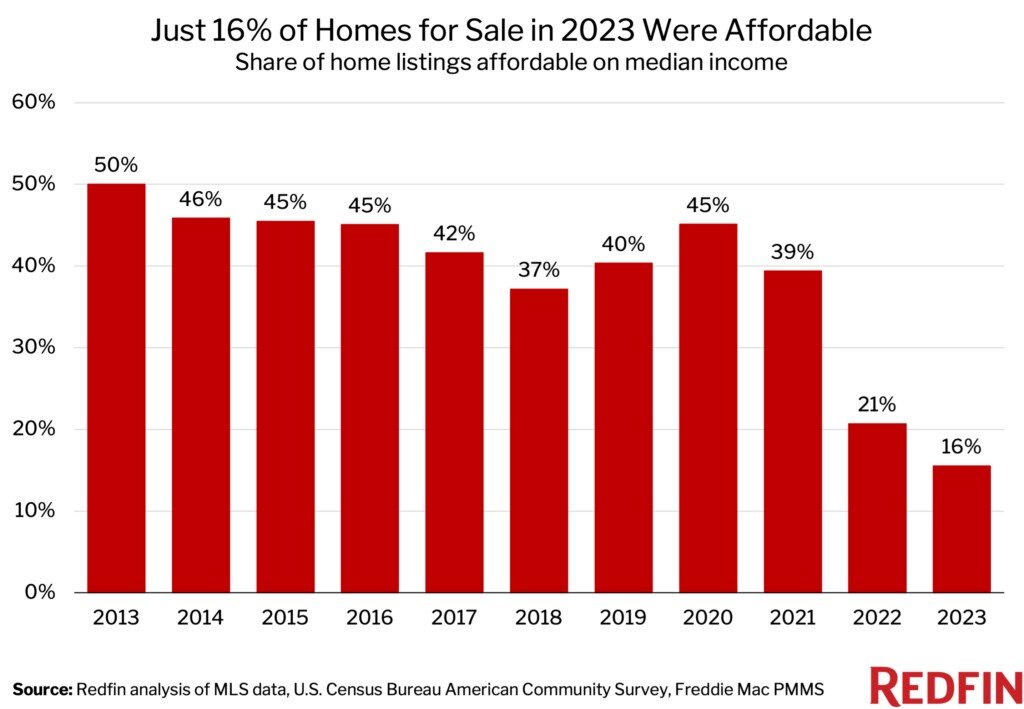

According to Redfin, just 15.5% of U.S. homes for sale in 2023 were affordable for the typical U.S. household--the lowest share on record. That's down from 20.7% in 2022 and more than 40% before the pandemic homebuying boom.

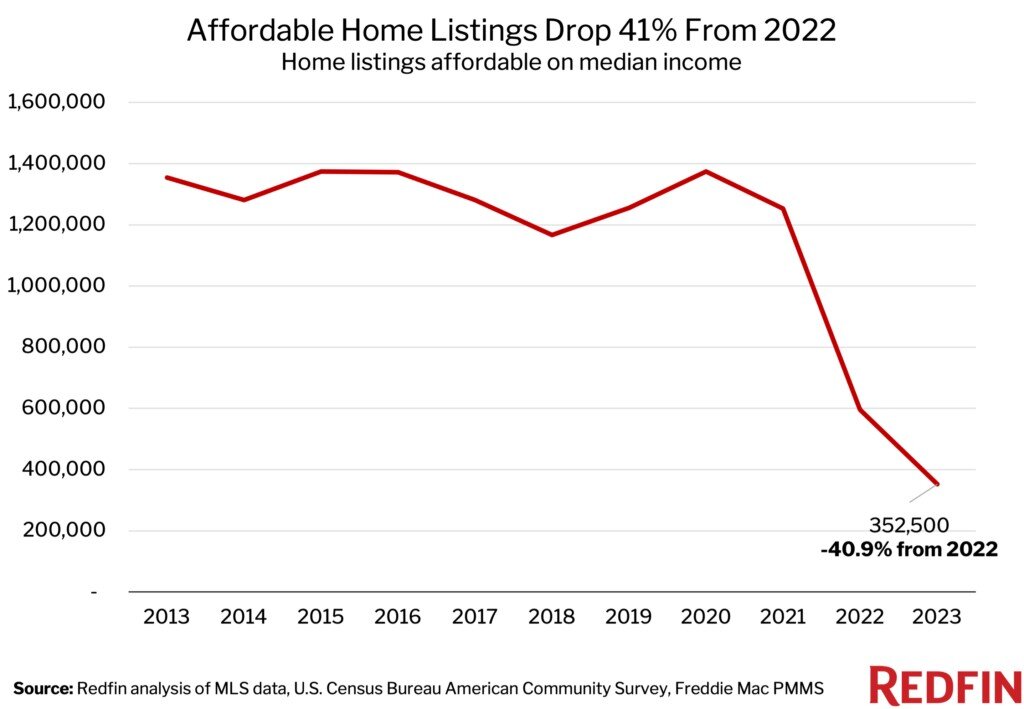

The number of affordable homes for sale also dropped to the lowest level on record. There were 352,500 affordable listings in 2023, down 40.9% from 596,135 in 2022 and down from over a million per year during the prior decade. While the decline is partly due to a drop in listings in general--listings overall fell 21.2% year over year--it's also due to the fact that elevated mortgage rates and stubbornly high prices made the listings hitting the market more expensive.

Mortgage rates have fallen from their October peak, but remain higher than they were in 2022; the typical homebuyer's monthly payment is roughly $250 more than it was a year ago. Elevated mortgage rates have also propped up housing costs by limiting supply. Many homeowners are staying put instead of selling because they don't want to lose their ultra low interest rate. That's bolstering home prices because it means buyers are competing for a limited pool of homes.

The good news is that housing affordability has already started to improve, and Redfin expects it to continue improving in 2024.

"Many of the factors that made 2023 the least affordable year for home buying on record are easing," said Redfin Senior Economist Elijah de la Campa. "Mortgage rates are under 7% for the first time in months, home price growth is slowing as lower rates prompt more people to list their homes, and overall inflation continues to cool. We'll likely see a jump in home purchases in the new year as buyers take advantage of lower mortgage rates and more listings after the holidays."

Housing Affordability Was Three Times Worse for Black Households Than for White Households

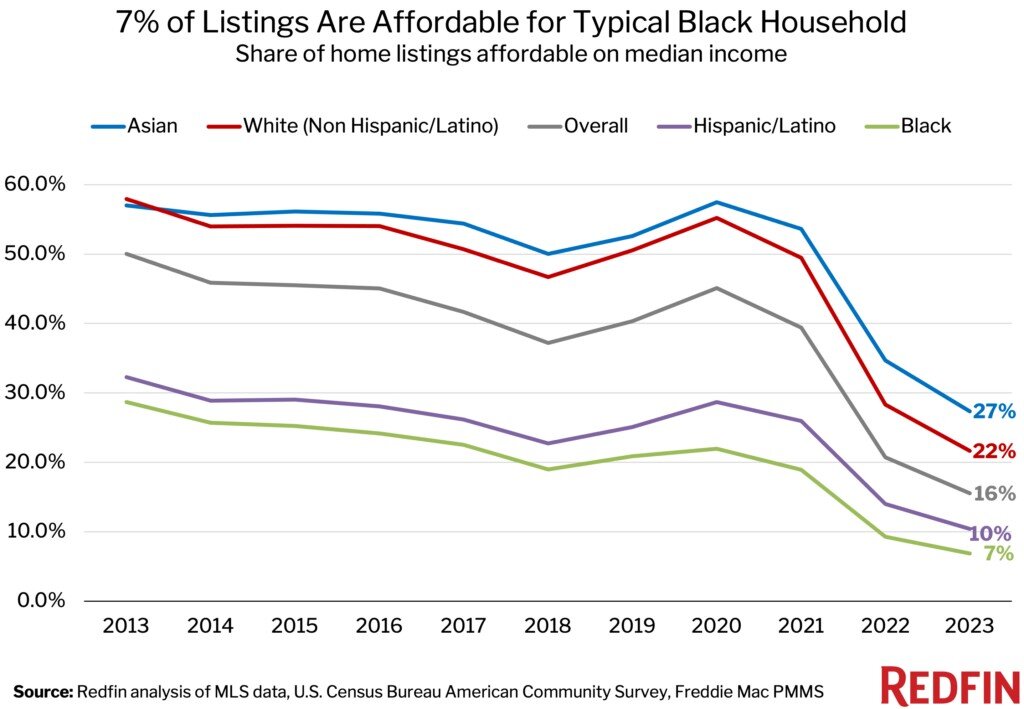

Only 6.9% of homes for sale in 2023 were affordable for the typical Black household, compared with 21.6% for the typical white household. The share was nearly as low for Hispanic/Latino households (10.4%) and was highest for Asian households (27.4%).

Housing has become unaffordable for a lot of Americans, but Black and Hispanic/Latino families have been hit especially hard because they're often less wealthy to begin with. On average, these groups earn less money, have less generational wealth, and have lower credit scores (and sometimes no credit scores at all) than white Americans due to decades of discrimination. That makes it tougher to afford a down payment and qualify for a low mortgage rate. Black Americans, in particular, also frequently face racial bias during the homebuying process.

The racial housing affordability gap exists nationwide, from the least affordable metros to the most affordable metros. In Detroit, which has the lowest mortgage payments in the country, 31.8% of listings were affordable for the typical Black household this year and 50.2% were affordable for the typical Hispanic/Latino household, but that's much lower than the 66% affordable for the typical white household. In Anaheim, CA, one of the most expensive markets in the country, people across the board have a hard time finding affordable housing. Still, Black and Hispanic/Latino house hunters have fewer options. Less than 0.5% of listings were affordable for the typical Black household and the typical Hispanic/Latino household in 2023, compared with 1.8% for the typical white household.

It's worth noting that wages have grown faster for nonwhite households than for white households this year, helping to shrink the income gap. Rents have also started to fall, which disproportionately impacts communities of color because they're more likely to be renters.

Affordable Markets Became Much Less Affordable in 2023

In Kansas City, MO, 27.9% of homes for sale in 2023 were affordable for the typical local household, down from 42.8% in 2022. That 14.8 percentage point decline is the largest among the metros Redfin analyzed. Next came Greenville, SC (-14.1 ppts), Worcester, MA (-13.7 ppts), Cincinnati (-13.7 ppts) and Little Rock, AR (-13.5 ppts).

Relatively inexpensive metros have seen affordability erode quickly because housing costs have relatively more room to rise, and local incomes are often climbing at a fraction of the pace that mortgage payments are.

In San Francisco, 0.3% of homes for sale in 2023 were affordable for the typical local household, down from 0.4% in 2022. That's the smallest decline among the metros Redfin analyzed. Next came Detroit (-0.2 ppts), Los Angeles (-0.2 ppts) Boise, ID (-0.3 ppts) and Oakland, CA (-0.5 ppts).

Markets that have long been expensive like San Francisco, Oakland and Los Angeles already had so few affordable homes that the share didn't have much room to fall. In the five aforementioned metros aside from Detroit, less than 5% of listings were affordable for the typical household in 2023.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October