Residential Real Estate News

Active Home Listings For Sale in America Fell to a Record Low in May

Residential News » Seattle Edition | By David Barley | June 22, 2023 8:39 AM ET

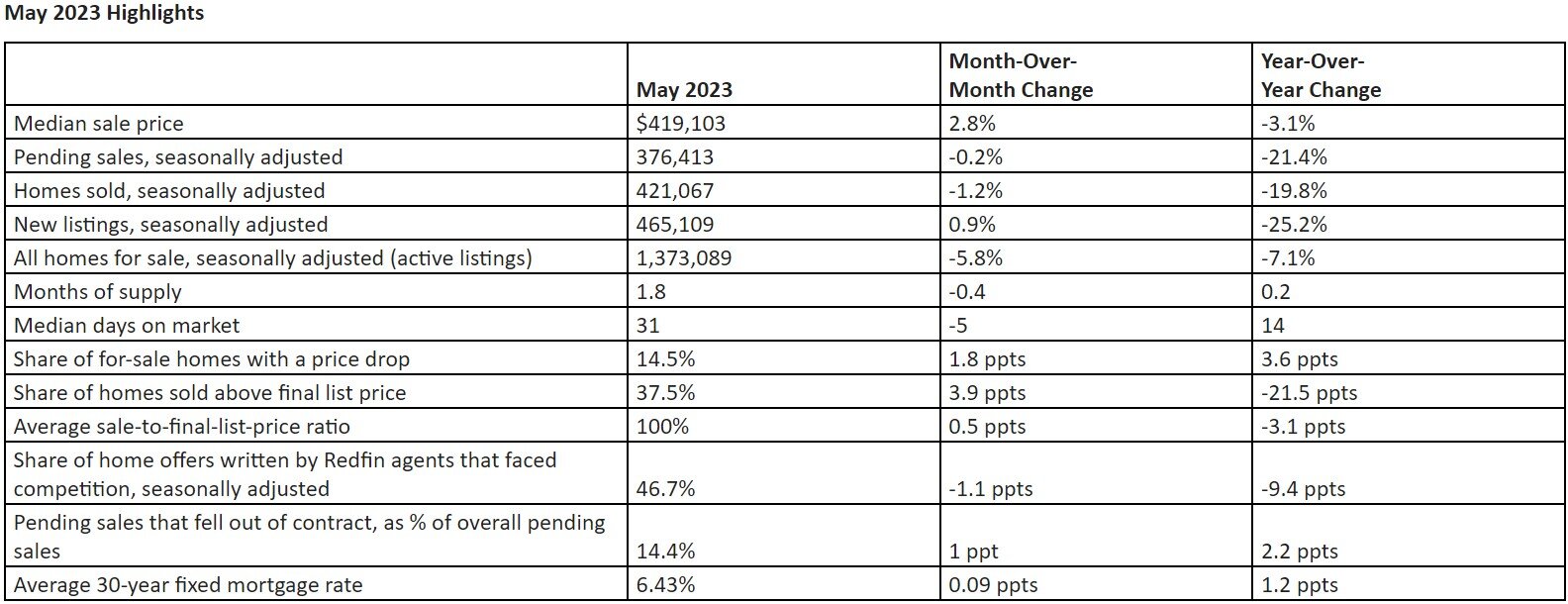

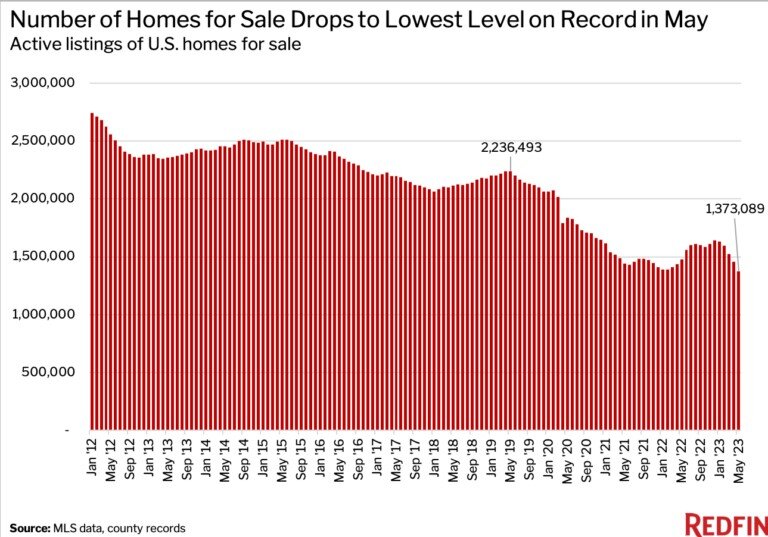

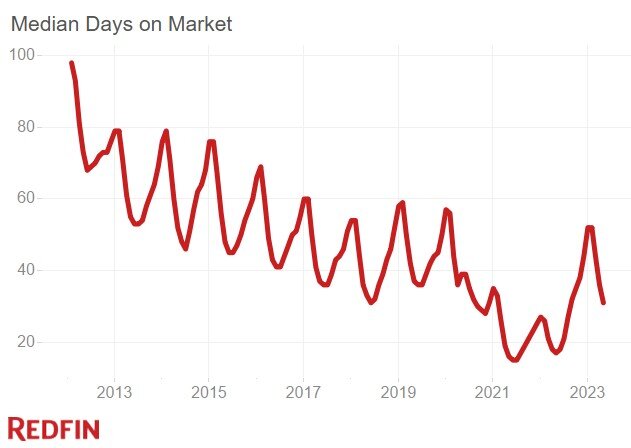

According to national property broker Redfin, the number of homes for sale in the U.S. fell 7.1% year over year to 1.4 million on a seasonally adjusted basis in May 2023. That's the lowest level in Redfin's records, which date back to 2012, and the first annual decline since April 2022.

By comparison, there were 2.2 million homes for sale in May 2019--before the pandemic rocked the U.S. housing market--meaning housing supply was 38.6% below pre-pandemic levels this May. America's housing stock is dwindling because there are very few people selling homes. New listings of homes for sale declined 25.2% year over year in May to the third lowest level on record on a seasonally adjusted basis, as homeowners were handcuffed by high mortgage rates.

Nearly every homeowner with a mortgage has an interest rate below 6%, meaning many are opting to stay put because selling and buying a new home would mean taking on a higher monthly mortgage payment. The average 30-year-fixed mortgage rate in May was 6.43%, up from 5.23% a year earlier and a record low of 2.65% in 2021.

The Intensifying Housing Shortage Is Propping Up Home Prices

The median U.S. home sale price was $419,103 in May. That's down just 3.1% from a year earlier, when prices hit a record high of $432,311. While home prices fell in May, they posted a smaller decline than they did in April, when prices dropped 4.2% from a year earlier--the largest decrease on record with the exception of January 2012.

"It's too early to say that price declines have bottomed out," said Redfin Chief Economist Daryl Fairweather. "Prices may have room to fall because mortgage rates could still rise. The Federal Reserve just signaled that it is likely to continue raising interest rates this year. That could further hamper homebuyer demand and cause home prices to fall in the near term, though the drops would be minimal. We're unlikely to see double-digit price declines like we did during the 2008 housing crisis."

Fairweather continued: "Many people think it's a bad time to buy a home because mortgage rates are high, but they should keep in mind that when rates do ultimately fall, many buyers waiting on the sidelines could jump back in. That could lead to more bidding wars since there aren't enough homes for sale, and heightened competition could push up prices, offsetting some or all of the benefit of lower interest rates."

The typical home that sells is no longer selling at a discount. The average sale-to-list price ratio, which measures how close homes are selling to their final asking prices, was 100% in May, meaning the typical home that sold was purchased at its list price. That's down from 103.1% a year earlier, but is the highest level of any May on record prior to the pandemic and follows nine straight months of sub-100% sale-to-list price ratios.

It's worth noting that price changes differ vastly from market to market. For example, Austin, TX, Boise, ID and Oakland, CA all saw double-digit year-over-year price declines in May, while prices rose roughly 10% in Hartford, CT, Rochester, NY and Cincinnati. Pandemic boomtowns and expensive coastal hubs have seen their housing markets slow relatively quickly because prices soared to unsustainable levels during the pandemic and are now coming back down to earth.

The Housing Shortage Is Fueling Homebuyer Competition in Many Markets

While demand from homebuyers has fallen, new listings have fallen even further, meaning many of the buyers who are out there are encountering bidding wars.

Even though the typical home that sold in May was purchased for its list price, more than one-third (37.5%) went for more than their list prices--a sign that some buyers are facing competition. That's down from 59% a year earlier but is the highest share of any May on record prior to the pandemic.

Nearly half (46.7%) of home offers written by Redfin agents faced a bidding war in May on a seasonally adjusted basis. While that's down from 56.1% a year earlier and a peak of 69.6% in January 2022, it's notable that so many buyers are facing competition at a time when demand is sluggish.

"There's a huge lack of housing inventory in Miami, and that combined with higher interest rates is making homebuyers' lives very challenging. Their money just isn't going as far," said local Redfin Premier real estate agent Rafael Corrales. "I'm encouraging my buyers to be a little more flexible; in some cases, I'm suggesting they go back to 2021 winning strategies, which can mean waiving contingencies and offering high earnest money deposits because they're competing against a lot of cash buyers."

Home Sales Are Falling, But Not as Quickly as They Were at the Start of the Year

Closed home sales fell 19.8% year over year on a seasonally adjusted basis in May, the smallest drop in nearly a year and an improvement from the record 35.3% decline in January. Still, sales were significantly below pre-pandemic levels, down 21% from May 2019.

Pending home sales performed similarly. They fell 21.4% year over year on a seasonally adjusted basis in May, the smallest drop since last summer and an improvement from the record 36.1% decline in November. Pending sales were down 16.1% from May 2019 levels.

Metro-Level Highlights: May 2023

- Pending sales: In Boise, pending sales fell 70.1% year over year, more than any other metro Redfin analyzed. It was followed by Baton Rouge, LA (-66%) and Allentown, PA (-54%). The smallest declines were in Dallas (-0.3%), Fort Worth (-2.2%) and Buffalo, NY (-3.5%).

- Closed sales: In Tacoma, WA, closed home sales dropped 38.9% year over year, more than any other metro Redfin analyzed. Next came Seattle (-34.7%) and Portland, OR (-32.9%). The smallest declines were in Atlanta (-1.5%), North Port, FL (-2.1%) and Fort Worth (-4.4%).

- Prices: Median sale prices fell from a year earlier in 40 of the metros Redfin analyzed. The biggest declines were in Austin (-15.1%), Boise (-14.3%) and Oakland (-11.2%). The biggest increases were in Hartford (10%), Rochester (9.7%) and Cincinnati (9.3%).

- Listings: New listings fell most from a year earlier in Allentown (-55.7%), Greensboro, NC (-51.1%) and Boise (-48.8%). They fell least in McAllen, TX (-7.3%), Buffalo (-8.9%) and El Paso, TX (-9.4%).

- Supply: Active listings fell most from a year earlier in Allentown (-46%), Greensboro (-38.6%) and Cincinnati (-37.6%). They rose most in North Port (50.8%), New Orleans (45.9%) and McAllen (40.4%).

- Competition: In Rochester, 72.7% of homes sold above their final list price, down from 75.8% a year earlier. That 3.1-percentage-point decline is the smallest among the metros Redfin analyzed. Next came Milwaukee (-3.4 ppts) and Hartford (-4.3 ppts). The largest declines were in Austin (-48 ppts), Dallas (-40.4 ppts) and North Port (-36.9 ppts).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years