The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Fast Rising Unemployment in U.S. Greatly Increases Housing Rent Burden

Residential News » Seattle Edition | By David Barley | March 27, 2020 8:00 AM ET

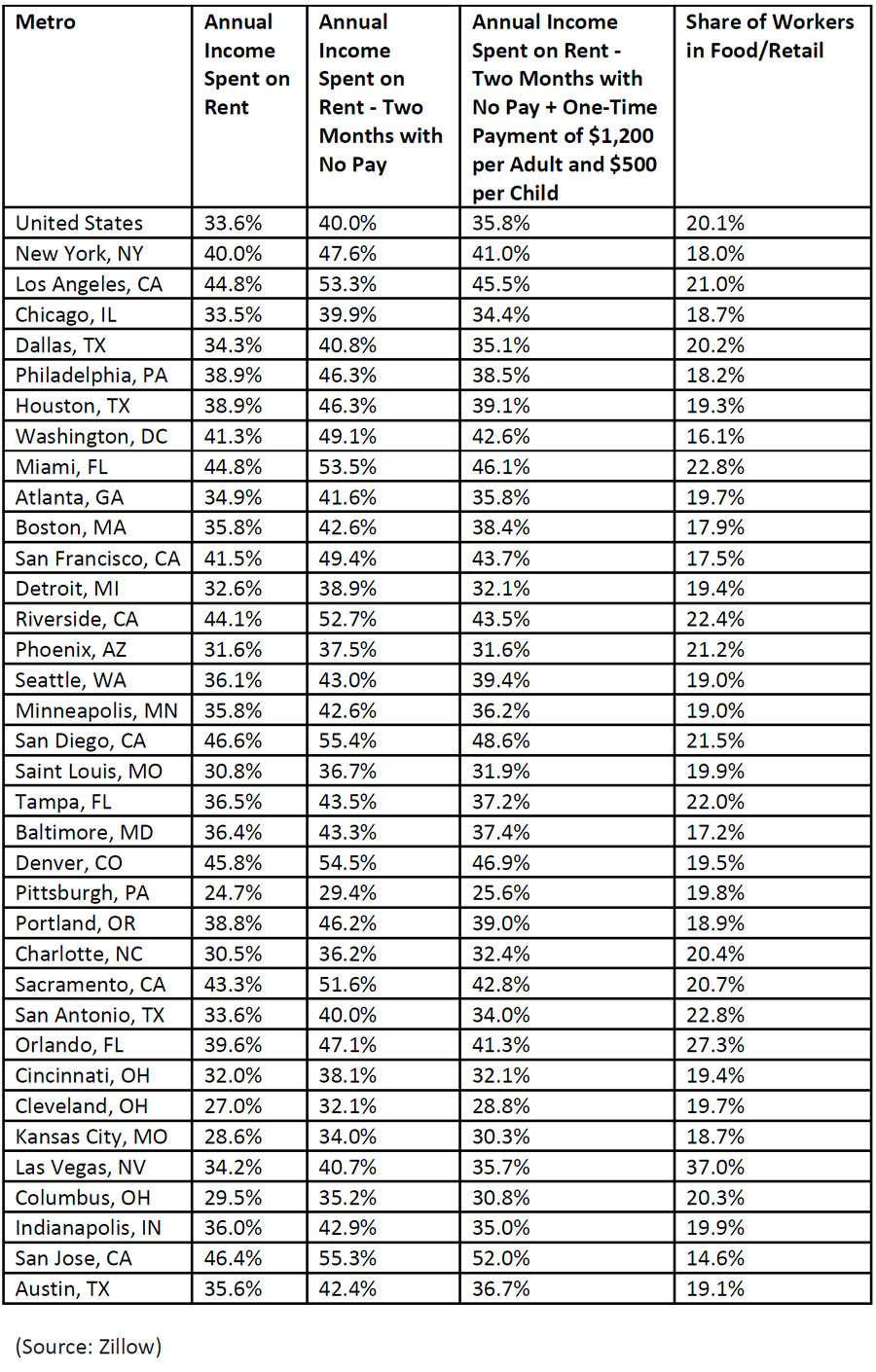

Zillow research is now reporting that American renters who work in food and retail industries can find themselves spending 40% of their annual income on housing costs if they are unable to work for two months -- up about six percentage points from their current rent burden.

As local governments limit or close businesses to stop the spread of the coronavirus, different measures have been proposed to alleviate the financial hardships facing employees. Zillow analyzed how a short-term loss of income could affect renters' finances, and what effect these proposals could have on housing affordability for workers in some hard-hit industries if they are out of work for two months.

Single earners working in food or retail could expect to spend a median of 33.6% of their income on rent. Missing just two weeks' worth of paychecks would raise that to 35% of their annual income. And if they are out of work for two months, they could spend 40% of their income on housing, absent any other source of money. According to previous Zillow research, only 51% of renters say they can afford an unexpected $1,000 expense, and most renters (66%) already make at least one sacrifice to afford their rent1. The first sacrifice renters make is cutting back on entertainment, followed by picking up additional work -- which may not be an option right now.

As the economic impact of shutting down or severely limiting the operations of restaurants, retail shops and other businesses grows, plans to address the gap in income have been proposed, including a one-time payment of $1,200 per single adult and $500 per qualified child. A one-time payment similar to this legislation would ease some of the financial strain on renters who are out of work for two months, lowering the share of annual income needed to cover the year's rent from 40% to 35.8%.

Two months with no income would push food and retail workers to spend more than half of their annual income on rent in San Diego, San Jose, Calif., Denver, Miami, Los Angeles, Riverside, Calif. and Sacramento. A one-time payment would keep their rent burden under 50% in each of these markets except San Jose.

In Las Vegas, 37% of the local employee base works in food or retail, the highest share of any market in this analysis. Rent typically takes up 34.2% of their annual household income -- if they missed two months of work, that would jump to 40.7% absent any other money. A one-time payment of $1,200 for each adult and $500 for each child would put their median rent burden at 35.7% of their annual income.

"We're still in the early stages of understanding exactly what effects the coronavirus will have on the housing market in the long term, but many workers and families are living through an immediate strain as their jobs are cut back and paychecks dry up," said Zillow Senior Policy Advisor Alexander Casey. "Renters across the country, and in the service industries especially, are already often stretching their budgets. They are likely to see their rent burden increase if paychecks disappear, which also means they'll have less funds left after paying housing costs for other essentials, which can quickly become devastating. But without drastic measures now to slow the spread of this disease, we risk it worsening, further delaying the economy's return to business as usual and resuming the livelihoods for these workers."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More