The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Miami Ranks Six in Top 40 Most Important Global Cities for Super Wealthy

Residential News » United States Edition | By Michael Gerrity | March 5, 2015 10:05 AM ET

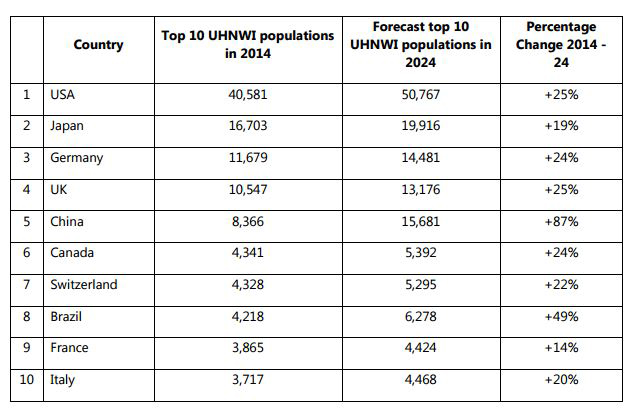

According to Knight Frank's new Global Wealth Report for 2015, London is still the most important global city for the world's ultra-high-net-worth individual (UHNWI), followed by New York and Hong Kong, but changing fortunes across the global over the past 12 months has seen Hong Kong and Singapore continue to slug it out for pole position in Asia.

Yet Miami, over the last decade, has quietly moved further up the list of the 'Top 40' most important global cities for the world's super rich. In 2015, Miami now is ranked number six worldwide, ahead of cities like Paris and Dubai.

Yet Miami, over the last decade, has quietly moved further up the list of the 'Top 40' most important global cities for the world's super rich. In 2015, Miami now is ranked number six worldwide, ahead of cities like Paris and Dubai. Liam Bailey, head of global research for Knight Frank further reports Hong Kong has also edged ahead, moving from fourth to third position in Knight Franks' global top 10 cities.

With Shanghai maintaining its steady rise, Asia holds four of the top 10 slots in our list. Although Geneva loses ground this year, Zurich's strengthening helps maintain European representation.

Focusing purely on the population of wealthy residents, Knight Franks data confirms that London remains the single biggest centre for global UHNWIs, followed by Tokyo, Singapore and New York. Ten years hence and the expectation is that London will retain its top spot, but Singapore will have closed the gap with a 54% growth in its population of UHNWIs over that period.

With the exception of London, European cities will see a relative decline in their rankings based on the size of their UHNWI populations over the next decade, despite an average 27% growth in wealthy residents.

Europe's relative, if not absolute, decline is reflected in North America, Australasia and even the Middle East, with one standout reason - the dramatic growth of wealth in Asia. On average, cities across that region will see a 91% growth in their UHNWI populations over the next decade.

The most rapid growth in wealth will be seen in the likes of Ho Chi Minh City, Jakarta, Mumbai and Delhi. One-fifth of the cities assessed are expected to see greater than 100% growth over the next decade, all of which are in Asia or Africa.

Geographic concentration of wealth remains a key facet with 10% of all additional growth in UHNWIs taking place in just five cities - Singapore, Hong Kong, New York, London and Mumbai - over the next decade.

Knight Frank further states when they focus on the broader measure of dollar millionaires, or HNWIs, rather than UHNWIs, we see some resilience in the performance of cities in the developed world.

Tokyo contains the biggest single cluster of HNWIs today. At 466,000 the HNWI population is nearly a fifth larger than the number two city, New York, with a little under 400,000.

In 10 years there will be a reversal, with New York expected to be home to the biggest global total, with over 520,000 HNWIs, and Tokyo slipping to second place with 508,000.

By this point Beijing will sit in third position, with 350,000 dollar millionaires, a rise of 55% over the decade.

Despite the US and Japan hanging on with the two biggest city counts, growth even at this wealth level will be dominated by Asian centers, with six of the 10 biggest growth cities in absolute terms being in Asia.

Collectively they are expected to add 600,000 new HNWIs to their populations over the period to 2024. In Mumbai alone forecast growth is a phenomenal 125,000 - a 128%.

Knight Frank's Attitudes Survey points to the cities that UHNWIs believe will yield the best investment opportunities in 2015 - led by New York, London, Berlin and Los Angeles.

Looking to the future, Knight Frank says one constant remains: the rise of the Asian powerhouse cities, the relative decline of the European centers and the tussle between the two global behemoths - New York and London, with New York expected to be the most important city for global UHNWIs in 2025.

Source: Knight Frank

Source: Knight FrankSign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More