The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Mortgage Rates in U.S. Remain Low in Mid-February

Residential News » Washington D.C. Edition | By Monsef Rachid | February 24, 2020 8:30 AM ET

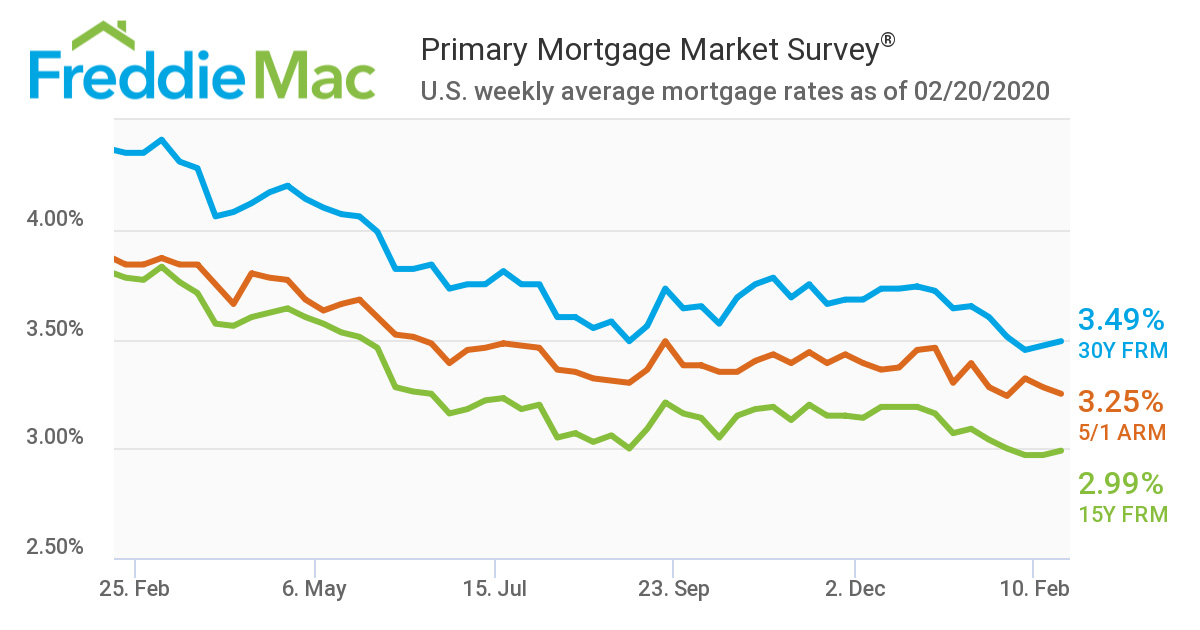

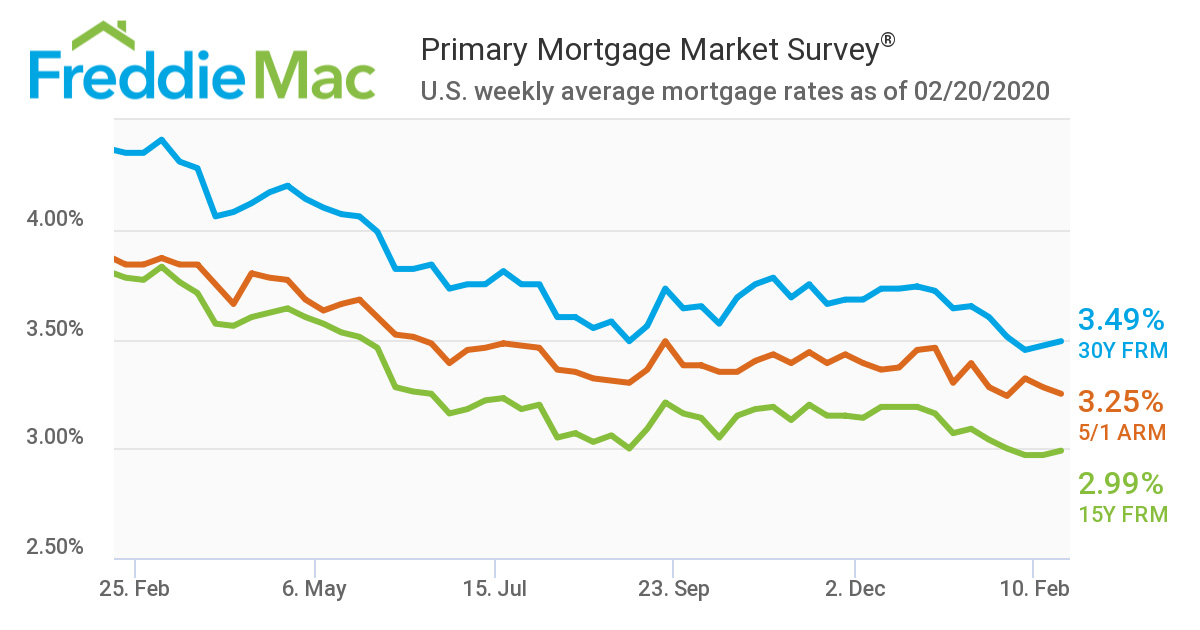

According to Freddie Mac's latest Primary Mortgage Market Survey, the 30-year fixed-rate mortgage in the U.S. averaged 3.49 percent in mid-February 2020.

"The low mortgage rate environment continues to spur homebuying activity, with applications to purchase a home up fifteen percent from a year ago," said Sam Khater, Freddie Mac's Chief Economist. "We've seen new residential construction surge over the last few months, on pace to reach the highest level in more than a decade. This is a good sign for the inventory-starved housing market and is a promising indication for the spring homebuying season."

Freddie Mac News Facts

"The low mortgage rate environment continues to spur homebuying activity, with applications to purchase a home up fifteen percent from a year ago," said Sam Khater, Freddie Mac's Chief Economist. "We've seen new residential construction surge over the last few months, on pace to reach the highest level in more than a decade. This is a good sign for the inventory-starved housing market and is a promising indication for the spring homebuying season."

Freddie Mac News Facts

- 30-year fixed-rate mortgage averaged 3.49 percent with an average 0.7 point for the week ending February 20, 2020, slightly up from last week when it averaged 3.47 percent. A year ago at this time, the 30-year FRM averaged 4.35 percent.

- 15-year fixed-rate mortgage averaged 2.99 percent with an average 0.8 point, slightly up from last week when it averaged 2.97. A year ago at this time, the 15-year FRM averaged 3.78 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.25 percent with an average 0.2 point, down from last week when it averaged 3.28 percent. A year ago at this time, the 5-year ARM averaged 3.84 percent.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More