The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

Veteran Real Estate Economist Reacts to Slow Q4 GDP Growth in U.S.

Residential News » Washington D.C. Edition | By Monsef Rachid | January 30, 2017 8:00 AM ET

The National Association of Realtors Chief Economist Lawrence Yun issued the following statement in reaction to this past Friday's U.S. Department of Commerce report on Gross Domestic Product (GDP) in the fourth quarter of 2016:

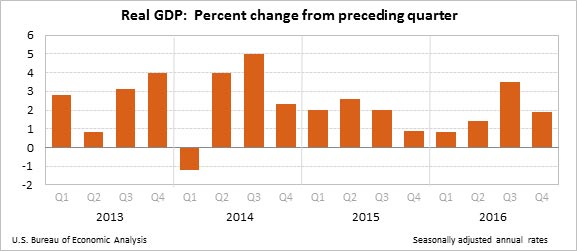

"The economic growth of 1.9% in the final quarter was again a slow grind producing no excitement. For the year as a whole, growth was only 1.6%, marking the 11th consecutive year of subpar expansion under the long-term historic average of 3% growth. The multiple years of slow growth is the chief reason why the real middle income has not been rising.

"As for the latest quarter, private sector commercial construction activity fell, as well as exports and military spending. On the positive side, consumers did their part with a near 3% growth in spending and residential construction and modeling spending rose by a solid 10%. Business spending, after being stuck near zero for a while, kicked higher by 4%.

"Looking ahead, as long as the real estate sector continues to expand, the economy should avoid a recession. Should the animal spirit revive in the business community, a stronger 3% GDP growth should be attainable. However, should exports and imports both consistently decline, then based on past data and experience, the economy could slip into a recession."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

5,300,000 CAD

Home For Sale

Mission, Canada

$1,350,000

Vacation Villas For Sale

Isla Mujeres, Mexico

$2,800,000

Commercial New Construction For Sale

General Luna, Philippines

$2,495,000

Condo For Sale

Boca Raton, Florida

$2,500,000

Mixed-Use Land For Sale

Von Ormy, Texas

$1,350,000

Mixed Use For Sale

Huaraz, Peru

$1,400,000

Vacation Villas For Sale

Lowlands, Trinidad and Tobago

$1,475,000

Townhome For Sale

Phoenix, Arizona

$740,000

Home For Sale

West Palm Beach, Florida

49,000,000 THB

Villa For Sale

Hua Hin, Thailand

$750,000

Mixed Use For Sale

Corozal, Belize

$350

Home For Rent

Lake Arrowhead, California

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October

Reader Poll

In 2025, which region of the world are you most likely to buy or invest in real estate?