Residential Real Estate News

Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

Residential News » Washington D.C. Edition | By Michael Gerrity | March 18, 2025 8:50 AM ET

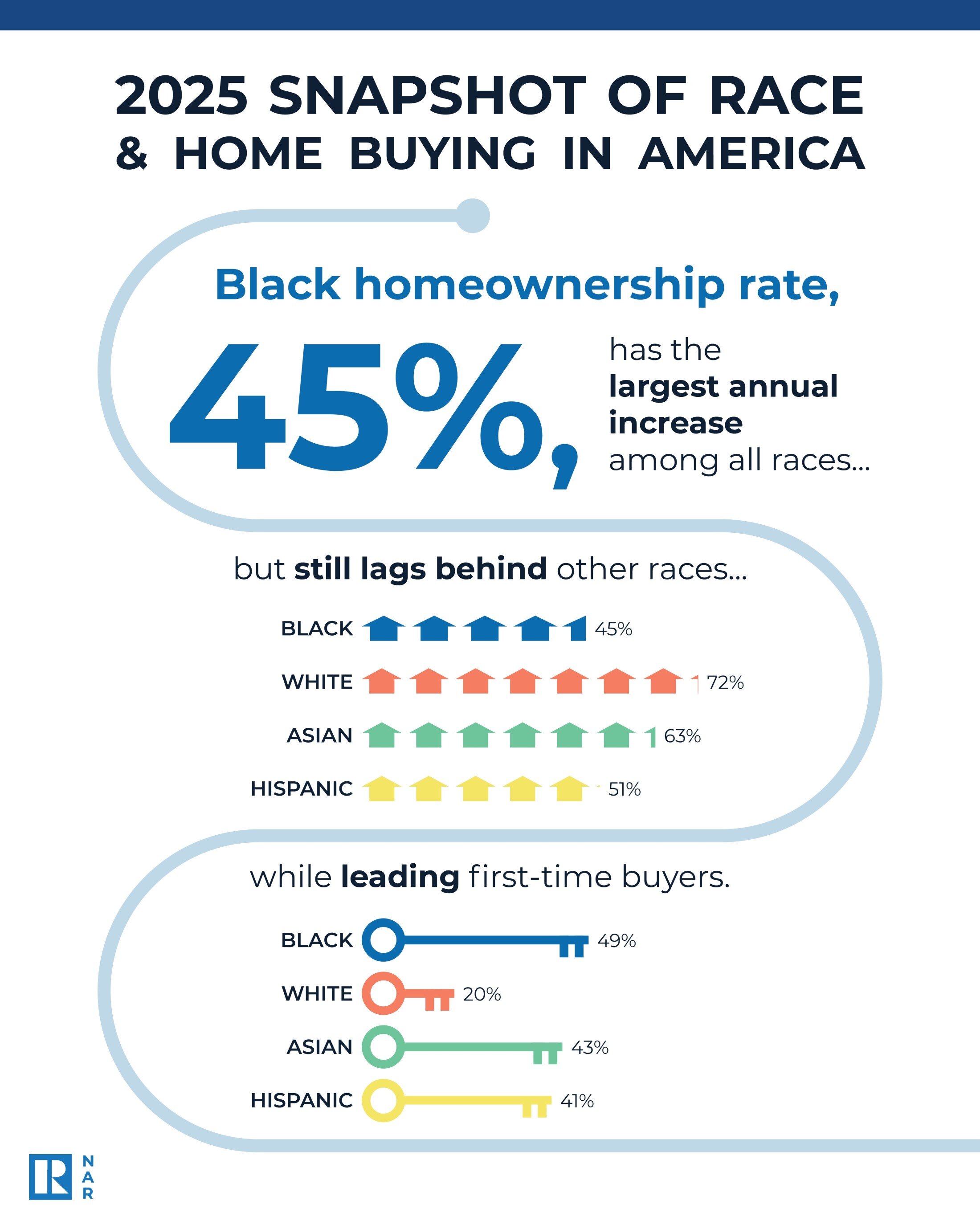

The National Association of Realtors' 2025 Snapshot of Race and Home Buying in America reports that Black homeownership in the U.S. saw the highest year-over-year increase among racial groups in 2023. However, the Black homeownership rate continues to lag significantly behind that of White homeowners.

This real estate market intelligence report provides insight into who is entering the housing market and examines how demographics, affordability, and access to financing influence homeownership trends among different racial and ethnic groups. It also explores homeownership rates across all 50 states and the District of Columbia. Using data from NAR's 2024 Profile of Home Buyers and Sellers, the report analyzes buyer demographics, purchase motivations, property types, and financial profiles, with a specific focus on racial disparities.

"This report offers a deeper understanding of how racial and ethnic groups engage with the housing market," said Jessica Lautz, NAR deputy chief economist and vice president of research. "By delivering detailed local insights into both challenges and successes, it helps industry professionals navigate these dynamics effectively."

In 2023, the Black homeownership rate reached 44.7%, reflecting a 0.6 percentage point increase--the highest annual gain among all racial groups. However, it remains significantly lower than the rates for White (72.4%; +0.1 percentage points), Asian (63.4%; +0.1 percentage points), and Hispanic (51.0%; -0.1 percentage points) homeowners.

Despite persistent affordability challenges, overall U.S. homeownership rose to 65.2% in 2023, up from 63.5% in 2013, representing approximately 11.8 million additional homeowners over the past decade. Notably, the homeownership rate rebounded in 2023 following a decline in 2022.

Hispanic Americans experienced the most significant homeownership growth since 2013, with a 5.8 percentage point increase, adding 3.5 million homeowners. They were followed by Asian (+5.6 percentage points, +1.6 million homeowners), White (+3.6 percentage points, +702,200 homeowners), and Black Americans (+2.8 percentage points, +1.2 million homeowners). However, the Black-White homeownership gap has widened since 2013, now standing at 28 percentage points.

Key demographic shifts include a rise in homeownership among younger households: one in three Hispanic households is within the 25-40 age range, a prime home buying demographic. The number of Asian households in this age group has increased by 34% since 2013, while Hispanic households in Hispanic communities have grown by 21% over the past decade.

Housing affordability remains a challenge, with nearly half of renters allocating over 30% of their income to rent. In 46 states, Black renters face greater affordability struggles than White renters. Additionally, Black homeowners experience higher housing cost burdens in 39 states, often spending more than 30% of their income on housing expenses.

Mortgage approval disparities persist, with Black (21%) and Hispanic (17%) applicants facing significantly higher denial rates than White (11%) and Asian (9%) applicants.

"Today's first-time buyers continue to face affordability and credit-access hurdles, but purchasing power varies across different regions," Lautz noted. "Beyond the mortgage, buyers must also consider total housing costs--including utilities, insurance, and commuting expenses--which are critical factors for new homeowners."

The median annual homeowners insurance cost has surged from $860 in 2013 to $1,310 in 2023--a 53% increase. Among racial groups, Black homeowners pay the highest insurance costs at $1,360, followed by Asian ($1,330), White ($1,310), and Hispanic ($1,300) homeowners.

According to NAR's 2024 Profile of Home Buyers and Sellers, White buyers (83%) comprised the largest share of total home purchases, followed by Black (7%), Hispanic (6%), Asian (4%), and Other (3%) buyers. Among first-time homebuyers, 49% were Black, 43% Asian, 41% Hispanic, and 20% White.

"Non-White homebuyers are more likely to be first-time buyers," Lautz added, "which highlights how shifting demographics and the age distribution of local populations will drive increased homeownership among non-White buyers in the years ahead."

Regarding down payments, Black homebuyers were the most likely to rely on 401(k)/pension withdrawals (11%) and community/government assistance programs (5%). Asian buyers had the highest median down payment at 21%, followed by White buyers at 19%.

Student loan debt remains a burden, with 42% of Black buyers (up from 41% last year) and 23% of Hispanic buyers (down from 29%) carrying student loans. Black and White buyers had the highest median student loan balances at $30,000.

Discrimination remains a concern, with 47% of Black buyers and 33% of Asian buyers reporting bias in loan product offerings. Additionally, 5% of Black and Asian buyers, and 2% of Hispanic buyers, experienced race-based discrimination during their home buying process.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

- Meet HAL, Real Estate Agent of the Future

- U.S. Homes Are Selling at Slowest Pace in 5 Years in Early 2025

- Pending Home Sales Dive Across America in December

- Greater Miami Residential Sales Uptick 3 Percent Annually in 2024

- U.S. Mortgage Applications Downtick in late January

- Under Biden, 2024 Marked the Slowest U.S. Home Sales Period in 30 Years

- Single-family Rent Growth in U.S. Slows to Lowest Rate in 14 Years

- Housing Starts Spike 15 Percent in America in Late 2024

- Day One: Trump Issues Executive Order on Emergency Price Relief for U.S. Housing

- 89 Percent of Homes Destroyed by Los Angeles Fires Were Single-Family Residences

- New AI-Powered Global Listings Service Under Construction

- World Property Media to Commence Industry Funding Round to Launch WPC TV

- Mortgage Rates in America Above 7 Percent, Again

- U.S. Residential Foreclosures Dip 10 Percent Annually in 2024

- U.S. Residential Asking Rents End 2024 at Lowest Levels in 3 Years

- World Property Markets to Commence Industry-wide Joint Venture Fundraise

- One Third of U.S. Homeowners Say They Will Never Sell

- Catastrophic Wildfires Devastating Tens of Billions of Dollars of Southern California Properties