Residential Real Estate News

America's March 2024 Inflation Data Is Very Bad, Says NAR Chief Economist

Residential News » Washington D.C. Edition | By Michael Gerrity | April 11, 2024 8:24 AM ET

U.S. Consumer Prices Rose 3.5 Percent in March, Hotter Than Expected

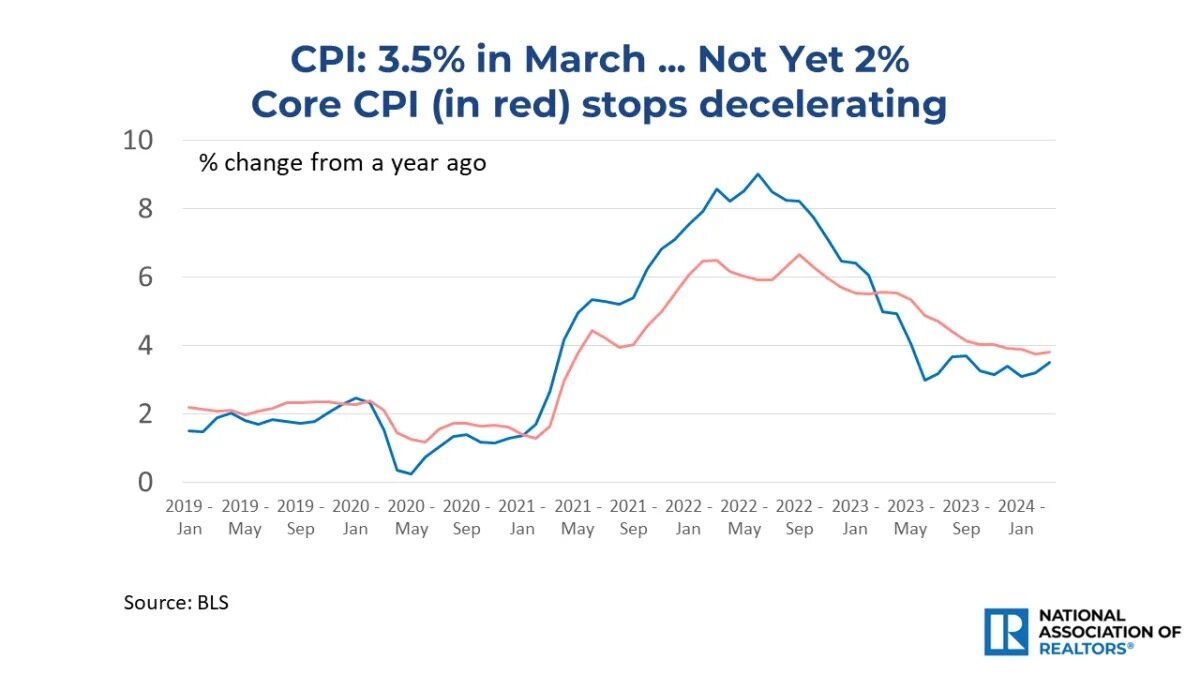

The Consumer Price Index (CPI) experienced a more rapid increase than anticipated in March 2024, driving up inflation and diminishing the likelihood of the Federal Reserve reducing interest rates in the near future.

As a comprehensive gauge of the cost of goods and services throughout the economy, the CPI climbed by 0.4% over the month. This uptick positioned the annual inflation rate at 3.5%, marking a 0.3 percentage point increase from February, according to data from the Labor Department's Bureau of Labor Statistics released on Wednesday. This exceeded the expectations of economists polled by Dow Jones, who had predicted a monthly rise of 0.3% and an annual rate of 3.4%.

When looking at the core CPI, which excludes the often-fluctuating prices of food and energy, there was also a 0.4% increase on a monthly basis and a 3.8% increase from the previous year. These figures surpassed the forecasts, which had been set at a 0.3% monthly and a 3.7% yearly increase.

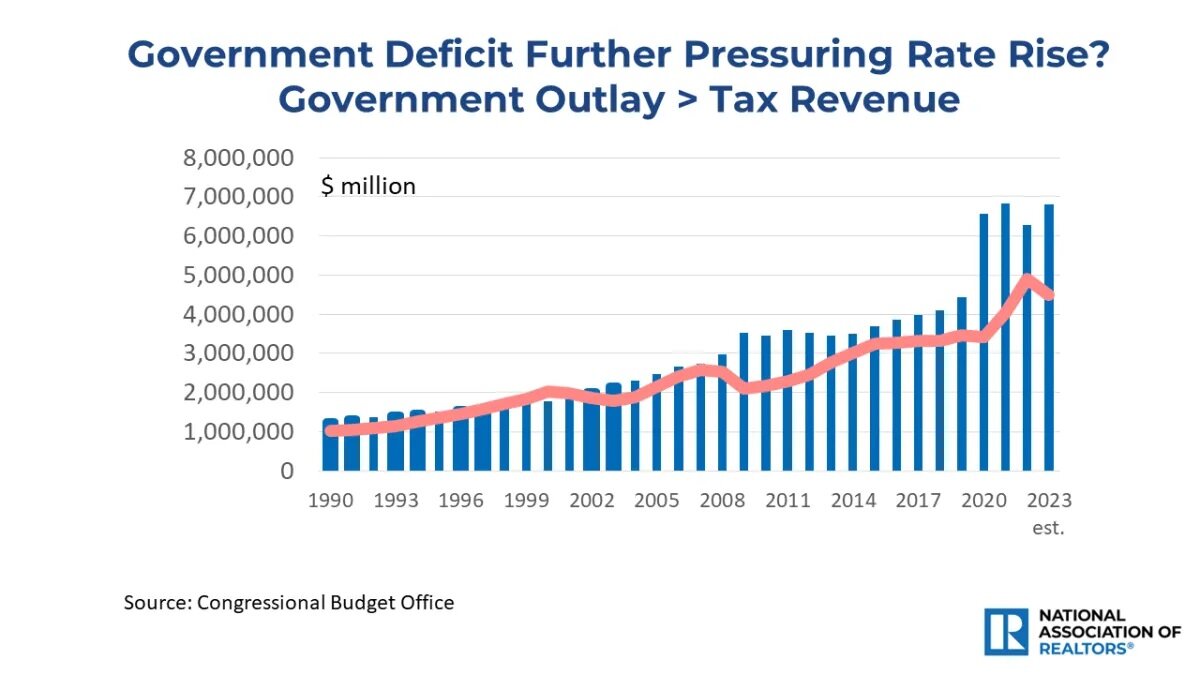

The National Association of Realtors chief economist Lawrence Yun commented on March's CPI data saying, "March 2024 inflation figures were very bad, which also means bad news for interest rates. Consumer prices reaccelerated to 3.5%. This is higher than the 2% target inflation, which raises eyebrows regarding the Federal Reserve's delay in cutting interest rates. The bond market immediately responded with high yields to compensate for the loss in purchasing power. Mortgage rates, unfortunately, will move a notch higher and are likely to cross above 7% in the upcoming weeks. In addition, the gigantic federal budget deficit will soak up more borrowing, thereby leaving less for mortgage borrowing."

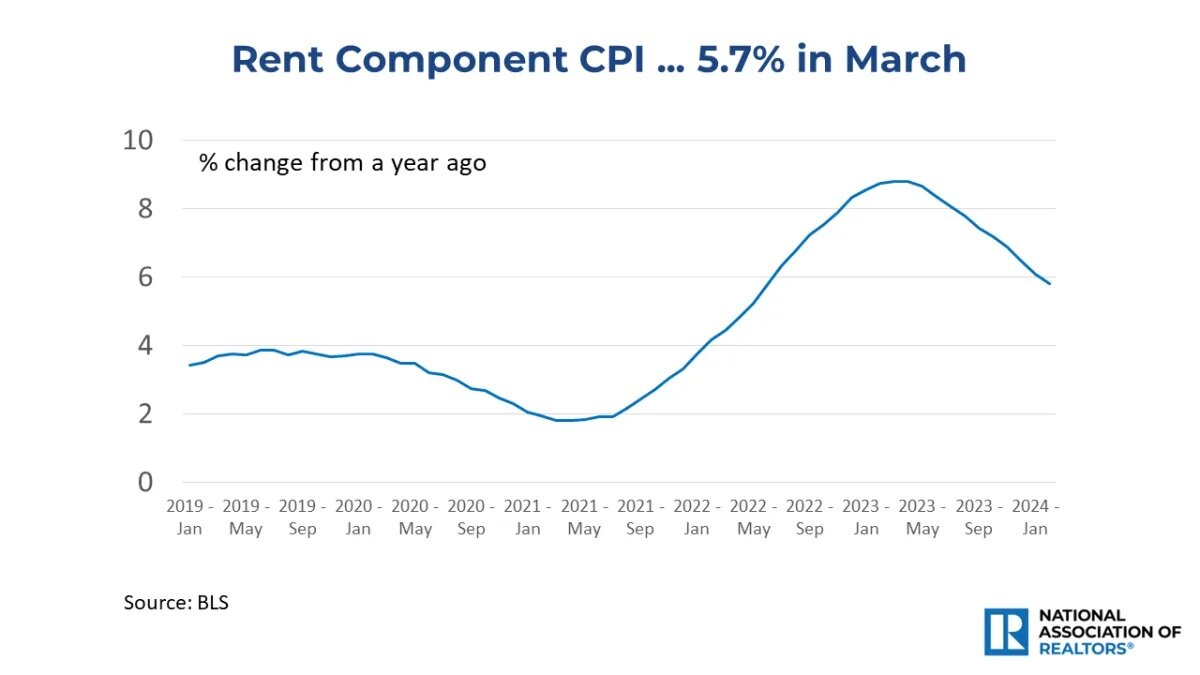

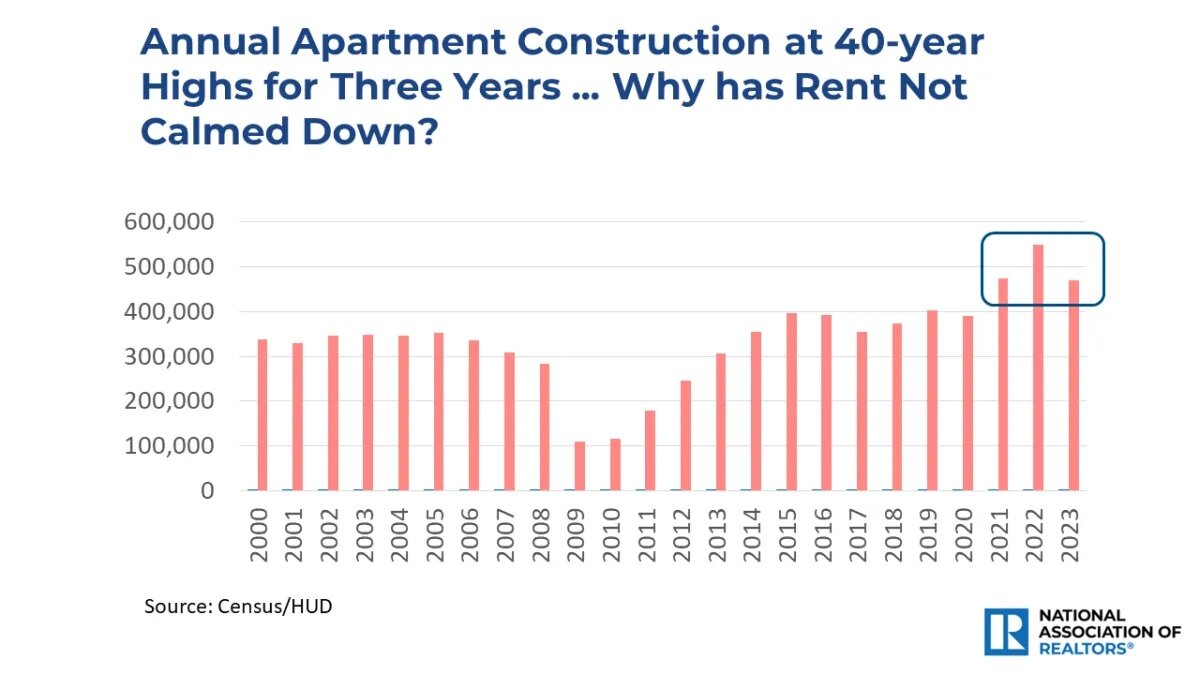

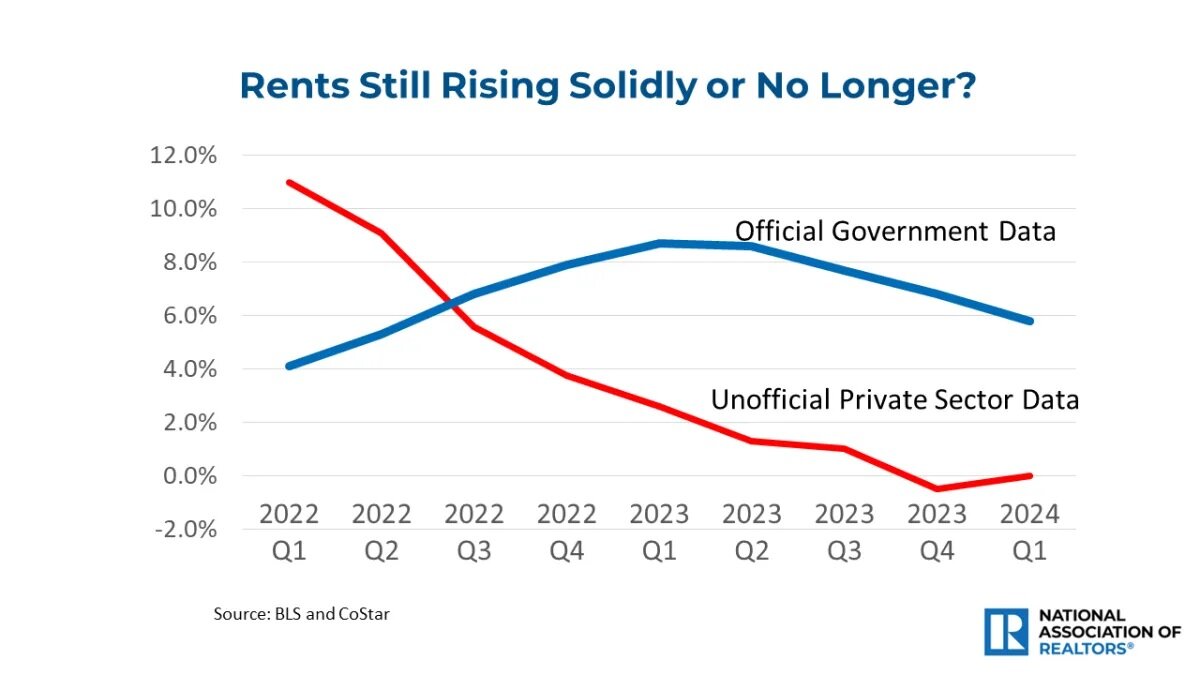

"One strange data point is rent, which the official data shows at 5.8%. The unofficial data from the apartment industry indicates falling rent due to over-construction. If rent data calms, then overall inflation will automatically be lower. It is, therefore, possible to get to the 2% inflation target by year's end, even with bumps and delays", concludes Yun.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October