Residential Real Estate News

U.S. Mortgage Rates Rise Again, Approaching 7 Percent in February

Residential News » Washington D.C. Edition | By Monsef Rachid | February 24, 2023 8:47 AM ET

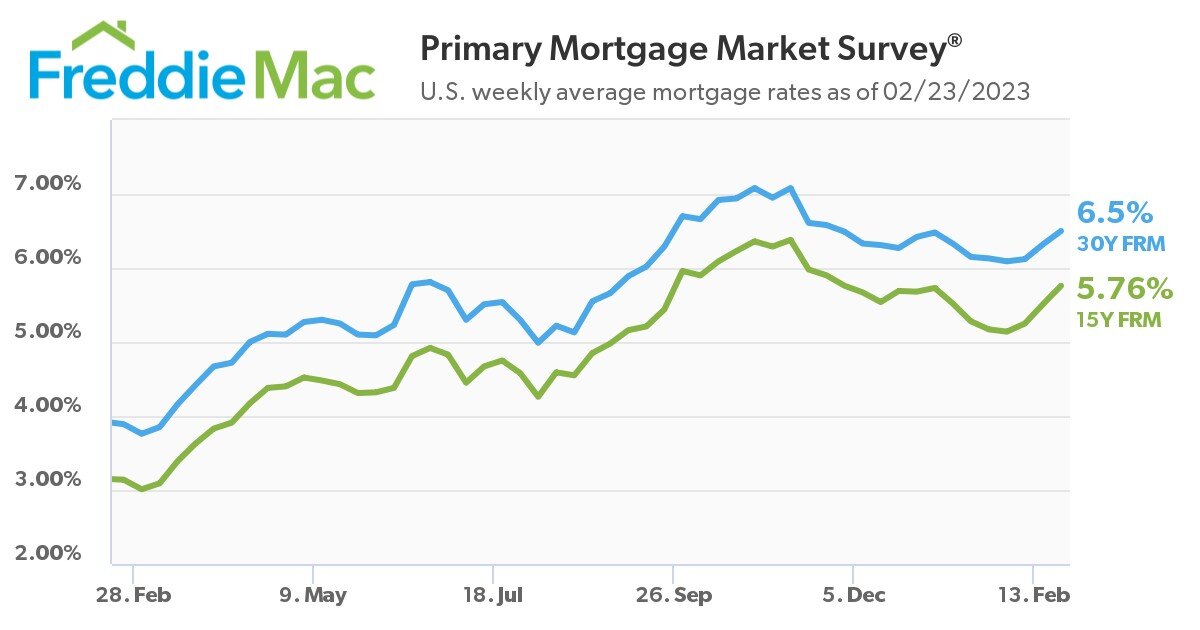

According to Freddie Mac's latest Primary Mortgage Market Survey, the 30-year fixed-rate mortgage (FRM) averaged 6.50 percent in the U.S. as of February 23, 2023.

"The economy continues to show strength, and interest rates are repricing to account for the stronger than expected growth, tight labor market and the threat of sticky inflation," said Sam Khater, Freddie Mac's Chief Economist. "Our research shows that rate dispersion increases as mortgage rates trend up. This means homebuyers can potentially save $600 to $1,200 annually by taking the time to shop among lenders to find a better rate."

Freddie Mac News Facts

- 30-year fixed-rate mortgage averaged 6.50 percent as of February 23, 2023, up from last week when it averaged 6.32 percent. A year ago at this time, the 30-year FRM averaged 3.89 percent.

- 15-year fixed-rate mortgage averaged 5.76 percent, up from last week when it averaged 5.51 percent. A year ago at this time, the 15-year FRM averaged 3.14 percent.

Nadia Evangelou, NAR senior economist and director of real estate research said, "Mortgage rates increased further this week, following the bond market trend. According to Freddie Mac, the average rate on a 30-year fixed mortgage rose to 6.50% from 6.32% the previous week. Even with this increase, owning a home is still affordable for Americans if they can put 20% down. The monthly mortgage payment is $1,880 for a median-priced home. Despite higher mortgage rates, the homeownership rate rose in 2022."

Evangelou further commented, "Even though many buyers were priced out due to historic low affordability, more Americans were able to become homeowners. There were about 1.6 million more homeowners in 2022 than the previous year. While many existing homeowners opt to stay put due to higher rates, some renters were able to purchase a home amid rising affordability challenges. Historically speaking, the homeownership rate continues to be below the pre-recession peak of 69.2% (in 2004) but is still above the historical average of 65.6%. With mortgage rates projected to stabilize below 6% in the second half of the year, more Americans will likely become homeowners, boosting the homeownership rate this year as well."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years