Residential Real Estate News

The Federal Reserve Makes Biggest Rate Cut in 16 Years in September

Residential News » Washington D.C. Edition | By Michael Gerrity | September 19, 2024 6:45 AM ET

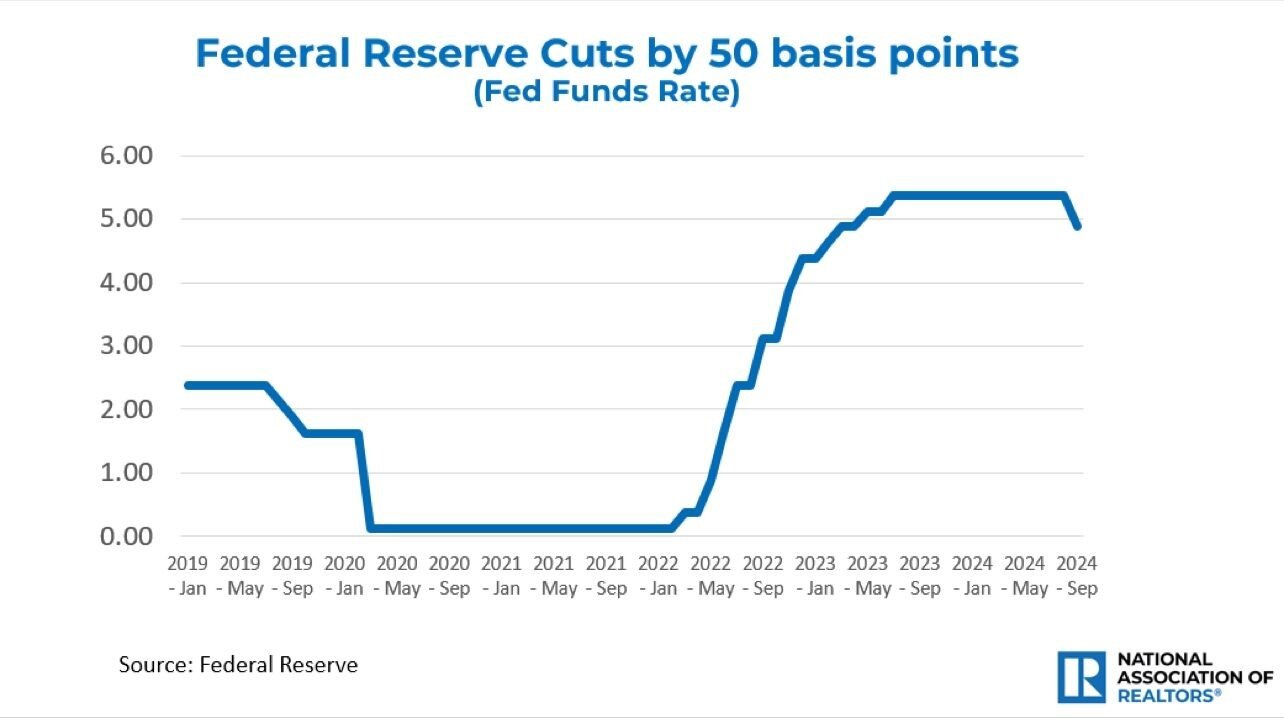

This week the Federal Reserve did follow through with its much-anticipated interest rate reduction as expected by many Wall Street analysts.

On September 18, 2024, the central bank approved a fifty-basis rate cut, marking its first reduction since the pandemic, and the largest single rate cut in 16 years.

In response, mortgage rates started declining ahead of the Fed's decision, giving a boost to the residential housing market.

The National Association of Realtors chief economist Lawrence Yun commented on the Federal Reserve's rate cut move saying, "The Fed's half-point rate cut decision is the beginning of six to eight rounds of further rate cuts well into 2025. The very next cut will occur after the presidential election. The justification is cooling inflation in recent months and lighter job gains. Mortgage rates have already anticipated the Fed's likely path. That is why the 30-year rate has fallen by 150 basis points from early in the year to today. Any further decline in mortgage rates will be minimal. The Fed does not directly control mortgage rates, and the federal budget deficit is huge. Future Fed rate cuts are not only anticipated but will not be as impactful because large federal borrowing will leave less capital available for mortgage lending. Due to the already low mortgage rates compared to spring, the purchasing power for home buyers has been lifted by around $50,000 for those with a $2,000 monthly mortgage payment budget. Consumers who were priced out due to earlier higher mortgage rates could now be back in the market."

The Mortgage Bankers Association chief economist Mike Fratantoni also commented, "The FOMC lowered rates by 50 basis points at its September meeting and signaled that this is the first cut in a series that should bring rates down by about 2 percentage points by the end of 2025. Market participants had been divided about how much the Fed would cut at its meeting today, so this decision is likely to spur some rate volatility as investors adjust to this expected path for monetary policy. Governor Bowman dissented from this decision, preferring a 25-basis-point cut, but it seems that the rest of the Committee is more worried about the weakening job market.

"The FOMC projections highlighted that inflation is returning to target more quickly than the Committee had expected in June and that the unemployment rate has moved higher and is likely to stay higher than expected. While not likely to be in a recession, the U.S. economy is likely in for a period of slower economic growth. It is also important to note that the FOMC's estimates of the neutral fed funds rates keeps moving up, and that the committee members see a range of outcomes, from 2.5-3.5% as consistent with neutral in the long run.

"The Fed's MBS holdings have continued to gradually decline with QT. While there are no changes to the pace of QT with this statement, faster refinances will result in the MBS portfolio paying off more quickly as prepayments have been well below the cap since the beginning of QT.

"Mortgage rates likely had this cut - and this expected rate path - priced in, and lower mortgage rates, now close to 6%, have resulted in much more refinance and some additional purchase activity in recent weeks. We do expect that if mortgage rates remain near these levels, it will support a stronger than typical fall housing market and suggest that next spring could see a real rebound in activity."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Mortgage Demand Spikes 20 Percent in Early April as Rates Drop

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024