Residential Real Estate News

Majority of U.S. Voters Say Housing Affordability Affects Their Pick for President in 2024

Residential News » Washington D.C. Edition | By Michael Gerrity | March 13, 2024 8:18 AM ET

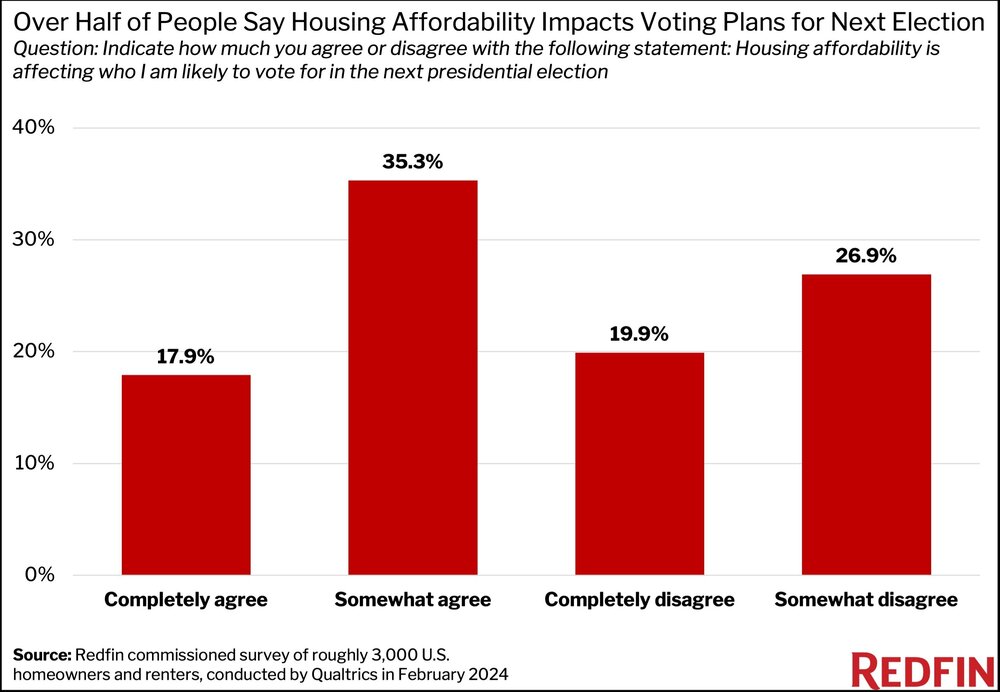

Based on new research by national property broker Redfin, more than half (53.2%) of U.S. homeowners and renters say housing affordability is impacting who they plan to vote for in the upcoming 2024 presidential election.

The findings are from a Redfin-commissioned survey conducted by Qualtrics in February 2024. The nationally representative survey was fielded to roughly 3,000 U.S. homeowners and renters.

"Housing affordability is top of mind for voters because elevated mortgage rates and home prices, along with an acute housing shortage, have pushed the dream of homeownership out of reach for many Americans," said Redfin Chief Economist Daryl Fairweather. "While the economy is strong on paper, a lot of families aren't feeling the benefits because they're struggling to afford the house they want or already live in. As a result, many feel stuck, unable to make their desired moves and life upgrades."

In addition, nearly two-thirds (64.2%) of homeowners and renters say housing affordability makes them feel negative about the economy.

President Biden last week unveiled a number of initiatives aimed at making housing more affordable. His proposal includes tax credits for first-time buyers and sellers of starter homes, along with a plan to build more than 2 million new homes.

"What the housing market needs most to address the affordability crisis is more supply," said Fairweather. "If 2 million homes are actually built over the next several years like President Biden is proposing, that's where the rubber will meet the road in addressing housing affordability."

Speaking at an event in Iowa last year, former President Trump laid out his own strategy to break the consumer gridlock in the nation's persistently competitive and expensive housing market. Trump said his plan was to: "First, cut energy costs. Then, cut interest rates. Then, the economy will improve."

Based on a transcript from that event President Trump further commented, "We'll get energy prices way down, then the interest rates down, then home builders will start building again -- because nobody can afford to get money from banks now because of high interest rates."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years