Residential Real Estate News

U.S. Mortgage Rates Continue to Climb in Early May, Fifth Consecutive Week

Residential News » Washington D.C. Edition | By David Barley | May 6, 2024 8:00 AM ET

Right in the middle of prime springtime home buying season

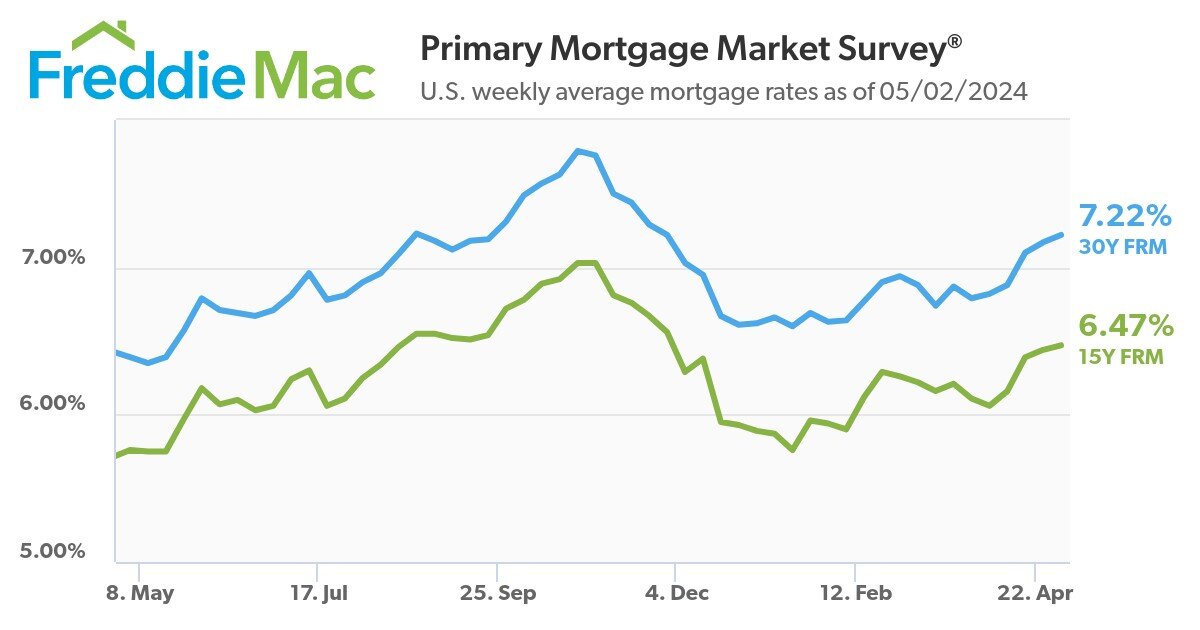

Based on the most recent survey from Freddie Mac's Primary Mortgage Market Survey, the average rate for a 30-year fixed-rate mortgage in the U.S. stood at 7.22 percent as of May 2, 2024.

"The 30-year fixed-rate mortgage increased for the fifth consecutive week as we enter the heart of Spring Homebuying Season," said Sam Khater, Freddie Mac's Chief Economist. "On average, more than one-third of home sales for the entire year occur between March and June. With two months left of this historically busy period, potential homebuyers will likely not see relief from rising rates anytime soon. However, many seem to have acclimated to these higher rates, as demonstrated by the recently released pending home sales data coming in at the highest level in a year."

Freddie Mac News Facts

- The 30-year FRM averaged 7.22 percent as of May 2, 2024, up from last week when it averaged 7.17 percent. A year ago at this time, the 30-year FRM averaged 6.39 percent.

- The 15-year FRM averaged 6.47 percent, up from last week when it averaged 6.44 percent. A year ago at this time, the 15-year FRM averaged 5.76 percent.

Last Wednesday, the Federal Reserve stressed that inflation has remained persistently high in recent months and indicated it has no intention to lower interest rates until it has "greater confidence" that price increases are slowing down sustainably toward its 2% target.

The Fed made this announcement following its latest meeting, during which it maintained its key rate at approximately 5.3%, its highest level in two decades. Several reports indicating higher-than-expected prices and economic growth have recently challenged the Fed's belief that inflation was gradually easing. The combination of elevated interest rates and ongoing inflation has also emerged as a potential threat to President Joe Biden's re-election bid.

"In recent months," Chair Jerome Powell said at a news conference, "inflation has shown a lack of further progress toward our 2% objective."

"It is likely that gaining greater confidence," he added, "will take longer than previously expected."

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years