Residential Real Estate News

U.S. Mortgage Rates Increase to Highest Levels Since 2019

Residential News » Washington D.C. Edition | By WPJ Staff | March 18, 2022 8:24 AM ET

New Home Purchase Mortgage Applications Slide 3.9 Percent in February

Based on the Mortgage Bankers Association's latest Builder Application Survey data for February 2022, U.S. mortgage applications for new home purchases decreased 3.9 percent compared from a year ago. Compared to January 2022, applications decreased by 1 percent. This change does not include any adjustment for typical seasonal patterns.

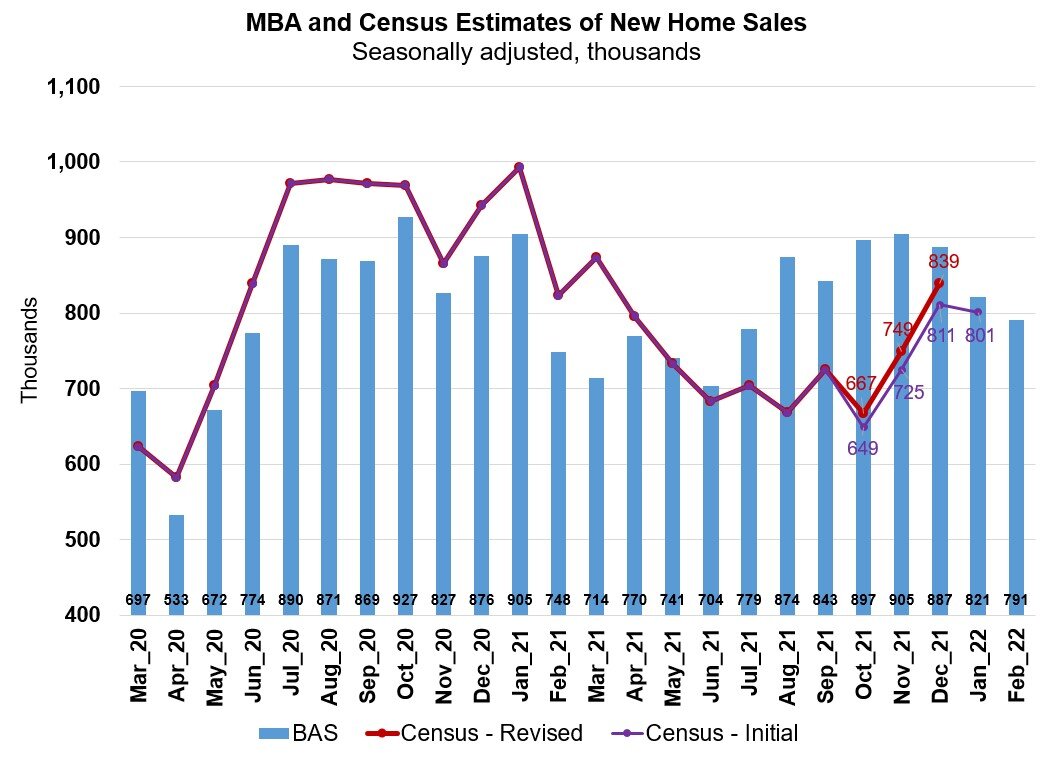

"New home purchase activity slowed in February, as for-sale inventories remained tight, and mortgage rates increased to their highest levels since 2019. February is typically the start of the spring home buying season, but applications to purchase a new home were down on a monthly and annual basis," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "MBA estimates that new home sales declined for the third consecutive month, hitting the lowest sales pace in seven months at 791,000 units. Over the last three months, mortgage rates have increased over 70 basis points, and combined with elevated sales prices, that is putting a weight on purchase activity. The decline in activity was also consistent with somewhat weaker homebuilder sentiment and increased uncertainty for the industry as the crisis in Ukraine has worsened the situation for building material prices and availability."

MBA estimates new single-family home sales were running at a seasonally adjusted annual rate of 791,000 units in February 2022, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The seasonally adjusted estimate for February is a decrease of 3.7 percent from the January pace of 821,000 units. On an unadjusted basis, MBA estimates that there were 66,000 new home sales in February 2022, unchanged from the new home sales level in January.

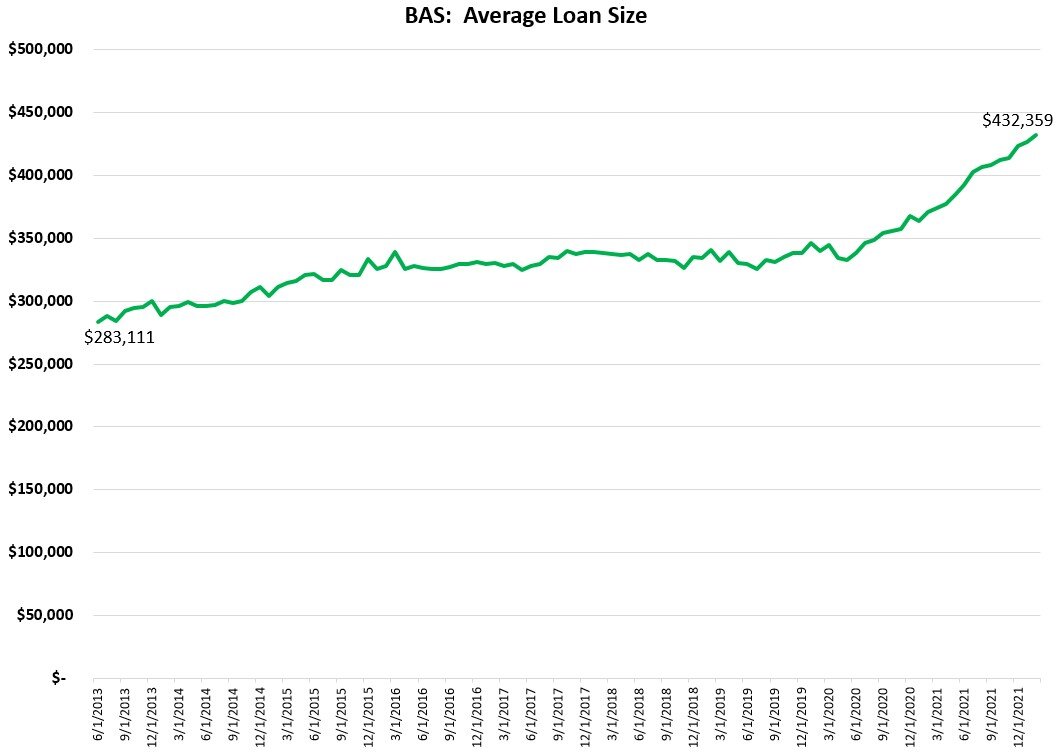

By product type, conventional loans composed 76.9 percent of loan applications, FHA loans composed 12.9 percent, RHS/USDA loans composed 0.3 percent and VA loans composed 9.9 percent. The average loan size of new homes increased from $426,954 in January to $432,359 in February.

MBA's Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country. Utilizing this data, as well as data from other sources, MBA is able to provide an early estimate of new home sales volumes at the national, state, and metro level. This data also provides information regarding the types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In that data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October