Residential Real Estate News

U.S. Mortgage Application Payments Spike $513 in 2022

Residential News » Washington D.C. Edition | By WPJ Staff | June 24, 2022 8:50 AM ET

According to the Mortgage Bankers Association's latest Purchase Applications Payment Index, U.S. homebuyer affordability was mostly unchanged in May 2022, with the national median payment applied for by applicants up slightly to $1,897 from $1,889 in April.

"The ongoing affordability hit of higher home prices and fast-rising mortgage rates led to a slowdown in purchase applications in May. While the median principal and interest payment only increased $8 from April, a typical borrower is paying $514 more through the first five months of 2022 - a jump of 37.1%," said Edward Seiler, MBA's Associate Vice President, Housing Economics, and Executive Director, Research Institute for Housing America. "Inflationary pressures and rates above 5 percent are both headwinds for the housing market in the coming months. MBA's new forecast anticipates that sales of new and existing homes will fall below 2021 levels."

An increase in MBA's PAPI - indicative of declining borrower affordability conditions - means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI - indicative of improving borrower affordability conditions - occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

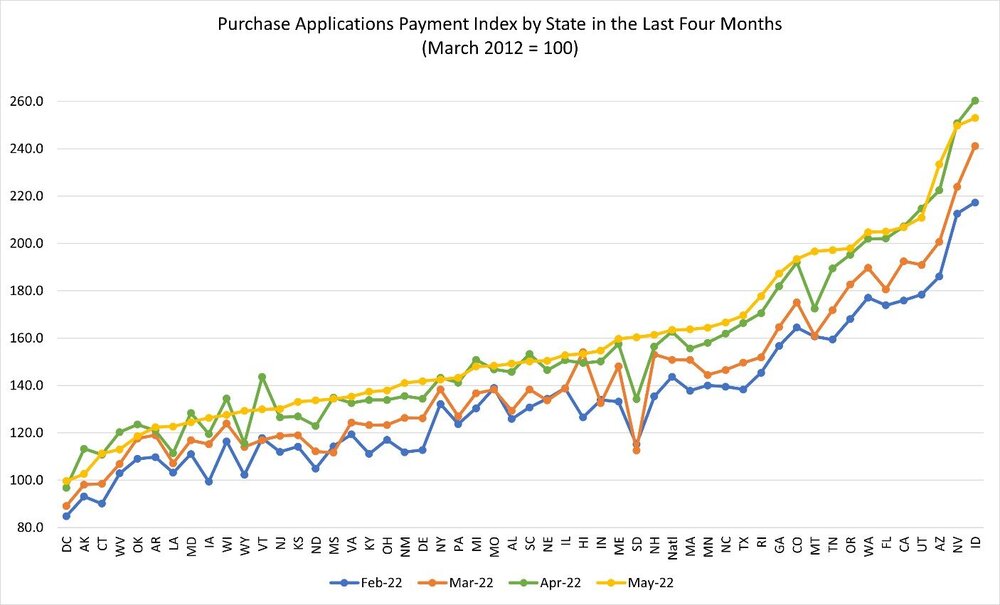

The national PAPI (Figure 1) increased 0.4 percent to 163.4 in May from 162.8 in April, meaning payments on new mortgages take up a larger share of a typical person's income. Compared to May 2021 (120.6), the index jumped 35.5 percent. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased 0.36 percent to $1,241 from $1,236 in April.

Additional Key Findings of MBA's Purchase Applications Payment Index (PAPI) - May 2022

- The national median mortgage payment was $1,897 in May, up from $1,889 in April and $1,736 in March. Payments have increased $513 (37.1%) in the first five months of the year.

- The national median mortgage payment for FHA loan applicants was $1,430 in May, up from $1,374 in April and $1,005 in May 2021.

- The national median mortgage payment for conventional loan applicants was $1,960, down from $1,967 in April but up from $1,394 in May 2021.

- The top five states with the highest PAPI were: Idaho (253.0), Nevada (249.7), Arizona (233.5), Utah (210.9), and California (206.9).

- The top five states with the lowest PAPI were: Washington, D.C. (99.7), Alaska (102.6), Connecticut (111.2), West Virginia (113.0), and Oklahoma (118.5).

- Homebuyer affordability decreased slightly for Black households, with the national PAPI increasing from 165.9 in April to 166.6 in May.

- Homebuyer affordability decreased slightly for Hispanic households, with the national PAPI increasing from 155.8 in April to 156.4 in May.

- Homebuyer affordability decreased slightly for White households, with the national PAPI increasing from 163.6 in April to 164.3 in May.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years