Residential Real Estate News

U.S. Mortgage Delinquency Rate Dips in Q1

Residential News » Washington D.C. Edition | By WPJ Staff | May 9, 2022 8:55 AM ET

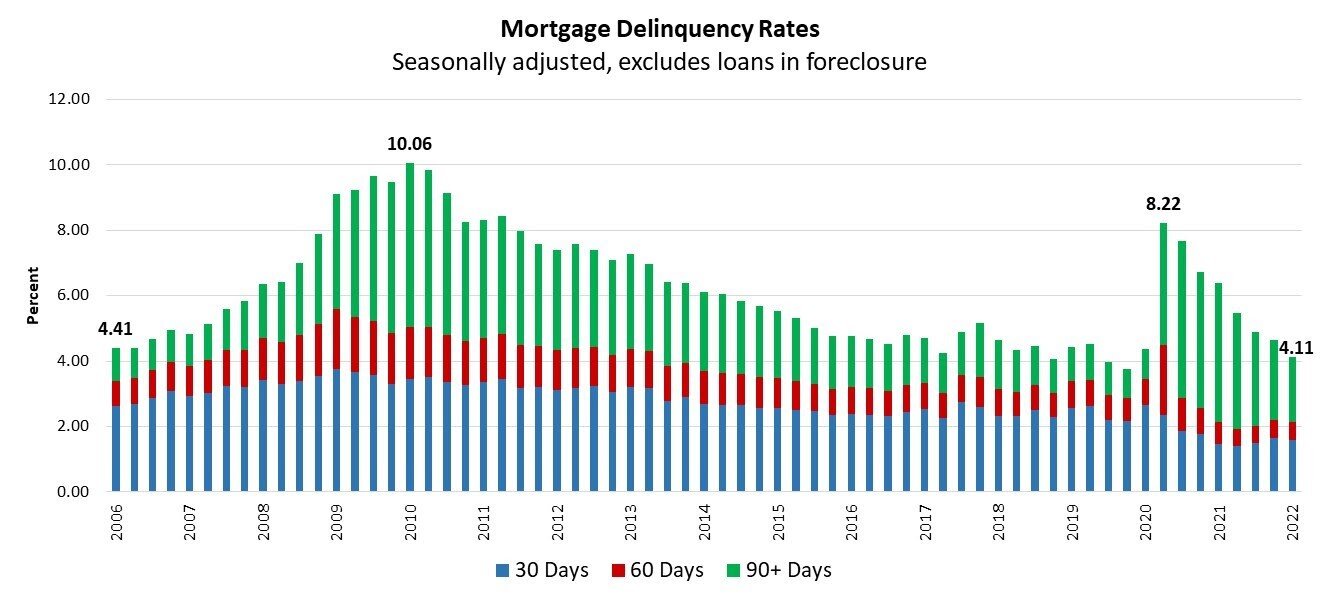

According to the Mortgage Bankers Association's latest National Delinquency Survey, the delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 4.11 percent of all loans outstanding at the end of the first quarter of 2022.

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage. The delinquency rate decreased 54 basis points from the fourth quarter of 2021 and was down 227 basis points from one year ago.

"The mortgage delinquency rate dropped for the seventh consecutive quarter, reaching its lowest level since the fourth quarter of 2019," said Marina Walsh, CMB, MBA's Vice President of Industry Analysis. "The decrease in delinquency rates was apparent across all loan types, and especially for FHA loans. The delinquency rate for FHA loans declined 118 basis points from fourth-quarter 2021 and was down 509 basis points from one year ago."

According to Walsh, most of the improvement in loan performance can be attributed to the movement of loans that were 90-days or more delinquent. The majority of these aged delinquencies were either cured or entered post-forbearance loan workouts.

The expiration of pandemic-related foreclosure moratoriums led to a modest increase in foreclosure starts from the record lows maintained over the past two years. At 0.19 percent, the foreclosure starts rate remains below the quarterly average of 0.41 percent dating back to 1979.

Added Walsh, "Given the nation's limited housing inventory and the variety of home retention and foreclosure alternatives on the table across various loan types, the probability of a significant foreclosure surge is minimal. Borrowers have more choices today to either stay in their homes or sell without resorting to foreclosure."

Key Findings of Q1 National Delinquency Survey

- Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 6 basis points to 1.59 percent, the 60-day delinquency rate remained unchanged at 0.56 percent, and the 90-day delinquency bucket decreased 48 basis points to 1.96 percent.

- By loan type, the total delinquency rate for conventional loans decreased 55 basis points to 3.03 percent over the previous quarter - the lowest level since the fourth quarter of 2019. The FHA delinquency rate decreased 118 basis points to the lowest level since the fourth quarter of 2019 (9.58 percent), and the VA delinquency rate decreased by 38 basis points to 4.86 percent - the lowest level since the first quarter of 2020.

- On a year-over-year basis, total mortgage delinquencies decreased for all loans outstanding. The delinquency rate decreased by 154 basis points for conventional loans, decreased 509 basis points for FHA loans, and decreased 276 basis points for VA loans.

- The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the first quarter was 0.53 percent, up 11 basis points from the fourth quarter of 2021 and down 1 basis point from one year ago. The percentage of loans on which foreclosure actions were started in the first quarter rose by 15 basis points to 0.19 percent. The foreclosure starts rate remains below the quarterly average of 0.41 percent dating back to 1979.

- The non-seasonally adjusted seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 2.39 percent. It decreased by 44 basis points from last quarter and decreased by 231 basis points from last year. This is the lowest seriously delinquent rate since first-quarter 2020. The seriously delinquent rate decreased 26 basis points for conventional loans, decreased 115 basis points for FHA loans, and decreased 67 basis points for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased by 155 basis points for conventional loans, decreased 567 basis points for FHA loans, and decreased 244 basis points for VA loans.

- The five states with the largest quarterly decreases in their overall delinquency rate were: Louisiana (168 basis points), New Jersey (109 basis points), Indiana (105 basis points), Mississippi (97 basis points), and Maryland (97 basis points).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years