Residential Real Estate News

Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

Residential News » Washington D.C. Edition | By WPJ Staff | February 10, 2025 7:51 AM ET

According to the National Association of Realtors' latest quarterly report, 89% of U.S. metro markets (201 out of 226) saw home price increases in the fourth quarter of 2024. During this period, the 30-year fixed mortgage rate ranged from 6.12% to 6.85%. Notably, 14% of tracked metro areas reported double-digit price gains, up from 7% in the previous quarter.

"Record-high home prices and the accompanying wealth gains are great for property owners," said NAR Chief Economist Lawrence Yun. "However, renters aiming to become homeowners face significant challenges."

Compared to the same period a year ago, the national median price for single-family existing homes rose 4.8% to $410,100, following a 3.2% increase in the previous quarter. Over five years, from 2019 to 2024, median home prices surged by 49.9%.

Among major U.S. regions, the South accounted for the largest share of home sales (45.1%) in the fourth quarter, with prices rising 2.1% year over year. Other regions saw price gains of 10.6% in the Northeast, 8.0% in the Midwest, and 4.0% in the West.

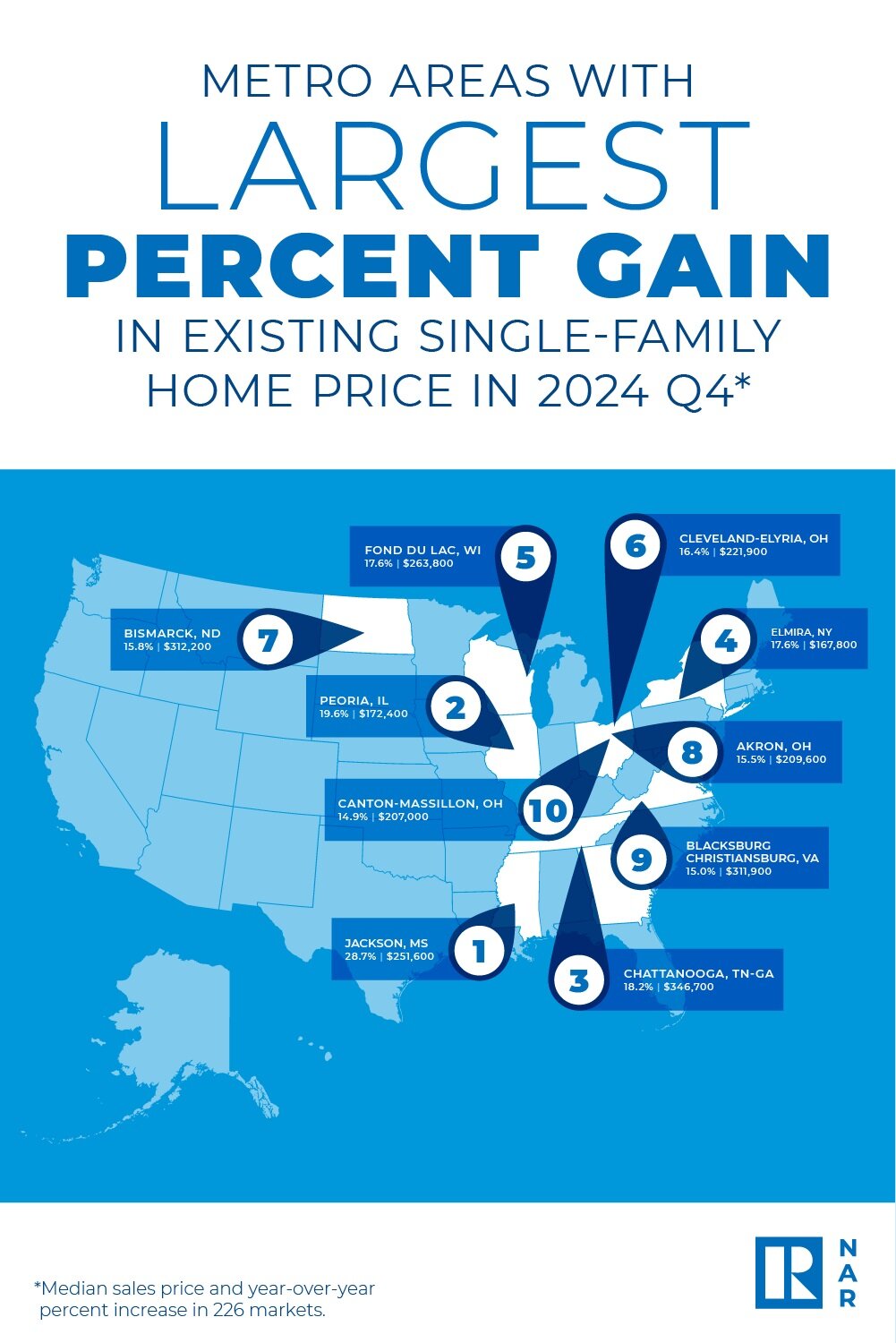

The top 10 metro areas with the highest year-over-year price increases saw gains of at least 14.9%, with six located in the Midwest. Leading markets included:

- Jackson, Miss. (28.7%)

- Peoria, Ill. (19.6%)Chattanooga, Tenn.-Ga. (18.2%)

- Elmira, N.Y. (17.6%)

- Fond du Lac, Wis. (17.6%)

- Cleveland-Elyria, Ohio (16.4%)

- Bismarck, N.D. (15.8%)

- Akron, Ohio (15.5%)

- Blacksburg-Christiansburg, Va. (15.0%)

- Canton-Massillon, Ohio (14.9%)

California remained home to eight of the top 10 most expensive housing markets, led by:

- San Jose-Sunnyvale-Santa Clara, Calif. ($1.92M; 9.7%)

- Anaheim-Santa Ana-Irvine, Calif. ($1.36M; 4.7%)

- San Francisco-Oakland-Hayward, Calif. ($1.32M; 5.2%)

- Urban Honolulu, Hawaii ($1.1M; 3.2%)

- San Diego-Carlsbad, Calif. ($985K; 5.7%)

Despite overall price growth, 24 out of 226 metro areas (11%) experienced home price declines, down from 13% in the previous quarter.

"Workers with the flexibility to relocate may find more affordable housing options given the wide regional price differences," Yun noted.

Housing affordability improved slightly in the fourth quarter. The monthly mortgage payment on a typical home with a 20% down payment fell 0.8% from the previous quarter to $2,124, a 1.7% drop from a year ago. Families spent 24.8% of their income on mortgage payments, down from 25.2% in the previous quarter and 26.5% a year earlier.

First-time buyers also saw minor relief. For a typical starter home priced at $348,600 with a 10% down payment, the monthly mortgage payment dropped to $2,083--a 0.9% decrease from the previous quarter. This reduced the share of income spent on mortgage payments from 38.1% to 37.4%.

To afford a 10% down payment mortgage, a family needed an income of $100,000 or more in 43.8% of metro areas, up slightly from 42.5% in the prior quarter. Meanwhile, only 2.2% of markets required an income under $50,000--unchanged from the previous quarter.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- U.S. Homes Are Selling at Slowest Pace in 5 Years in Early 2025

- Pending Home Sales Dive Across America in December

- Greater Miami Residential Sales Uptick 3 Percent Annually in 2024

- U.S. Mortgage Applications Downtick in late January

- Under Biden, 2024 Marked the Slowest U.S. Home Sales Period in 30 Years

- Single-family Rent Growth in U.S. Slows to Lowest Rate in 14 Years

- Housing Starts Spike 15 Percent in America in Late 2024

- Day One: Trump Issues Executive Order on Emergency Price Relief for U.S. Housing

- 89 Percent of Homes Destroyed by Los Angeles Fires Were Single-Family Residences

- New AI-Powered Global Listings Service Under Construction

- World Property Media to Commence Industry Funding Round to Launch WPC TV

- Mortgage Rates in America Above 7 Percent, Again

- U.S. Residential Foreclosures Dip 10 Percent Annually in 2024

- U.S. Residential Asking Rents End 2024 at Lowest Levels in 3 Years

- World Property Markets to Commence Industry-wide Joint Venture Fundraise

- One Third of U.S. Homeowners Say They Will Never Sell

- Catastrophic Wildfires Devastating Tens of Billions of Dollars of Southern California Properties

- Is Greenland Soon Going to be Trump's Biggest Real Estate Deal?

- Greater Las Vegas Home Sales Jump 19 Percent Annually in December

- Active U.S. Residential Listings Spike 22 Percent in December

- U.S. Mortgage Rates Rise in Early 2025, Reach 6-Month High

- Greater Palm Beach Area Condo, Home Sales Collapse in November

- U.S. Pending Home Sales Increase Four Straight Months in November

- Global Real Estate Podcasts Coming to WPC TV Next Year

- Ireland Home Prices Spike 9 Percent in 2024

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3