Residential Real Estate News

If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

Residential News » Washington D.C. Edition | By David Barley | March 13, 2025 9:00 AM ET

America's National Flood Insurance Program (NFIP) is authorized to operate until 11:59 p.m. on March 14, 2025. To prevent a lapse in the program, Senator John Kennedy introduced a bill (S.824) on March 4, 2025, aiming to extend the NFIP's authorization. This bill is currently under consideration by the Senate Committee on Banking, Housing, and Urban Affairs.

Historically, Congress has enacted multiple short-term extensions to ensure the NFIP's continuity, with 32 such extensions since its last five-year reauthorization expired in 2017. Given this precedent, it is anticipated that Congress will pass the necessary legislation to reauthorize the NFIP before the March 14 deadline, thereby preventing any interruption in the program's operations.

Failure to reauthorize the NFIP by the deadline would result in the program's inability to issue new or renew existing policies, potentially impacting property transactions in flood-prone areas. However, based on past actions and current legislative efforts, it is expected that reauthorization will occur in a timely manner.

Without the National Flood Insurance Program (NFIP), property owners and buyers must depend on the private insurance market, which lacks consistency in offering flood coverage, according to the National Association of Realtors (NAR). This creates a significant challenge for homebuyers in FEMA-designated Special Flood Hazard Areas (SFHAs), where lenders require flood insurance as a condition for mortgage approval. Consequently, buyers in flood-prone areas may experience delays in closing their loans while securing coverage. If these delays are prolonged, some contracts may expire, forcing buyers to renegotiate or withdraw from the sale. From a seller's standpoint, this leads to extended listing periods and increased market uncertainty.

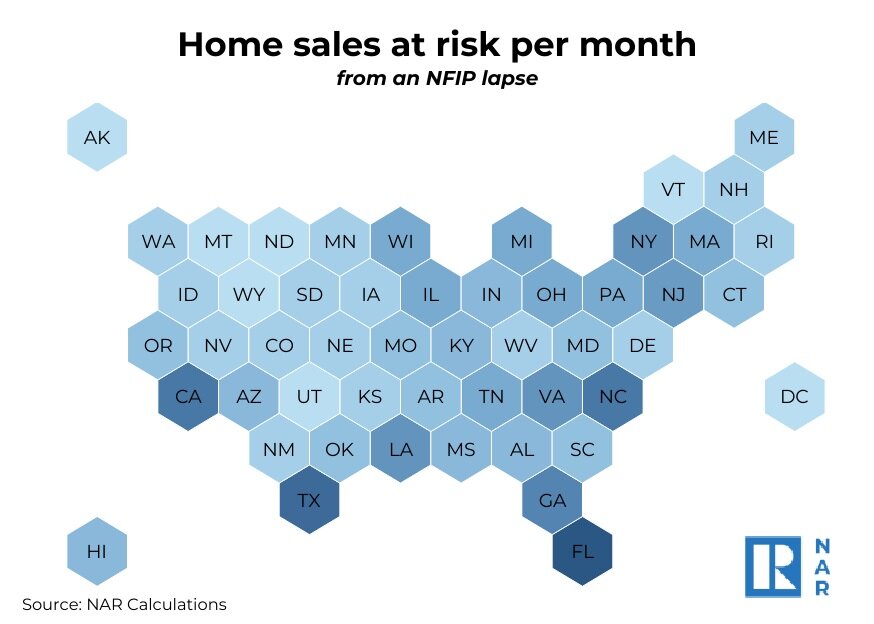

The NAR estimates that the NFIP is crucial to the completion of approximately 1,360 home sales each day, impacting about 41,300 transactions per month nationwide. While the effects vary by state, Florida's housing market stands to be most affected, followed by Texas and California. In Florida alone, an estimated 14,870 home sales per month could be delayed or canceled. Meanwhile, in Texas and California, the uncertainty caused by an NFIP lapse could disrupt 3,590 and 1,680 home sales per month, respectively.

Economic Impact

The housing market plays a critical role in driving economic activity. Beyond facilitating homeownership, it stimulates economic growth by contributing to gross domestic product (GDP) through construction, home sales, and renovations. These activities not only require labor and materials but also generate demand across multiple industries, including construction, manufacturing, and retail. Additionally, home purchases--especially of older properties--often prompt further consumer spending on renovations, furniture, appliances, and home improvement services.

The economic ripple effect extends even further. The development of new homes and the renovation of existing properties create jobs for architects, builders, and interior designers. The real estate industry itself employs a vast network of professionals, including agents, brokers, and mortgage lenders. A strong housing market, therefore, helps lower unemployment and increase household incomes.

Based on income estimates from home sales in each state, the NAR projects that an NFIP lapse could result in annual income losses totaling $69.7 billion--roughly equivalent to Alaska's entire GDP. Florida ($23.0 billion), California ($5.5 billion), and Texas ($4.9 billion) would experience the most significant local income losses.

Given the scale of these economic consequences, ensuring continued access to reliable flood insurance is essential--not only for homebuyers and sellers but also for broader market stability and economic growth.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

- Meet HAL, Real Estate Agent of the Future

- U.S. Homes Are Selling at Slowest Pace in 5 Years in Early 2025

- Pending Home Sales Dive Across America in December

- Greater Miami Residential Sales Uptick 3 Percent Annually in 2024

- U.S. Mortgage Applications Downtick in late January

- Under Biden, 2024 Marked the Slowest U.S. Home Sales Period in 30 Years

- Single-family Rent Growth in U.S. Slows to Lowest Rate in 14 Years

- Housing Starts Spike 15 Percent in America in Late 2024

- Day One: Trump Issues Executive Order on Emergency Price Relief for U.S. Housing

- 89 Percent of Homes Destroyed by Los Angeles Fires Were Single-Family Residences

- New AI-Powered Global Listings Service Under Construction

- World Property Media to Commence Industry Funding Round to Launch WPC TV

- Mortgage Rates in America Above 7 Percent, Again

- U.S. Residential Foreclosures Dip 10 Percent Annually in 2024

- U.S. Residential Asking Rents End 2024 at Lowest Levels in 3 Years

- World Property Markets to Commence Industry-wide Joint Venture Fundraise

- One Third of U.S. Homeowners Say They Will Never Sell

- Catastrophic Wildfires Devastating Tens of Billions of Dollars of Southern California Properties

- Is Greenland Soon Going to be Trump's Biggest Real Estate Deal?

- Greater Las Vegas Home Sales Jump 19 Percent Annually in December

- Active U.S. Residential Listings Spike 22 Percent in December