Residential Real Estate News

Pending Home Sales in U.S. Slip 3 Percent in January

Residential News » Washington D.C. Edition | By Michael Gerrity | February 26, 2021 8:12 AM ET

According to the National Association of Realtors, pending home sales in the U.S. took a step backward in January 2021 as inventory constraints continue to hold back prospective buyers.

The South was the lone region with a modest gain from the month prior, while the other three major U.S. regions experienced month-over-month decreases in January. However, all four areas saw contract transactions increase from a year-over-year standpoint, including two regions reaching double-digit gains, spurring an all-time high for pending home sales in the month of January.

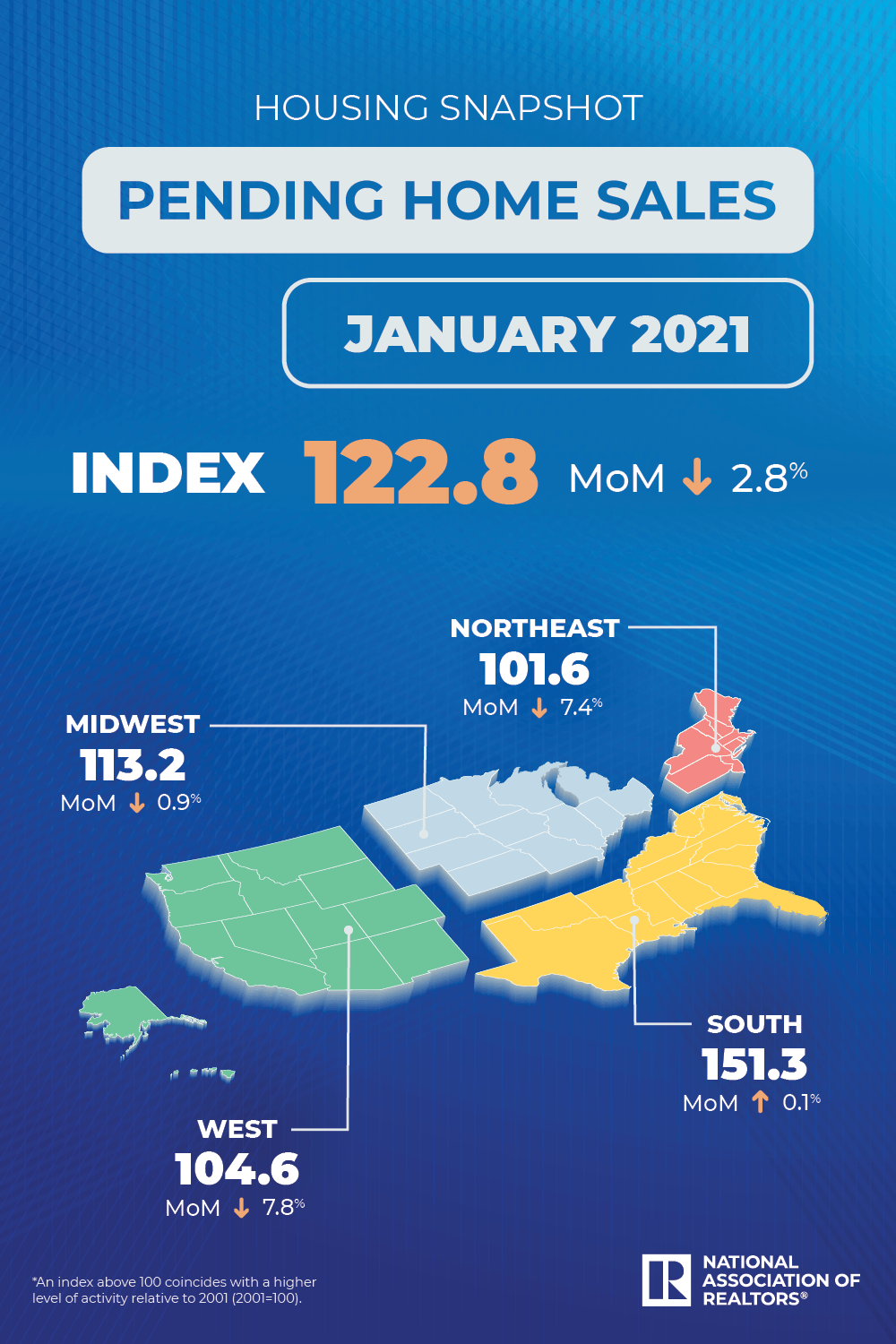

The Pending Home Sales Index, a forward-looking indicator of home sales based on contract signings, dropped 2.8% to 122.8 in January 2021. Year-over-year, contract signings rose 13.0%. An index of 100 is equal to the level of contract activity in 2001.

"Pending home sales fell in January because there are simply not enough homes to match the demand on the market," said Lawrence Yun, NAR's chief economist. "That said, there has been an increase in permits and requests to build new homes."

There has been a consistent rise in housing permits for single-family homes for eight straight months. According to Yun, this is a good sign that the supply and demand imbalance in the residential real estate market could be easing, as soon as mid-2021.

"There will also be a natural seasonal upswing in inventory in spring and summer after few new listings during the winter months," he said. "These trends, along with an anticipated ramp-up in home construction will provide for much-needed supply."

Realtor.com's Housing Market Recovery Index, which reveals metro areas where the market has recovered or even exceeded prior trends, showed Austin, Texas; Denver, Colo.; San Antonio, Texas; Riverside, Calif.; and Sacramento, Calif., had enjoyed the most significant recovery as of February 13.

Following a week where January's existing-home sales increased, Yun noted that pending contracts are a great early indicator for upcoming closed sales, but stressed that the timing of the relationship between existing-home sales and pending home sales may not be in lockstep.

"The two measurements aren't always perfectly correlated due to varying amounts of time required to close a contract," Yun said. "This is because a number of fallouts can occur due to a variety of factors, including a buyer not obtaining mortgage financing, a problem with a home inspection, or an appraisal issue."

The economy is showing promising signs of improvement, according to Yun, especially in light of many millions of Americans already receiving a COVID-19 vaccination. Still, he cautioned that longer-term interest rates will soon rise, partly from the better economic prospects, but also due to rising inflationary expectations and higher budget deficits.

"I don't foresee mortgage rates jumping to an alarming level, but we should prepare for a rise of at least a decimal point or two," he said.

The Mortgage Bankers Association's AVP of Economic and Industry Forecasting Joel Kan also commented, "Despite a slowdown in January, pending home sales remained 13 percent higher than a year ago, which points to continuing strength in the housing market. The monthly ebbs and flows are a result of the low availability of homes for sale.

"The housing market is very competitive right now, with buyers seeing limited options and faster home-price growth. Various other data sources have pointed to higher median sales prices and record-high purchase mortgage loan sizes, all of which have started to create affordability challenges in many parts of the country. While home building has picked up to attempt to meet the high demand, increased listings of existing homes will be needed in the coming months to alleviate this shortage of housing inventory."

January 2021 Pending Home Sales Regional Breakdown

- The Northeast PHSI fell 7.4% to 101.6 in January, a 9.6% rise from a year ago. In the Midwest, the index declined 0.9% to 113.2 last month, up 8.6% from January 2020.

- Pending home sales transactions in the South inched up 0.1% to an index of 151.3 in January, up 17.1% from January 2020. The index in the West dropped 7.8% in January, to 104.6, up 11.5% from a year prior.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years