The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

West Palm Beach Luxury Home Sales Set Record in Q4

Residential News » West Palm Beach Edition | By Michael Gerrity | February 1, 2021 8:30 AM ET

Wall Street's move south driving multiple South Florida's luxury housing markets

U.S. property broker Redfin is reporting this week that luxury home sales in West Palm Beach, FL surged 116% year over year in the fourth quarter of 2020.

This represents a bigger gain than any other major U.S. metro and the largest increase since at least 2013, when Redfin began tracking this data. By comparison, sales of affordable homes in West Palm Beach grew just 10%.

The report is based on an analysis that divided all U.S. residential properties into five price tiers based on Redfin Estimates of the homes' market values.

The median sale price of luxury homes in West Palm Beach rose 14% year over year to $1.8 million in the fourth quarter--the biggest jump since 2018. That compares with 9% growth in the affordable price tiers.

West Palm Beach's high-end housing market has experienced explosive growth as affluent New Yorkers have flocked to the sunny city in search of more space and lower taxes while working remotely during the pandemic. More than half (56.1%) of Redfin.com home searches in Palm Beach County came from outside the county in the fourth quarter--up from 50.2% a year earlier--and Cook County, IL (Chicago) and Kings County, NY (Brooklyn) were the most popular out-of-state origins. Lately, most house hunters in the area have been in the market for primary homes--a shift from before the pandemic, when a majority of buyers were looking for vacation homes, said Delray Valle, Redfin's West Palm Beach market manager.

A handful of Wall Street financial firms have also been expanding their presence in the region, or are considering doing so. The list includes Goldman Sachs, Virtu Financial and Elliott Management. Local Redfin real estate agent Andrea Duke said she's been getting more calls than normal from prospective high-end buyers who are considering moving to West Palm Beach because their employers have opened offices in the area.

"Buyers are coming in from expensive cities--especially New York--and beating locals in bidding wars by offering all cash," said Valle. "As a result, many folks are being forced to rent or buy new-construction homes."

Nationwide, homes listed between $1 million and $1.5 million were the most likely to encounter bidding wars in December, with 60% of Redfin offers for homes in that segment facing competition.

In November, Duke sold one West Palm Beach home for $1.1 million--$425,000 more than her client had purchased it for in 2017. To transform the property into a luxury home, the client had invested in an upgraded kitchen, an open floor plan, a new roof and storm windows. Within 24 hours of listing the property, Duke had seven showings scheduled, and by day two, she had three offers. The winning buyer, from Chicago, purchased the home sight-unseen for $42,000 over the asking price.

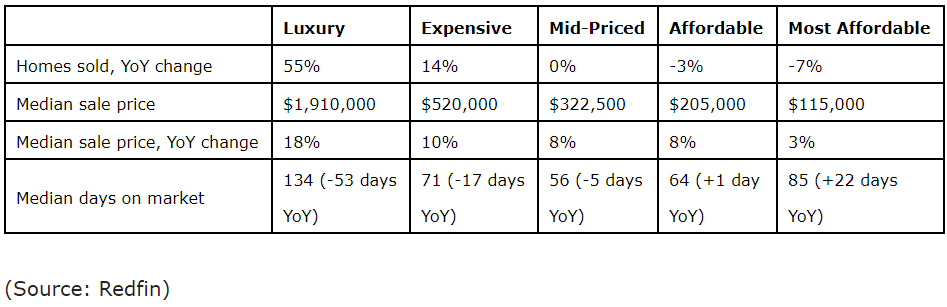

Fierce competition is driving buyers to act quickly. The typical luxury home for sale in West Palm Beach during the fourth quarter spent 46 fewer days on the market than the same period a year earlier (115 days in Q4 2020 versus 161 days in Q4 2019). Meanwhile, homes in the affordable price tier spent more time on the market compared with a year earlier (64 days in Q4 2020 versus 61 days in Q4 2019).

West Palm Beach Housing Market Summary, Fourth Quarter 2020

U.S. property broker Redfin is reporting this week that luxury home sales in West Palm Beach, FL surged 116% year over year in the fourth quarter of 2020.

This represents a bigger gain than any other major U.S. metro and the largest increase since at least 2013, when Redfin began tracking this data. By comparison, sales of affordable homes in West Palm Beach grew just 10%.

The report is based on an analysis that divided all U.S. residential properties into five price tiers based on Redfin Estimates of the homes' market values.

The median sale price of luxury homes in West Palm Beach rose 14% year over year to $1.8 million in the fourth quarter--the biggest jump since 2018. That compares with 9% growth in the affordable price tiers.

West Palm Beach's high-end housing market has experienced explosive growth as affluent New Yorkers have flocked to the sunny city in search of more space and lower taxes while working remotely during the pandemic. More than half (56.1%) of Redfin.com home searches in Palm Beach County came from outside the county in the fourth quarter--up from 50.2% a year earlier--and Cook County, IL (Chicago) and Kings County, NY (Brooklyn) were the most popular out-of-state origins. Lately, most house hunters in the area have been in the market for primary homes--a shift from before the pandemic, when a majority of buyers were looking for vacation homes, said Delray Valle, Redfin's West Palm Beach market manager.

A handful of Wall Street financial firms have also been expanding their presence in the region, or are considering doing so. The list includes Goldman Sachs, Virtu Financial and Elliott Management. Local Redfin real estate agent Andrea Duke said she's been getting more calls than normal from prospective high-end buyers who are considering moving to West Palm Beach because their employers have opened offices in the area.

"Buyers are coming in from expensive cities--especially New York--and beating locals in bidding wars by offering all cash," said Valle. "As a result, many folks are being forced to rent or buy new-construction homes."

Nationwide, homes listed between $1 million and $1.5 million were the most likely to encounter bidding wars in December, with 60% of Redfin offers for homes in that segment facing competition.

In November, Duke sold one West Palm Beach home for $1.1 million--$425,000 more than her client had purchased it for in 2017. To transform the property into a luxury home, the client had invested in an upgraded kitchen, an open floor plan, a new roof and storm windows. Within 24 hours of listing the property, Duke had seven showings scheduled, and by day two, she had three offers. The winning buyer, from Chicago, purchased the home sight-unseen for $42,000 over the asking price.

Fierce competition is driving buyers to act quickly. The typical luxury home for sale in West Palm Beach during the fourth quarter spent 46 fewer days on the market than the same period a year earlier (115 days in Q4 2020 versus 161 days in Q4 2019). Meanwhile, homes in the affordable price tier spent more time on the market compared with a year earlier (64 days in Q4 2020 versus 61 days in Q4 2019).

West Palm Beach Housing Market Summary, Fourth Quarter 2020

Miami Luxury Home Sales Jumped 55% In the Fourth Quarter

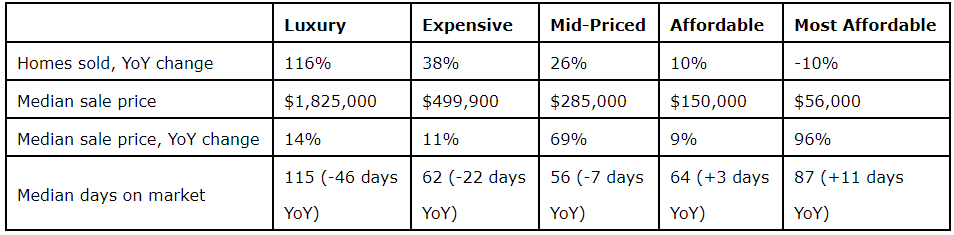

Sales of luxury homes in the Miami metro area rose 55% year over year in the fourth quarter--far more than any other price tier. By comparison, sales of affordable homes declined 3%.

The median sale price of luxury homes in Miami soared 18% year over year to $1.9 million, the largest increase since 2017 and the third-biggest gain among the 50 most populous U.S. metros (behind only New Brunswick, NJ and Phoenix). That was more than double the increase in the affordable price tier.

"Miami's high-end housing market is taking off because everything is wide open here, whereas places including California are shut down due to coronavirus restrictions," said local Redfin agent Cecilia Cordova. "A lot of people are also coming here to avoid taxes. I have several clients who recently bought homes here to avoid the potential capital-gains tax in Seattle."

Cordova continued: "With Miami's lower taxes, high-end buyers know that they can buy more house for their money. A $5 million home here would probably be $10 million in Seattle or California."

Just over a quarter (27.7%) of Redfin.com home searches in Miami-Dade County came from users outside of the county in the fourth quarter--up from 20.7% a year earlier--and Los Angeles County, CA and Cook County, IL were the most popular out-of-state origins. Technology and finance companies have also been growing in Miami. Microsoft and Citadel are among firms that are reportedly in talks to secure new office space in the city's Brickell neighborhood.

Similar to West Palm Beach, Miami is seeing high-end homes sell much more quickly than in the past. The typical luxury home for sale in Miami during the fourth quarter spent 53 fewer days on the market than the same period a year earlier (134 days in Q4 2020 versus 187 days in Q4 2019). By comparison, homes in the affordable price tier spent one more day on the market than the same period the year before (64 days in Q4 2020 versus 63 days in Q4 2019).

An increase in market speed is an indicator of intensifying competition. Bidding wars in Miami are extremely common across all price tiers, according to Cordova.

"At some of my open houses, I'll have close to 50 people waiting outside to get in," she said. "Sellers are asking for whatever they want, and buyers are willing to pay whatever the sellers are asking."

Miami Housing Market Summary, Fourth Quarter 2020

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- Las Vegas Area Home Prices Uptick 4.3 Percent Annually in March

- Single-Family Rent Growth in U.S. Trends Upward in 2025

- U.S. Mortgage Rates Tick Down Post Trump Tariffs Commencement

- President Trump's 'Liberation Day' Tariffs Potential Impact on the U.S. Housing and Mortgage Markets

- Baby Boomers Biggest Cohort of U.S. Home Buyers in 2025 as Millennials Decline

- U.S. Monthly Housing Payments Hit Record High in 2025

- U.S. Pending Home Sales Uptick in February

- Global Prime Residential Rent Slowdown Continued in Late 2024

- Ireland Home Price Inflation Hits 8 Year High in Early 2025

- Existing Home Sales in America Uptick in February

- Great Miami Area Residential Sales Decline 15 Percent Annually in February

- Mortgage Rates Uptick in Mid-March, Ending 9-Week Decline in U.S.

- World Property Ventures Builds the Future of Real Estate with New Funding Round

- U.S. Builder Sentiment Declines Amid Economic Uncertainty and Rising Costs

- Black Homeownership Rates in U.S. Enjoy Largest Annual Increase of All Racial Groups

- Wealthy Renters Are Taking Over More of the U.S. Rental Market

- If U.S. Congress Does Not Extend NFIP Soon, Thousands of Daily Home Closings Impacted

- U.S. Mortgage Applications Spike 11 Percent in Early March

- Greater Palm Beach Area Residential Sales Rise in Early 2025

- New Apartments in U.S. Are Leasing at Slowest Pace on Record

- U.S. Mortgage Rates Drop to 4 Month Low in March

- Overall U.S. Mortgage Delinquency Rates Dip in December

- New Tariffs on Canada, Mexico to Impact U.S. Homebuilder Input Costs

- Monaco's Property Market: A Tale of Two Cities

- U.S. Home Purchase Cancellations Surge, 1 in 7 Sales Getting Canceled

- U.S. Pending Home Sales Hit Historic Low in Early 2025

- Greater Miami Area Residential Sales Dip in January

- Governor DeSantis Supports Ending Property Taxes in Florida

- WPV Aims to Become the Berkshire Hathaway of Real Estate Tech

- U.S. Home Sales Slump Continues in January

- Average Americans Spend 38 Percent of Monthly Income on Mortgage Payments

- Switzerland's Safe-Haven Appeal Grows with World's Wealthy Homebuyers

- U.S. Builder Confidence Rapidly Declines in February

- Las Vegas Home Sales Rise 6.7 Percent Annually in January, Condo Sales Dip

- Homebuyer Demand in America Drops to 5-Year Low in Early 2025

- Ownership More Affordable Than Renting in Most U.S. Markets

- The World's First Global Listings Service Launches, Called a GLS

- Home Prices Continue to Rise in 89 Percent of U.S. Metros in Late 2024

- Global Luxury Residential Prices Showed Gradual Improvement in Late 2024

- U.S. Construction Hiring Rate Drops to Lowest Levels in 5 Years

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More