The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Commercial Real Estate News

Manhattan Office Market Fundamentals Continue to Improve

Commercial News » Commercial Real Estate Edition | By Michael Gerrity | December 12, 2011 2:06 PM ET

According to a new report by Jones Lang LaSalle, continued global uncertainty as Europe's sovereign debt crisis weighs heavily on the financial markets.

According to a new report by Jones Lang LaSalle, continued global uncertainty as Europe's sovereign debt crisis weighs heavily on the financial markets.This has already led to a sharp downturn in liquidity across nearly all fixed income sectors, including CMBS. Lenders have struggled to amass enough loans to package into securities as investor demand weakens and the ability to gauge the success of future bond sales becomes increasingly difficult. CMBS issuance will likely end the year at $29 billion, well ahead of 2010 issuance of $11 billion. However, 90 percent of the issuance in 2011 was through September. Taking into account the time lag in bringing a deal to market, CMBS lending was effectively put on hold well before then.

While macro uncertainty will persist through next year, there are positives on the micro level. Commercial real estate fundamentals continue to improve. Transactions volumes have increased, vacancies have declined and landlords have found improved pricing power. The bifurcation between the prime assets and markets versus the Class B/C properties in secondary and tertiary markets will persist, but will hopefully see a narrowing if the global economy sees improvement and greater clarity.

While demand for CMBS has weakened, investor demand for overall commercial real estate risk has remained healthy. According to JPMorgan, total lending this year will be approximately $140 billion, comparable to 2002 levels. Borrowers, however, will rely less on CMBS and more on portfolio companies. Life insurance originations grew by more than 50 percent this year, and currently account for 24 percent of all commercial real estate lending--more than twice their share back in 2002-2003. CMBS issuance in 2012 is not expected to grow beyond 2011 issuance. However, overall lending in 2012 is expected to remain strong, with portfolio lenders taking up a greater share of the pie.

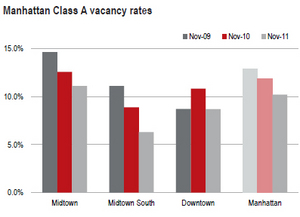

Class A vacancy in Midtown Manhattan decreased in November to 11.1 percent--marking the lowest point since 2008. Credit Agricole renewed at 1301 Avenue of the Americas for the largest transaction of the quarter. Credit Agricole occupies approximately 350,000 square feet. Morgan Lewis renewed and expanded at 101 Park Avenue for 200,000 square feet. In one of the largest new transactions, the law firm Baker & McKenzie signed at 452 Fifth Avenue for 105,000 square feet--driving the vacancy lower at the Penn Station/Garment District submarket.

Class A vacancy in Midtown Manhattan decreased in November to 11.1 percent--marking the lowest point since 2008. Credit Agricole renewed at 1301 Avenue of the Americas for the largest transaction of the quarter. Credit Agricole occupies approximately 350,000 square feet. Morgan Lewis renewed and expanded at 101 Park Avenue for 200,000 square feet. In one of the largest new transactions, the law firm Baker & McKenzie signed at 452 Fifth Avenue for 105,000 square feet--driving the vacancy lower at the Penn Station/Garment District submarket.Despite the decline in vacancy, momentum seems to have slowed since the first half of the year. Class A average asking rents increased marginally for the month to $70.36 per square foot from $70.28 per square foot. The Plaza District retains the title of the highest priced submarket in Manhattan with asking rents of $79.79 per square foot--up 17 percent from the market bottom in first quarter 2010.

Midtown South's Class A vacancy rose to 6.3 percent from 4.6 percent with the addition of a large block at 101 Avenue of the Americas. The shift in vacancy will not likely change market sentiment as the space had already been on the horizon. Midtown South remains the tightest market in the country with an overall vacancy rate of 6.8 percent--up from 6.4 percent in October.

The spike in vacancy rate corresponded with a sharp increase in Class A asking rents from $47.07 per square foot to $58.97 per square foot. The increase was largely because of the addition of new space in Hudson Square, but landlords have been raising rents throughout Midtown South. A handful of buildings now post rates greater than $65.00 per square foot.

Despite a slight up-tick in November, Downtown's vacancy rate remained under the 10.0 percent threshold--finishing at 9.9 percent, up 20 basis points from October. Class A vacancy remained relatively flat at 8.7 percent while the Class B vacancy rate increased from 11.5 percent to 11.9 percent. This increase in the Class B vacancy rate was mostly due to a large block of space coming back on the market in the Financial District. Upcoming space dispositions at the World Financial Center are likely to push vacancy rates higher in late 2012.

Downtown class A rents inched higher in November to $42.31 per square foot from $41.65 per square foot. Class B rents rose 10 cents from October finishing at $36.22 per square foot as the result of a higher-end block of space coming back on the market. The same situation is likely to occur in late 2012, when large blocks of high-quality space are expected to return to the market at the World Financial Center resulting in both an increase in vacancy and asking rent.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

$291,264

Home For Sale

Dubai South, United Arab Emirates

$850,000

Hotel For Sale

Big Falls, Belize

$2,800,000

Commercial New Construction For Sale

General Luna, Philippines

$16,800

Home For Rent

Laguna Beach, California

$23,900,000

Home For Sale

Laguna Beach, California

$795,000

Home For Sale

Cuenca, Ecuador

$1,350,000

Vacation Villas For Sale

Isla Mujeres, Mexico

49,000,000 THB

Villa For Sale

Hua Hin, Thailand

$315,000

Condo For Sale

Las Vegas, Nevada

€1,600,000

Residential Land For Sale

Scortoasa, Romania

$144,000

Residential Land For Sale

Bokeelia, Florida

5,300,000 CAD

Home For Sale

Mission, Canada

Related News Stories

Commercial Real Estate Headlines

- 2025 Prediction: U.S. Commercial Investment Recovery Expected to Gain Traction

- Holiday Retail Sales for 2024 to Hit Record $1 Trillion

- Tech, AI Industries Drive Largest Share of Office Leasing Activity in U.S.

- Commercial Real Estate Lending in U.S. Enjoys Strong Growth in Q3

- U.S. Multifamily Market Begins Recovery in Q3

- Commercial Investment in Japan Spikes 24 Percent Annually in Q3

- Despite Return-to-Office Mandates, U.S. Office Vacancies Continue to Rise

- PROPSIG Tech Startup Acquired by World Property Data

- U.S. Commercial Mortgage Debt Hits $4.7 Trillion in Q2 as Delinquencies Increase

- Hong Kong Class A Office Rents Continue to Downtick in Mid-Summer

- U.S. Office Landlords Tenant Concessions Decline for First Time in 4 Years

- U.S. Commercial Mortgage Originations Spike 27 Percent in Q2 Over Q1

- Phnom Penh's Commercial Office, Retail Markets Face Slowdowns in 2024

- Global Edge Data Center Market to Hit $300 Billion by 2026

- Commercial Property Transactions in Japan Dive 25 Percent Annually in Q2

- Delinquency Rates for U.S. Commercial Property Loans Downticks in Q2

- Megawarehouse Lease Deals in U.S. Increase in 2024

- Office Tenants' Flight to Quality Buildings Increases in 2024

- Commercial Lending in Japan Upticks 6 Percent Annually in Q1

- AI Driving Significant Global Data Center Growth in 2024

- Total U.S. Commercial Mortgage Debt Rises to $4.7 Trillion in Q1

- U.S. Commercial Mortgage Delinquencies Rise in Early 2024

- Asia Pacific Office Sector to Further Reprice Throughout 2024

- U.S. Retail Foot Traffic to Surpass Pre-Pandemic Levels by 2025

- Commercial Real Estate Lending in U.S. Slowed in First Quarter

- Japan Commercial Property Investment Volume Jumps 7 Percent in Q1

- Asia Pacific Commercial Property Investment Leads the World, Spikes 13 Percent

- Driven by High Rates, U.S. Commercial Lending Imploded 47 Percent in 2023

- After Two Year Slump, Prime Multifamily Metrics Uptick in U.S.

- Commercial Co-Broker Commissions Not Affected by NAR-DOJ Settlement, Yet

- U.S. Office Buildings with Upscale Tenant Amenities Still Enjoy Premium Rents in 2024

- U.S. Commercial, Multifamily Mortgage Delinquency Rates Uptick in Q4

- U.S. Commercial Mortgage Debt Continued to Rise in 2023, Hits $4.7 Trillion

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

Reader Poll

In 2025, which region of the world are you most likely to buy or invest in real estate?