The WPJ

THE WORLD PROPERTY JOURNALReal Estate Facts Not Fiction

Residential Real Estate News

U.S. Foreclosure Activity Falls to 44-Month Lows in July; Artificially Slowed by Banks

Residential News » Residential Real Estate Edition | By Michael Gerrity | August 11, 2011 8:00 AM ET

According to RealtyTrac's U.S. Foreclosure Market Report for July 2011, foreclosure filings -- default notices, scheduled auctions and bank repossessions -- were reported on 212,764 U.S. properties in July, a 4 percent decrease from June and a 35 percent decrease from July 2010. The report also shows one in every 611 U.S. housing units with a foreclosure filing during the month of July.

"July foreclosure activity dropped 35 percent from a year ago, marking the 10thstraight month of year-over-year decreases in foreclosure activity and the lowest monthly total since November 2007," said James J. Saccacio, chief executive officer of RealtyTrac.

"This string of decreases was initially triggered by the robo-signing controversy back in October 2010, which forced lenders to substantially slow the pace of foreclosing, but the downward trend in foreclosure activity has now taken on a life of its own. It appears that the foreclosure processing delays, combined with the smorgasbord of national and state-level foreclosure prevention efforts -- including loan modifications, lender-borrower mediations and mortgage payment assistance for the unemployed --may be allowing more distressed homeowners to stave off foreclosure.

"Unfortunately, the falloff in foreclosures is not based on a robust recovery in the housing market but on short-term interventions and delays that will extend the current housing market woes into 2012 and beyond," Saccacio continued. "A stabilizing economy and improving job market are the long-term keys to a housing market recovery."

Foreclosure Activity by Type

Default notices (NOD, LIS) were filed for the first time on a total of 59,516 U.S. properties in July, a 7 percent decrease from the previous month and a 39percent decrease from July 2010. July's default notice total was 58percent below the monthly peak of 142,064 default notices in April 2009.

Foreclosure auctions (NTS, NFS) were scheduled for 85,419 U.S. properties in July, a decrease of 5 percent from June and a decrease of 37 percent from July 2010.July's foreclosure auction total hit a 36-month low and was 46 percent below the monthly peak of 158,105 scheduled auctions in March 2010.

Lenders repossessed a total of 67,829 properties (REO) in July, a 1 percent decrease from the previous month and a 27 percent decrease from July 2010. The July REO total was 34 percent below the monthly peak of 102,134 bank repossessions in September 2010.

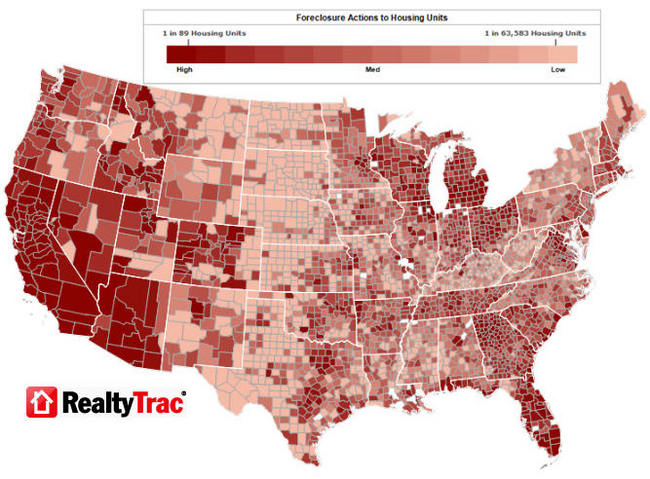

Nevada, California, Arizona post top state foreclosure rates

Nevada posted the nation's highest state foreclosure rate for the 55thstraight month in July, with one in every 115 housing units receiving a foreclosure filing during the month. A total of 9,930 Nevada properties had a foreclosure filing in July, a 1 percent decrease from the previous month and a 28 percent decrease from July 2010.

Despite a 16 percent year-over-year decrease in foreclosure activity, California registered the nation's second highest state foreclosure rate in July, with one in every 239 housing units with a foreclosure filing during the month.

With one in every 273 housing units with a foreclosure filing, Arizona posted the nation's third highest state foreclosure rate, after holding the No. 2 spot for seven straight months ending in June. A 39 percent month-over-month drop in REO activity pulled Arizona's total foreclosure activity in July down 25 percent from the previous month and down 38 percent from July 2010.

Other states with foreclosure rates ranking among the top 10 were Georgia, Utah, Florida, Michigan, Idaho, Illinois and Wisconsin.

10 states account for more than 70 percent of U.S. total

10 states accounted for 73 percent of U.S. foreclosure activity in July, led by California, where 56,193 properties had a foreclosure filing during the month -- up 4 percent from the previous month but still down 16 percent from July 2010. Initial default notices in California were down 6 percent from the previous month, but REOs increased on a month-over-month basis for the second straight month and scheduled auctions were up 11 percent from the previous month.

There were a total of 22,377 Florida properties with foreclosure filings in July, down 6 percent from June and down 57 percent from July 2010. Initial default notices and scheduled auctions in Florida were both down on a monthly and annual basis in July, while REO activity increased 8 percent from June but was still down 55 percent from July 2010. The month-over-month REO increase in July followed monthly increases in initial default notices and scheduled auctions in June.

An 18 percent monthly increase in foreclosure activity helped Georgia post the nation's third highest foreclosure activity total in July. There were a total of 11,461 Georgia properties with foreclosure filings during the month, still down 9 percent from July 2010. The overall increase in Georgia foreclosure activity was driven largely by a 25 percent month-over-month increase in REO activity.

Michigan foreclosure activity in July decreased 16 percent from the previous month and was down 42 percent from July 2010, but the state still documented the fourth highest state foreclosure activity total for the month -- 10,894 properties with foreclosure filings.

Illinois REO activity increased 20 percent from the previous month, and the state documented a total of 10,627 properties with foreclosure filings in July. Texas REO activity increased 15 percent from the previous month, and the state documented a total of 10,571 properties with foreclosure filings during the month.

Other states with foreclosure activity totals among the nation's 10 highest in July were Arizona (10,098), Nevada (9,930), Ohio (8,376) and Wisconsin (4,534).

Foreclosure activity spikes in some hard-hit cities

Las Vegas continued to post the nation's highest foreclosure rate among metropolitan areas with a population of 200,000 or more, with one in every 99housing units with a foreclosure filing in July.

But spiking foreclosure activity in some of the other cities with foreclosure rates in the top 20 narrowed the gap between those cities and Las Vegas. Seven of the cities in the top 10 and 14 of the cities in the top 20 posted monthly increases in foreclosure activity.

Foreclosure activity in the Stockton, California metro area increased 57 percent from June to July, giving it the nation's second highest metro foreclosure rate -- one in every 124 housing units with a foreclosure filing during the month. Stockton foreclosure activity in July was still down 7 percent from July 2010.

With one in every 140 housing units with a foreclosure filing, the Vallejo-Fairfield, Calif., metro area posted the nation's fourth highest metro foreclosure rate in July thanks in part to a 33 percent month-over-month increase in foreclosure activity.

Foreclosure activity increased 83 percent on a month-over-month basis in the Naples-Marco Island, Fla., metro area, which posted the nation's 15th highest metro foreclosure rage, and foreclosure activity was up 60 percent on a month-over-month basis in the Ocala, Fla., metro area, which posted the nation's 17th highest metro foreclosure rate.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Residential Real Estate Headlines

- More Americans Opting for Renting Over Homeownership in 2024

- BLOCKTITLE Global Property Tokenization Platform Announced

- Small Investors Quietly Reshaping the U.S. Housing Market in Late 2024

- Greater Miami Overall Residential Sales Dip 9 Percent in November

- U.S. Home Sales Enjoy Largest Annual Increase in 3 Years Post Presidential Election

- U.S. Housing Industry Reacts to the Federal Reserve's Late 2024 Rate Cut

- U.S. Home Builders Express Optimism for 2025

- Older Americans More Likely to Buy Disaster-Prone Homes

- NAR's 10 Top U.S. Housing Markets for 2025 Revealed

- U.S. Mortgage Delinquencies Continue to Rise in September

- U.S. Mortgage Rates Tick Down in Early December

- Post Trump Election, U.S. Homebuyer Sentiment Hits 3-Year High in November

- Global Listings Aims to Become the Future 'Amazon of Real Estate' Shopping Platform

- Greater Las Vegas Home Sales Jump 15 Percent in November

- Ultra Luxury Home Sales Globally Experience Slowdown in Q3

- World Property Exchange Announces Development Plan

- Hong Kong Housing Market to Reach Equilibrium in Late 2025

- Construction Job Openings in U.S. Down 40 Percent Annually in October

- U.S. Mortgage Applications Increase in Late October

- World Property Markets, World Property Media to Commence Industry Joint-Venture Funding Rounds in 2025

- New Home Sales Hit 2 Year Low in America

- U.S. Pending Home Sales Increase for Third Consecutive Month in October

- Pandemic-led Residential Rent Boom is Now Fizzling in the U.S.

- Emerging Global Real Estate Streamer WPC TV Expands Video Programming Lineup

- 1 in 5 Renters in America Entire Paycheck Used to Pay Monthly Rent in 2024

- U.S. Home Sales Jump 3.4 Percent in October

- Home Buyers Negotiation Power Grows Amid Cooling U.S. Market

- Canadian Home Sales Surge in October, Reaching a Two-Year High

- Greater Orlando Area Home Sales Continue to Slide in October

- U.S. Mortgage Credit Availability Increased in October

- U.S. Mortgage Rates Remain Stubbornly High Post Election, Rate Cuts

- Construction Input Prices Continue to Rise in October

- BETTER MLS: A New Agent and Broker Owned National Listings Platform Announced

- Home Prices Rise in 87 Percent of U.S. Metros in Q3

- Caribbean Islands Enjoying a New Era of Luxury Property Developments

- The World's First 'Global Listings Service' Announced

- Agent Commission Rates Continue to Slip Post NAR Settlement

- Market Share of First Time Home Buyers Hit Historic Low in U.S.

- Greater Palm Beach Area Residential Sales Drop 20 Percent Annually in September

- Mortgage Applications in U.S. Dip in Late October

Reader Poll

Marketplace Links

This website uses cookies to improve user experience. By using our website you consent in accordance with our Cookie Policy. Read More